Quarterly Update Q3: Keep calm and keep your head down

In his quarterly update, pig market analyst Dr John Strak talks about rising pig prices and the uncertainty that dominates the market.

When I reported to you in July this year I said, “….pig prices will continue to rise this year…. but high energy and feed prices plus increased uncertainty as a result of the Russian aggression in Ukraine suggests that producers will not make a positive supply response to higher prices in 2022.”

Prices are on an upward trajectory

As we enter the season of falling leaves and cooler temperatures it seems that my forecast has been accurate. In North America, in Europe and in China, pig prices have been rising year on year (don’t confuse seasonal falls in prices that are sometimes reported incompletely elsewhere). Prices have been, and are, on an upward trajectory in the major producing countries but, nevertheless, producers are cutting back on production. That’s unsurprising since, until recently, producer margins have been squeezed by high input prices so my forecast wasn’t rocket science. What next? I predict more of the same through the winter– unless there is a collapse in demand, which isn’t impossible.

Uncertainty dominates the market

And it isn’t just a squeeze on profits that has discouraged producers from expanding (or even maintaining) the size of their breeding herds. The other factor (for businesses in all sectors except, perhaps, defence and pharmaceuticals) is uncertainty. War and plague are positive drivers for some firms but not for most of us. Clearly, we live in a very uncertain world at the moment – a global market escaping (just) from a pandemic and then being hit with rising prices, shortages and economic gloom as a war starts in Europe is not a world where investors carry on regardless. Keep calm and carry on works well as a slogan but it’s not one that you will see many astute investment managers shouting. They are more likely to say, keep calm and keep your heads down. Farmers and consumers are no different.

Global economy in poor shape

The global economy in 2022 appears to be in poor shape. Covid lockdown policies in China and the impacts of Russian aggression in Ukraine on fertiliser, energy and commodity prices are to blame. Thus, previous estimates of growth in 2022 and forecasts of economic growth and 2023 are almost all being revised downwards. The International Monetary Fund has warned of a worsening outlook for the global economy and has cut its forecast for global growth next year to 2.7% (from 2.9% in July) and states that it sees a 25% probability that growth will slow to less than 2%. About one-third of the global economy is at risk of contracting in 2023, with the US, EU and China all continuing to stall. And less money in the system and in consumers’ pockets means less money to spend on meat.

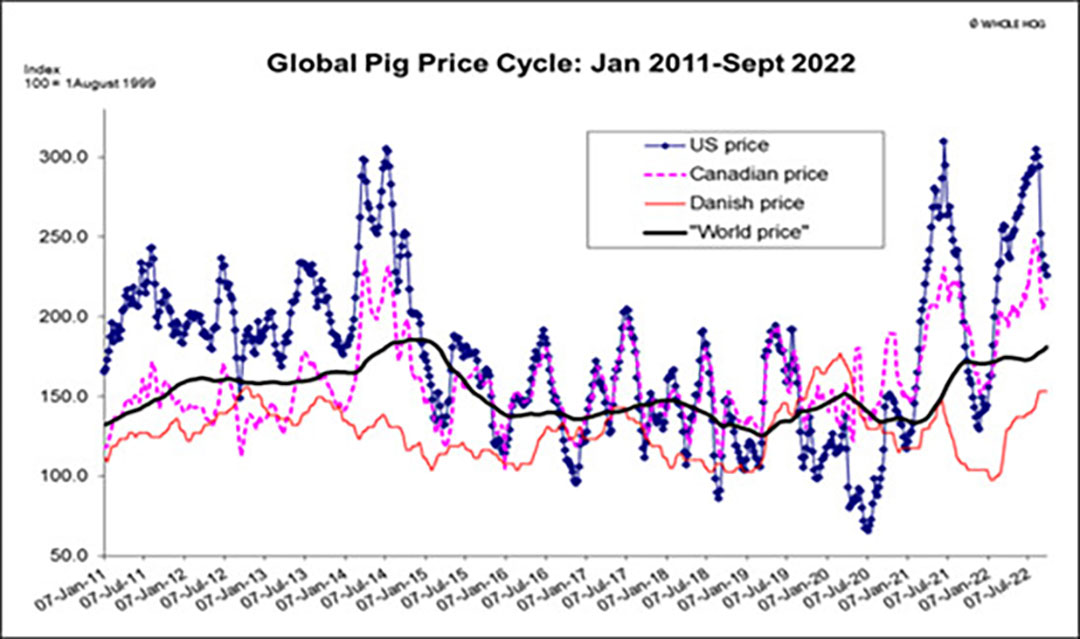

Global price cycle

The global pig price cycle is showing another upward tick. Prices, adjusted for seasonality, have continued to rise. And there is no sign of the upward phase in the pig price cycle levelling off or changing direction. Indeed, this positive phase of the cycle has been running since April 2021. Pig prices everywhere are significantly higher than a year ago and, with a few exceptions, pig inventories and breeding herd numbers are down. The meat supply side is also tightened by Avian flu which is hitting poultry flocks hard in several countries and this will support hog prices. Initial harvest estimates for feed grains and the war in Ukraine this autumn don’t look quite so terrifying for input prices but I reiterate that pig farmers seem to have taken the view that the risks of expanding production, or even standing still, are simply not worth it.

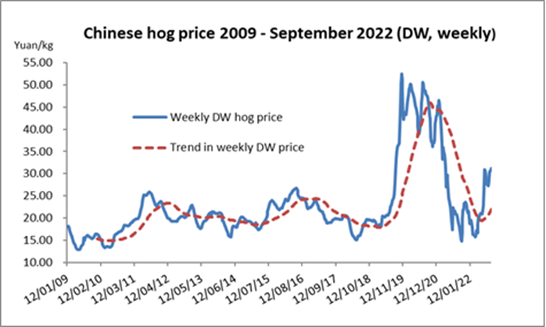

Chinese pig prices

Figure 2 presents a view of how Chinese pig prices are behaving. They have firmed up in recent weeks – even with sales of frozen pork from the official reserves around the time of the autumn festival and holiday. There are confusing signals about the direction of the Chinese breeding herd – recent price movements suggest it shrank earlier this year but it is unclear if it is now recovering. Production costs are still relatively high in China. There is no doubt that the Chinese economy is struggling and rumours of a property bubble and over extended bank financing only fuel the pessimism about the world’s second largest economy.

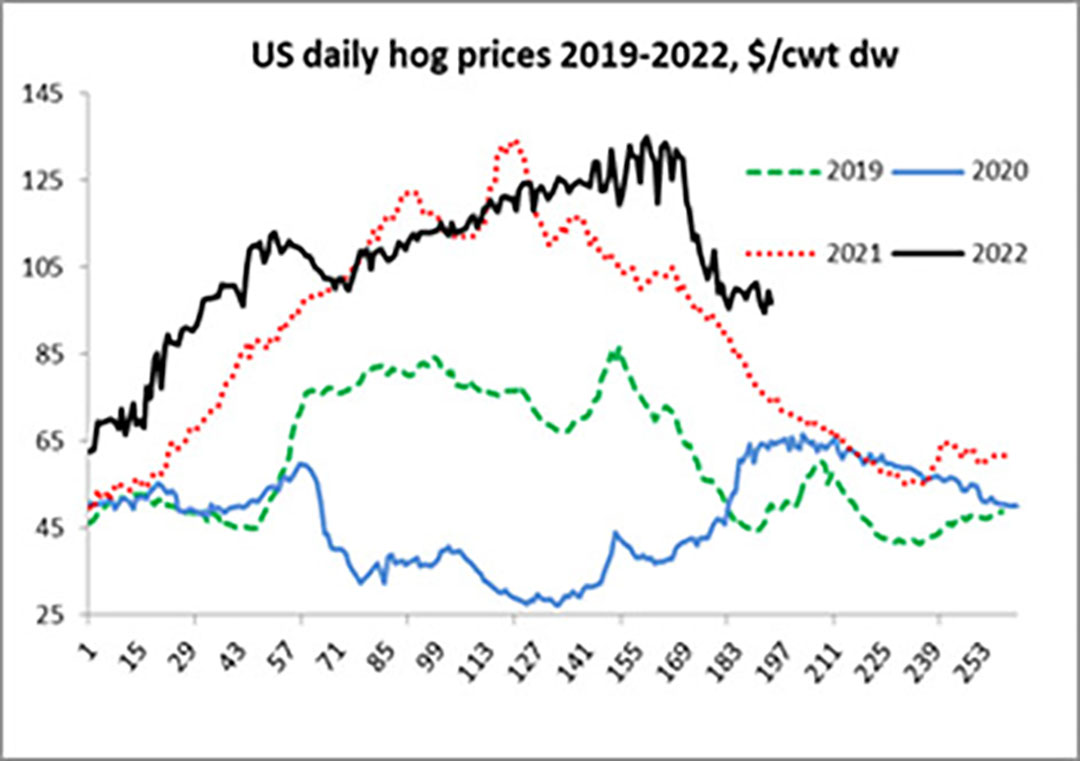

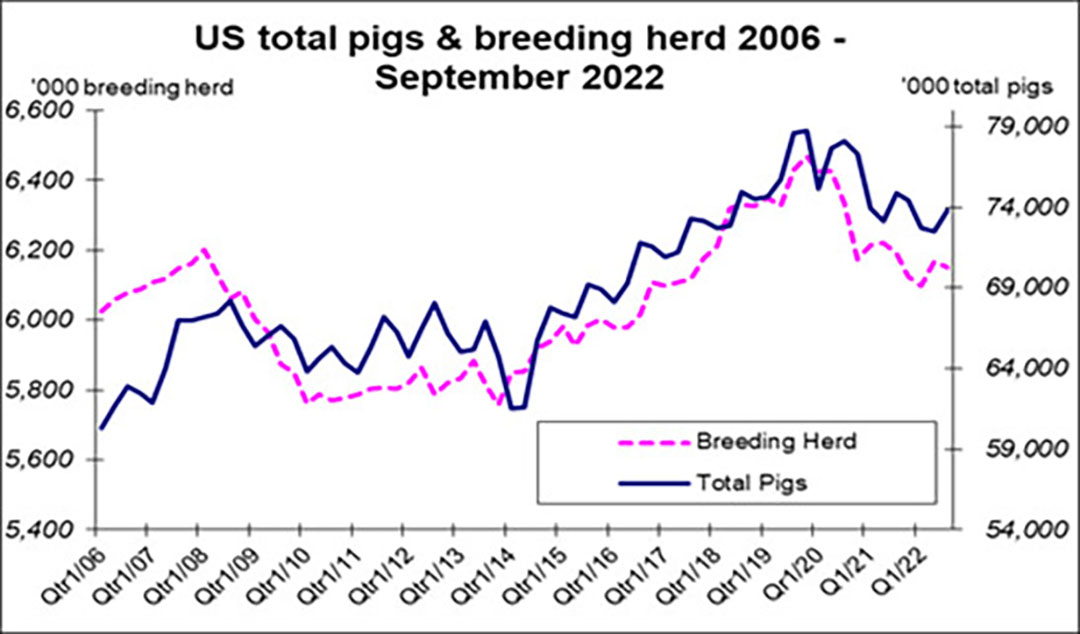

Pig numbers decline in the USA and in the EU

The behaviour of US hog prices since 2014 is portrayed in Figure 3. This overlay format for each of the last four years illustrates how, even when hog prices are falling, they can still be on an upward trend. The USA’s market for pork is firm with little hint of inflation affecting pork demand but the strong dollar and the industry’s dependence on exports has put the US pig sector under pressure in H2 2022. Even though export values are up there will be less volume sold overseas unless something extraordinary happens. Table 1 presents the US census data for the most recent period. The breeding herd in the USA is down by 0.6% in the latest (September) census. The census estimates for the total inventory show a decline of 1.4%. The estimate for the number of market pigs report a fall of 1.5%. Figure 4 presents these census data in a chart over the period 2006-2022.

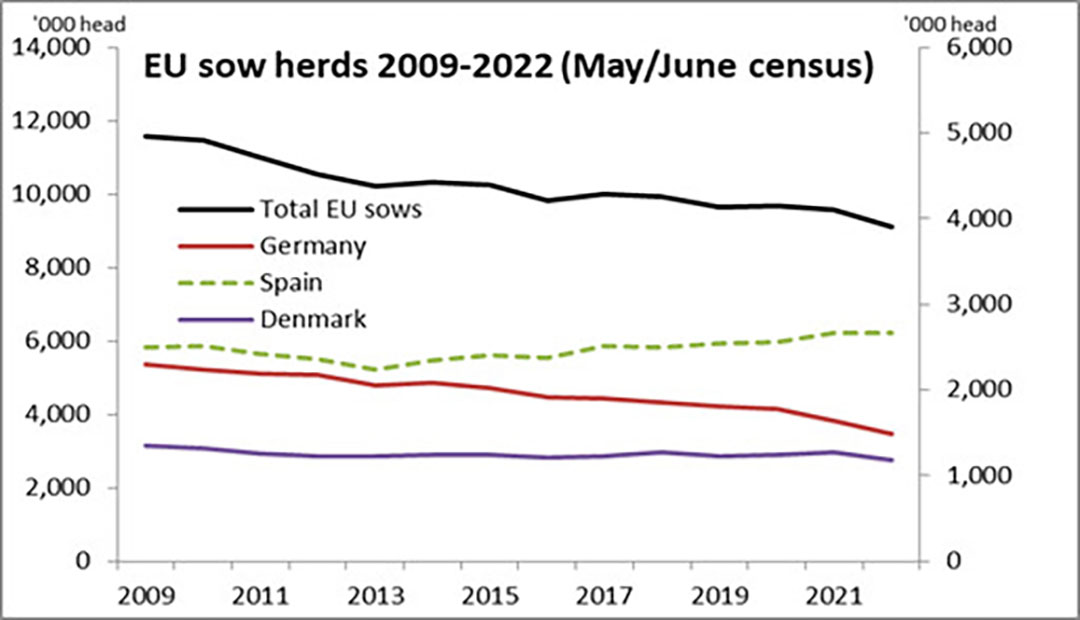

In the EU even bigger contractions in the numbers of breeding sows are evident and this is shown in Table 2 and Figure 5. Germany and Poland have reduced the size of their herds very significantly. Only Spain has shown any inclination to expand production. The total number of breeding sows in the EU has fallen back over time and by an extraordinary amount in 2022/21. The EU’s short term outlook for pigmeat production expects a decline of 5% year on year in 2022. Pragmatically, the report notes that,

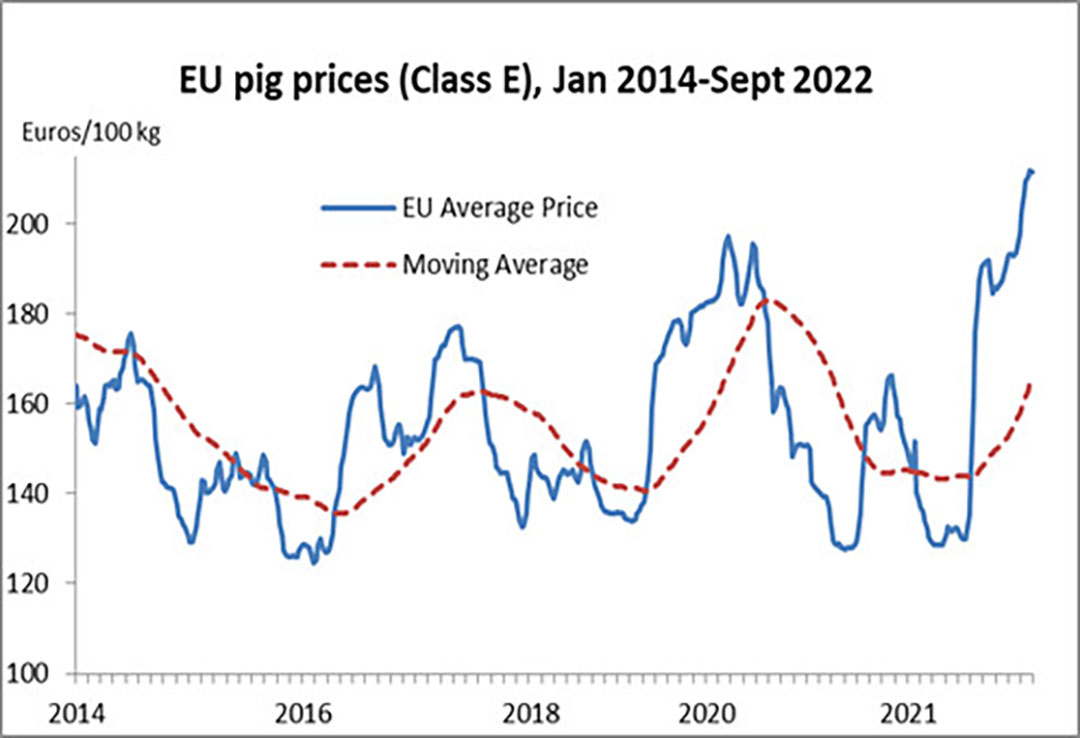

“This outlook is subject to a high degree of uncertainty linked to developments in Ukraine, including Ukraine’s capacity to produce, store and export its commodities.” This general contraction in pig production in the member states of the EU has driven the price recovery in Europe since Covid lockdown policies were relaxed. As demand has returned to foodservice, and in working families now able to work full time, pig prices have risen with apparently little thought from consumers about taking up vegetarianism or about switching to chicken. Figure 6 illustrates how strong pig prices in the EU have been since mid-2021.

Brace, brace, and fasten seat belts

The description of global events and the latest pig industry data presented here underlines the observation made in the title to this piece. This is not the time for investment or expansion. It is the time for caution and sweating the assets. Major external events in the world are producing forces that can sweep away the most efficient producers if the financial resilience of their businesses is not strong.

There is no clear path ahead for the establishment of robust assumptions for a business case or any sound basis for a return on investment calculation – unless you are an arms manufacturer or the inventor of new wonder drugs for animal or human disease. There are few of us in those latter positions and those that are will not be reading this. So, be aware that pig prices will continue to be strong – if consumer incomes hold up. But also be aware that until energy and feed prices weaken significantly the outlook for improved margins in pig production is very uncertain.