Quarterly Update: One puzzle after another in the global pig market

In his quarterly update, pig market analyst Dr John Strak highlights the puzzles that are thrown up by the data in the global market for pork and pig meat. It is no wonder that producers and processors are confused.

My last column was written in January 2023 – the start of a new year. I observed then, “There is a real possibility that profit margins will improve for producers – even if pig prices are falling.” But I also noted that, “It is possible that the global price will enter a downward phase in Q1 2023…. The (forecasting) model’s rate of change of prices are flashing red…”.

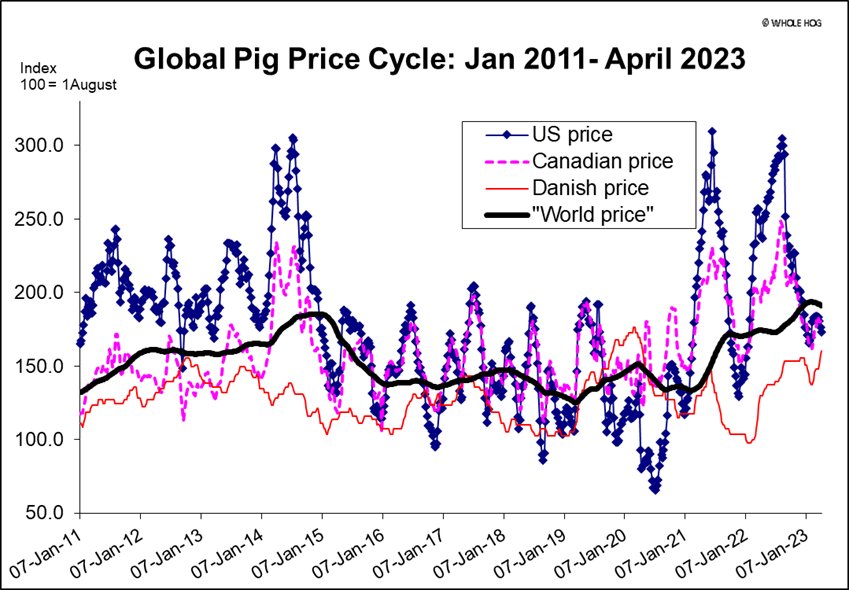

Now, at the beginning of Q2 in 2023 we can see that there are signs that the global price cycle for pigmeat has entered a downward phase but we can also see that there are as series of puzzles in the regional data that make predictions less certain about the future.

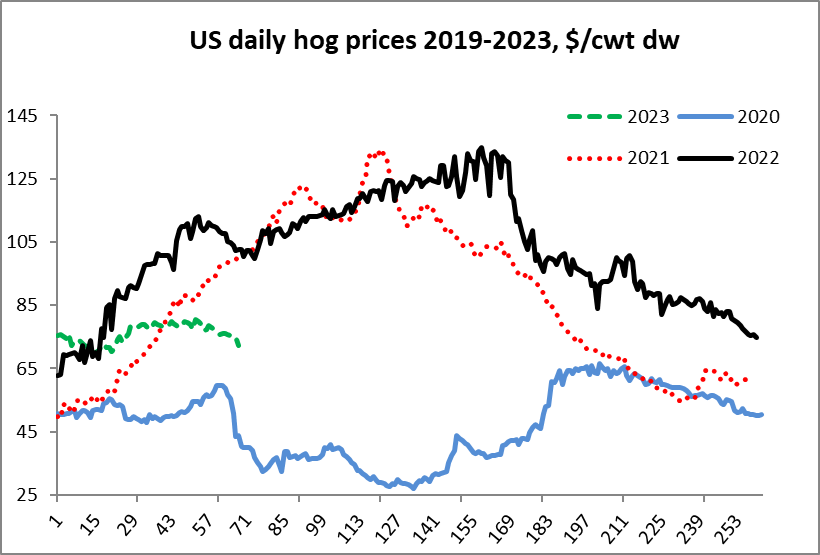

Figure 1

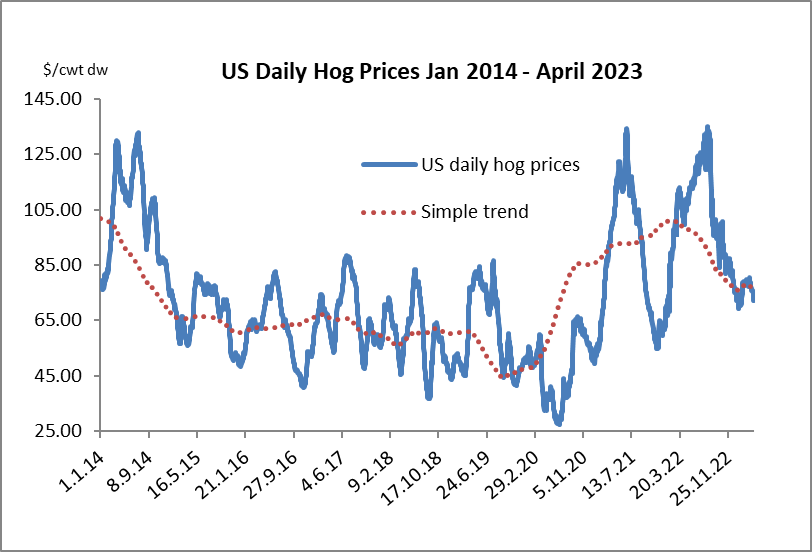

Figure 2

The puzzle in North America

Table 1 and figures 1, 2 and 3 present some recent data for the US hog sector. The graphic illustrations in charts 1 and 2 indicate that US hog prices are not following their usual behaviour. The seasonal pattern of prices for the early part of the year has been lost. The latest US hog census reports that the pig crop in the Dec ‘22-Feb ‘23 period was up slightly and that significant revisions were made to the 1 December census report.

The heaviest hog weight category in Q1 is now reported to be up by 2% as at 1 March 2023. (Table 1 presents the US census data as reported for March 2023). On the demand side, pork exports were significantly higher in January and February (+12%). But, as charts 1 and 2 show, hog prices have been weak in Q1. It seems that domestic demand was weak and that supply was unexpectedly high in the USA in the opening months of this year.

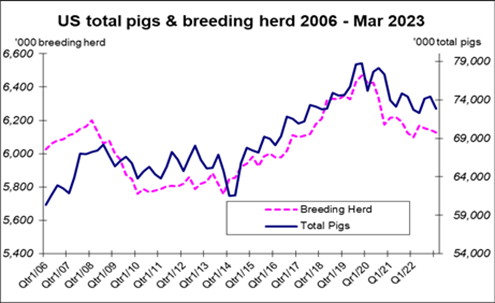

Figure 3

Looking ahead, the cohorts of younger market pigs are all smaller year on year, according to the March 1st census data, and that might suggest a recovery in US hog prices later this year. But what if the USDA revises its census again? Figure 3 presents the census data for the total number of hogs and the size of the breeding herd in a chart for the period 2006-2023. The most optimistic interpretation of this chart is that US producers are “pausing for breath”. Alternatively, a significant contraction in the US herd is ongoing. The demand side of the US market is the biggest puzzle. Is there a retail inflation effect on consumers as processors pass on higher costs which, in turn, has affected consumer demand?

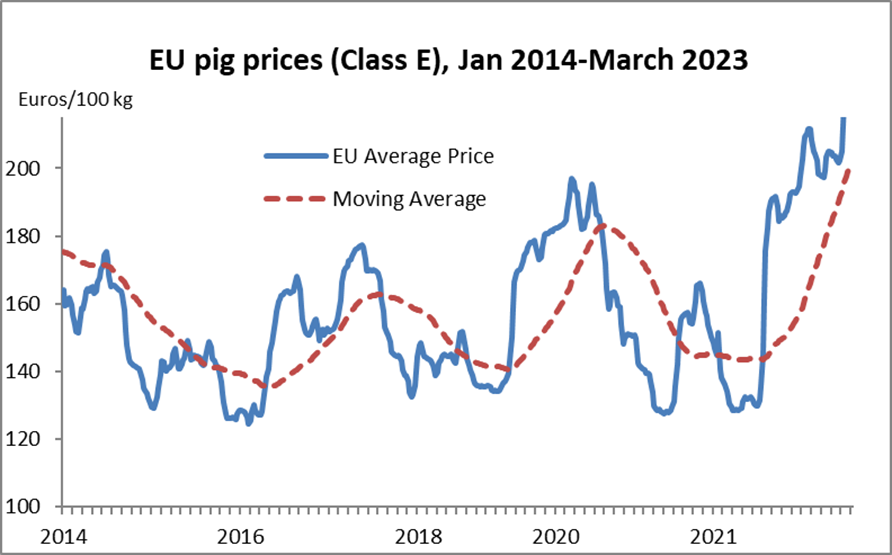

Figure 4

Europe’s market offers another puzzle

In contrast to North America, pig prices in Europe have been on a roll for 12 months now. Figure 4 illustrates how prices have behaved in the EU. Prices have been high and increasing despite a significant fall in exports in 2022, and at the start of 2023. As for profit margins, the European Commission’s data indicates that producers moved into the black (on average) in the autumn of last year.

Nevertheless, pig breeding herds and total numbers have been cut back remorselessly across the EU. The most recent data for Denmark indicate that the trend to reduce pig numbers is continuing (the breeding herd is down 10% in that country in the January and down by over 7% in the April census). The total pig inventory in Denmark in April is down 14%!

Across Europe pig producers have shown little enthusiasm to react to rising prices by increasing production and there is little prospect of pigmeat production being higher in 2023 in Europe than it was in 2022. Most likely, it will be lower and Brussels is predicting a fall of about 4% in production in 2023. The puzzles in Europe relate to supply and demand. When will rising prices and margins have an impact on producers’ outlook? Did the war in Ukraine and the resulting inflation create so much uncertainty about future costs and demand that all thoughts of investment and expansion (even just in existing herds) are off the table? And for consumers, when will pork prices get so high as to significantly affect long term demand?

I noted in my last article that the second half of 2023 might see a rebound in consumer confidence but the latest IMF forecast opines that global growth is forecast to slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic. If this holds true it’s not good news for meat consumption – especially if farmgate costs are rising.

Figure 5

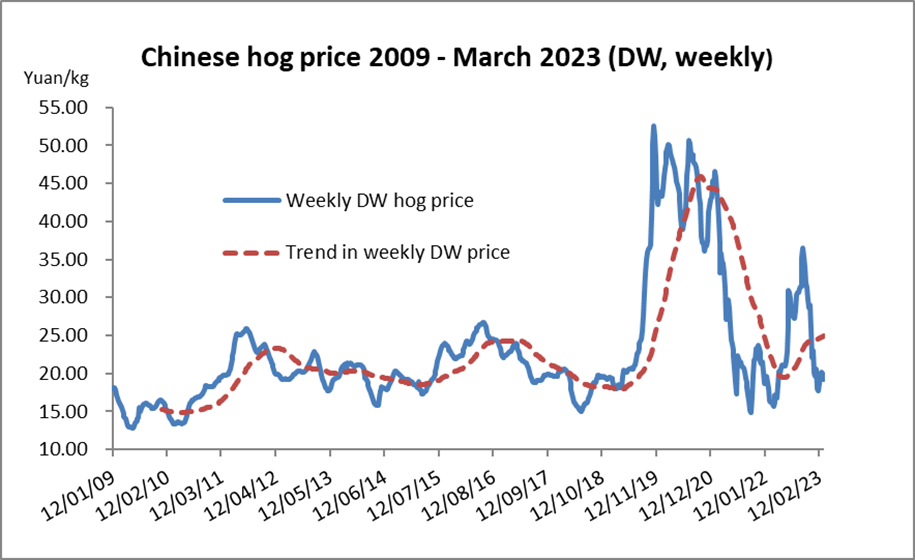

A Chinese puzzle

Writing about the Chinese livestock economy is always an exercise in graduated ambiguity and multiple qualifications about data. It is tiresome and inefficient but it is what it is. The most recent prices for China’s hog producers are shown in Figure 5. As ever prices, are seen to be “volatile”. This instability is mostly due to the disjointed and regulatory nature of the Chinese market combined with inaccurate and untimely official data. Domestic producers, large and small, are probably as much in the dark about disease impacts, breeding herd numbers, and inventories in China as foreigners are.

National and regional officials pay close attention to pork prices because of their place in the consumer inflation index and have a variety of levers to pull and buttons to push in order to change short- and long-term supply of pigs and pork (state purchases and sales, subsidies and other business incentives). In addition, the import trade can apparently open and close on a whim. However, all this official and unofficial management (tinkering) has not created a more stable pig sector because levers and buttons need accurate metrics before they are pulled or pushed. And these are mostly absent in China’s livestock sectors.

Large integrated pork processors are reported to be struggling as prices yo-yo and smaller producers have been in and out of the market as prices have adopted contrary positions. The latest destabilising news is that ASF has flared up again. How much and for how long is part of the puzzle that China sets the analyst but most commentators are saying that current prices reflect urgent disposals driven by ASF and/or unexpected losses as high feed prices and low hog prices persist. As with the US market, the optimistic view is that supplies will tighten later in the year and prices will recover then. The pessimistic view involves discussion about China’s ambitions for Taiwan and ensuing global tensions. Let’s not go there.

Figure 6

The global pig cycle

In the past, our model of global pig prices has been an accurate guide to the future direction of prices in the medium term. The latest update of that model provides the different chart lines shown in Figure 6. In particular, the global pig price index clearly shows itself to be in a downward phase and this chimes with the prediction I made in January that we were about to hit a turning point. Normally, I would expect this phase of the cycle to last at least six months but the puzzles I laid out in the paragraphs above lead me to be less definite than I would usually be. It may well be that excess supply and weak demand in Q1 2023 may be countered in Q2. However, with my eye on the mood of producers across the world, I think it would take a very big event to swing the cycle back to another turning point before the mid-way point of the year.

I signed off in January by urging pig industry players to be cautious but cheerful about prospects for the New Year. At the moment I am feeling more cautious and less cheerful.