Quarterly Update Q2: Pig prices to rise but pork supply to fall

In his quarterly update, pig market analyst, Dr John Strak, looks at the continuation of higher pig prices, lower pig producer confidence, and less discretionary spending by consumers.

The most recent data for the global pork market and the world economy suggests that pig prices will continue to rise this year. However, the combination of high energy and feed prices plus increased uncertainty as a result of the Russian aggression in Ukraine suggests that producers will not make a positive supply response to higher prices in 2022.

I expect that the upward phase of the global pig price cycle continues throughout the remaining part of this year. That may seem an unsurprising observation given the robust behaviour of the US, EU and Chinese markets in recent weeks but we would normally expect a supply response to show itself some 6 months or so after an upturn – which caps the tendency for prices to keep increasing.

Prices rise but producer confidence doesn’t

The current upturn in the cycle began in December 2021 and, apart from a small wobble in April this year, global pig prices have been on the rise since then. The usual associated rises in producer confidence and breeding intentions haven’t occurred – nor do they show any inclination to occur. Farmers are in a gloomy mood – even rebellious with recent protests in the Netherlands and Italy. We have seen global supplies rise before after a price hike but this time it’s different.

Glass half empty

I ended my last commentary here 3 months ago by saying that pig prices will be higher but so will costs, and that consumers’ purchasing power in the supermarket will fall. And, sadly, that some consumers will go hungry in 2022. This sounds more like a glass that is half empty rather than half full. If anything, the negative drivers of economic activity are stronger in Q2 than they were in Q1 – and the glass is even emptier. The discussion that follows uses some simple charts to illustrate this view about my expectations for the behaviour of the global market for pigmeat in the months ahead.

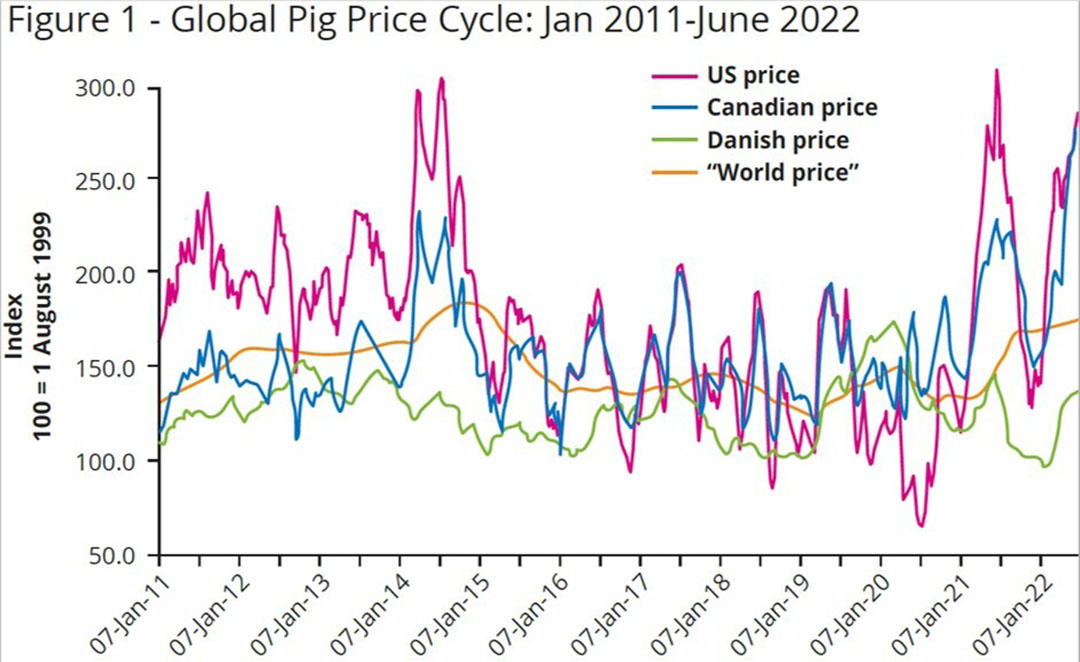

Global price cycle

The global pig price cycle has maintained the upward momentum seen in Q1 2022 and Figure 1 illustrates this. Prices are on the rise everywhere. Recent census data from key players: the USA (total pigs down by about 1%) and Germany (total pigs down by about 10%) and Denmark (total pigs down by about 5%) are important in understanding global supply. According to China’s official data, its breeding herd has also been in decline this year – down by about 8% in May. Canada’s herd appears to be stable and Spain is the only significant player that is the outlier in this parade of declining hog numbers. The global breeding herd and total inventory looks set to decline in the medium term.

What is happening on the Chinese pig market?

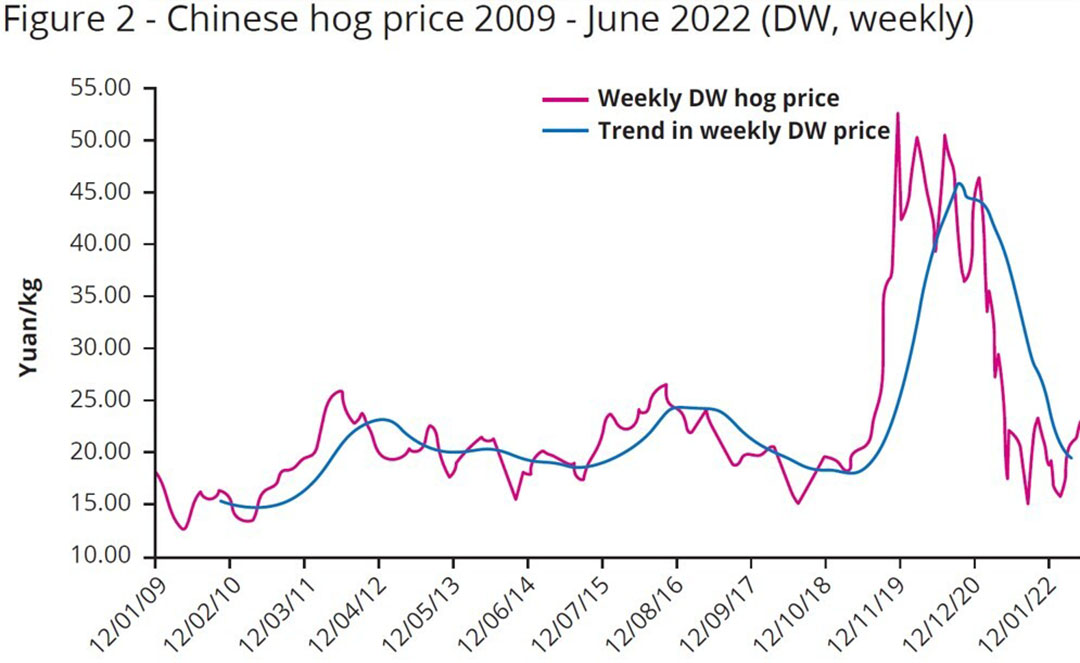

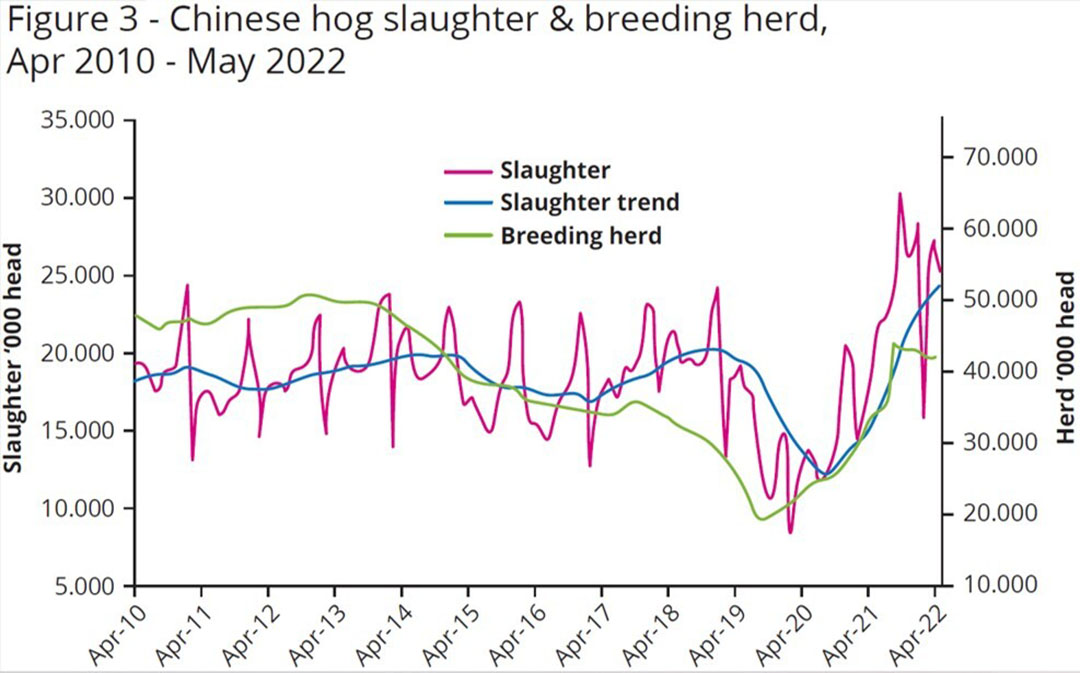

Figures 2 and 3 present views of how Chinese pig prices are behaving and how China’s kill numbers and the breeding herd have been changing. Hog prices in China have been firmer in recent weeks but they are still below production costs. The amounts of foreign-sourced pigmeat being shipped into China have fallen steeply in 2022. More generally, China’s total consumer retail sales fell at a slower pace in May as domestic demand gradually improved, according to official data. Nevertheless, the country’s domestic sales of consumer goods, a major indicator of consumption growth, fell by 6.7% from a year ago in May. The Covid-19 lockdowns have had an impact on economic growth and consumer demand in China and it’s not clear if these constraints have finally been overcome. Chinese consumers are not in a happy place.

US hog markets

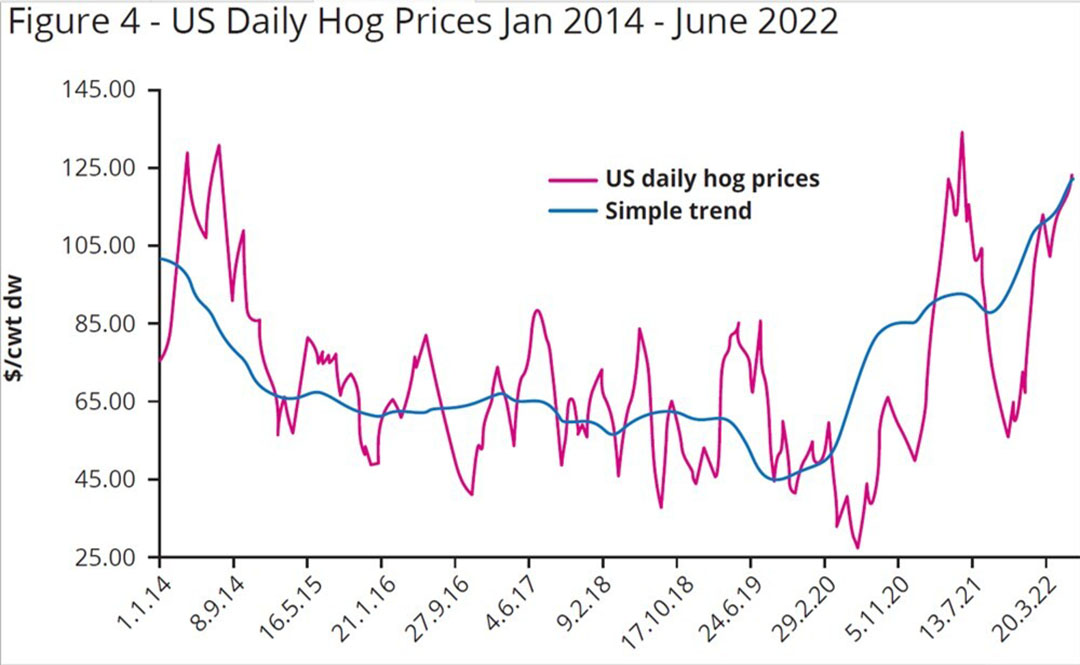

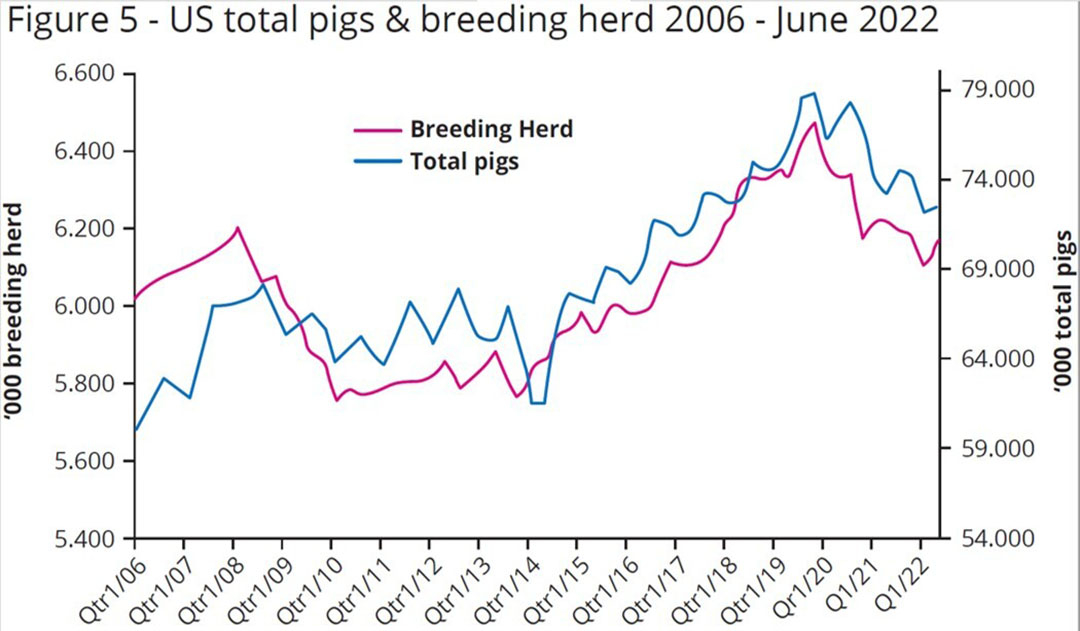

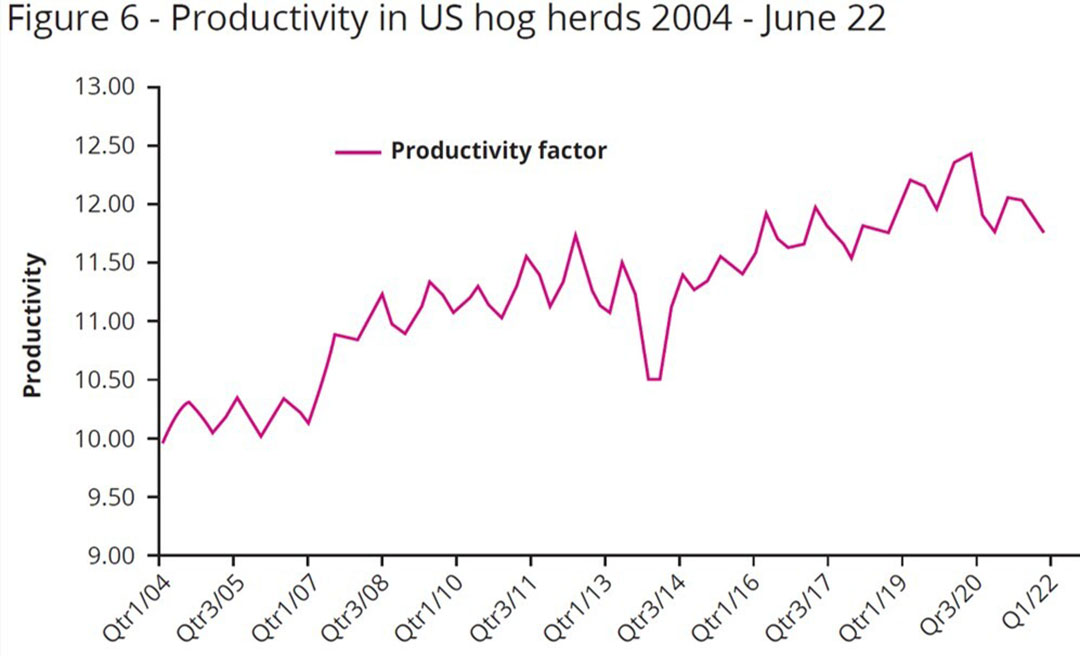

Figure 4 describes the behaviour of US hog prices since 2014. We seem to be on an upswing there. Table 1 illustrates how US hog and herd numbers have declined according to the most recent census data (1 June 2022). Figure 5 presents these survey data in a chart that dates back to 2006. According to these data, the breeding herd in the United States in June was down by about 1% year on year. The census estimates for the total inventory show a decline of about 1%. The estimate for the number of market pigs also shows a fall of nearly 1%. Figure 6 shows how the US pig sector’s productivity has been declining recently. It’s possible that PRRS in US sows is reducing on-farm productivity. All these data support the view that US pork production will be lower in H1 and H2 2022. And this view is without considering the impact of higher energy and feed prices on producers’ decisions.

EU: Only Spain expanding its herd

Except for Spain, pig farmers in the EU have been treading water or contracting throughout most of 2021. Spain, now the largest pig-producing country in the EU, has expanded its herd – it was up by about 2% at the end of 2021. But rising feed and energy costs and the uncertainties about consumers’ incomes and spending – all traced back to Russia’s aggression in Ukraine – ensure that most of the EU’s breeding herds will be smaller through 2022 than they were last year.

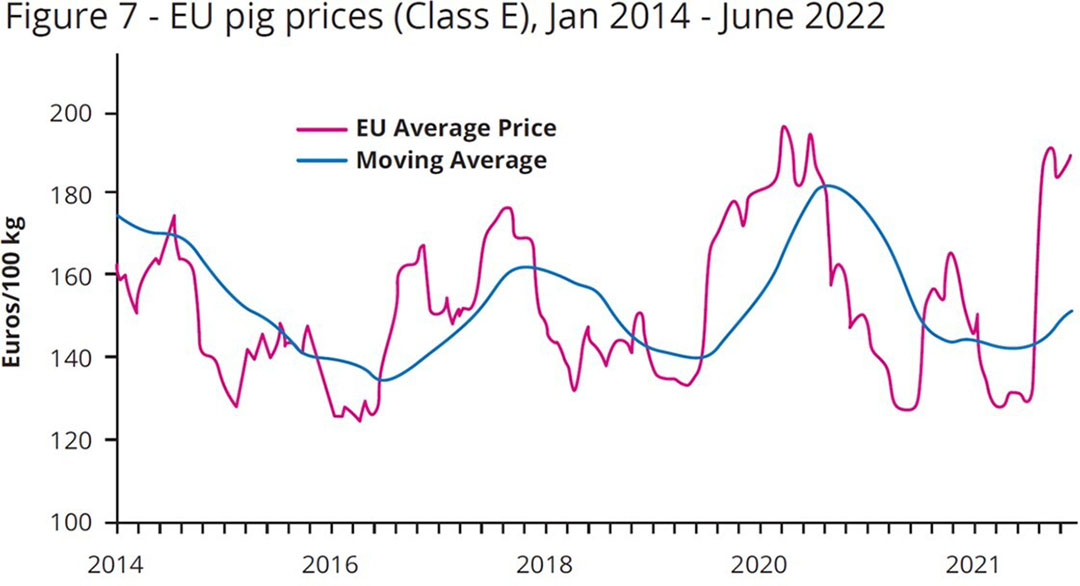

EU: Pork supply tight

The behaviour of average EU pig prices, shown in Figure 7, suggests that the supply of pork is already tight – though hot weather in Europe will be part of the explanation for recent robust prices. The EU’s short term outlook expects that production is expected to decline strongly in Germany (-14%), Italy (-7.5%), as well as in Poland (-4%) in 2022. In Belgium and the Netherlands environmental rules will put downward pressure on production. The anticipated impacts are -3% in Belgium and stabilisation in the Netherlands. In contrast, Spain is likely to continue increasing its production – up 3% in 2022. Overall, the EU Commission expects that EU pig meat production will decrease by 4.7% in 2022. EU pig meat exports are expected to decrease by nearly 10% this year.

Global consumer outlook

The world’s consumers are facing significant pressure on their incomes and their cost of living this year. Covid-19 used up savings for many of them and severely disrupted many consumers’ incomes and employment options. The Russia-Ukraine war is now taking over as the driver of consumers’ aspirations and purchasing power – and will have caused a loss of confidence and increased caution about discretionary spending. Global economic growth forecasts have been downgraded by all the official agencies. This will depress the demand for pork.

Supply chains

Economists’ models of the global pig and pork prices were not designed to deal with huge external shocks like global pandemics or major regional conflicts that disrupt global commodity supply chains. Those supply chains are not just about wheat and sunflower oil. Fertiliser and fertiliser substrates and steel are three non-food commodities that are seriously affected by this conflict. Other materials and inputs into modern supply chains are also affected by the sanctions against Russia.

The outlook for 2022 may be better predicted by thinking about the mood of producers. Everyone is on a steep learning curve about the resilience of their supply chains and price and profit predictions. Producers, who will be taking the risk, may have learnt lessons from previous periods of high prices and high input costs. Those costs are rising and there is a real prospect that consumer demand will fall. Super-cautious producers may not make the usual response to higher prices in the latter half of 2022 – hence, higher prices but lower profits and supplies are a likely result. And we thought Covid-19 was bad!