Quarterly Update: A cautious welcome to the New Year

In his quarterly update, pig market analyst Dr John Strak talks about the firm pig prices seen in 2022, the changing impacts of the war in Ukraine and China’s Covid-19, and the producer margins that have been slow to recover.

Margins have not recovered

That forecast has been accurate for producers in the West: pig prices have been relatively firm but margins, generally, have not recovered. In China, pig prices have fallen back. At the start of the New Year, it is time to revisit the crystal ball and look ahead. Where will prices and margins go next? The charts I present here and my text will suggest that there are reasons to give a cautious welcome to the advent of 2023.

War in Ukraine

The key characteristic of 2022 was the uncertainty presented to livestock producers as the war in Ukraine affected feed, energy and fertiliser prices. Inflation affected the costs of all producers who were not hedged or in some way protected from the sharp hike in input costs.

However, at the start of 2023 all of those input markets have reported significant reversals. Hostilities continue in Ukraine but various policy adjustments by governments and improved harvests of wheat and grains have combined to mitigate some of the inflationary pressures on input costs. Producers have hardly felt the benefits of these changes yet but (and this is a big but) if these price falls are maintained, the outlook for producers’ costs in 2023 has radically improved.

Further, on the demand side, although the forecasts for economic growth have been cut sharply from last year, government policies are in flux. Coincidentally, China’s rapid exit from Covid-19 lockdown policies will likely have an impact on domestic demand and, perhaps, the global economy. By the second half of 2023, there could be a rebound in a number of economic indicators and consumers everywhere might feel more confident. This isn’t a data-driven prediction but I think it is a real possibility.

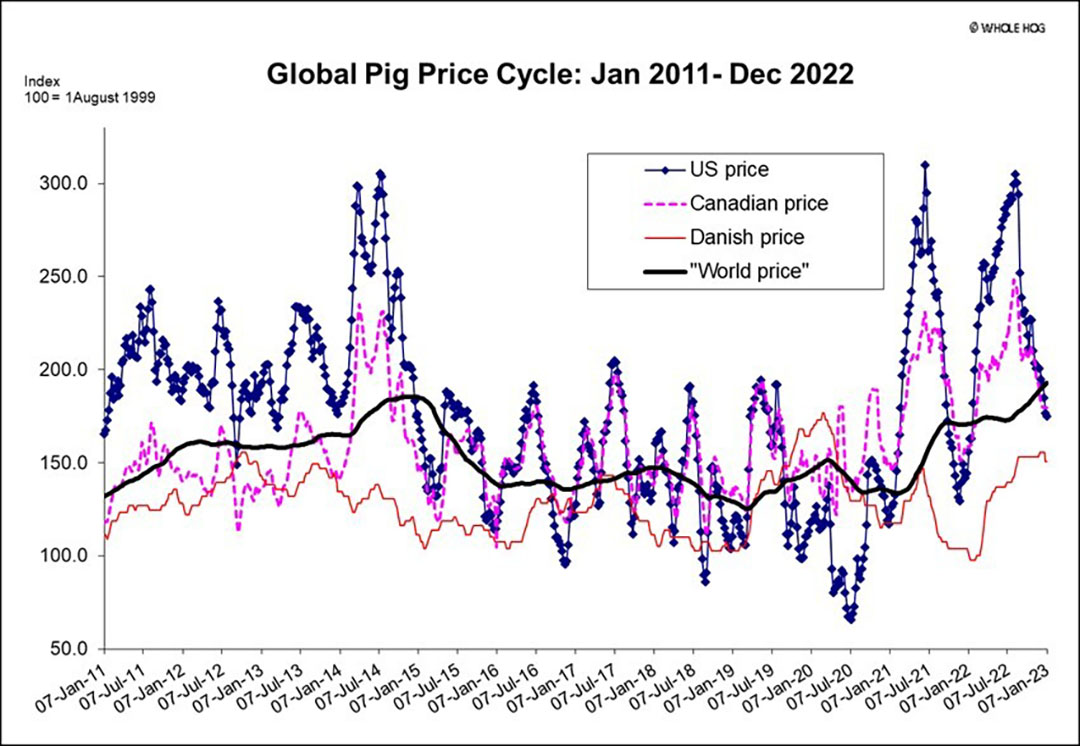

Rising prices dominated 2022

Our model of global pig prices was accurate and consistent in 2022. It described and predicted the performance of prices for the major pork exporters very well. Prices were higher than in 2021 in North America and in Europe as the global pig price cycle stayed in an upward phase. Figure 1 illustrates this. The story on profit margins was not so great. Most producers lost money in 2021 and 2022 as they were squeezed by:

Covid-19 disruption of supply chains and foodservice demand, higher input costs, and

consumers who were short of money and confidence.

There was (and still is) a real danger that consumer demand could fall off a cliff as Covid impacts, higher energy costs and food inflation have drained consumers’ wallets. Over the last 2 years, pig producers in almost every major pork exporting country have cut back on their breeding herds, and pig inventories have fallen. These responses to uncertainty and higher input costs across the globe have, of course, helped drive pig prices higher.

Pig prices are higher than a year ago

The positive uptrend shown in my representation of the pig price cycle has been maintained since April 2021. That’s a long time for an uptrend. Pig prices everywhere are significantly higher than a year ago and, paradoxically and with a few exceptions, pig inventories and breeding herd numbers are down. However, pig prices for the major exporters weakened at the end of 2022 and North America’s hog prices have broken down and through the (underlying) global pig price index.

It is possible that the global price will enter a downward phase in Q1 2023. But it is too early to confidently forecast this, even though the model’s rates of change of prices are flashing red. There is a big uncertainty about demand which our data cannot pick up yet. How will China’s exit from lockdown affect consumer spending and pork import demand?

The US hog sector – a turning point?

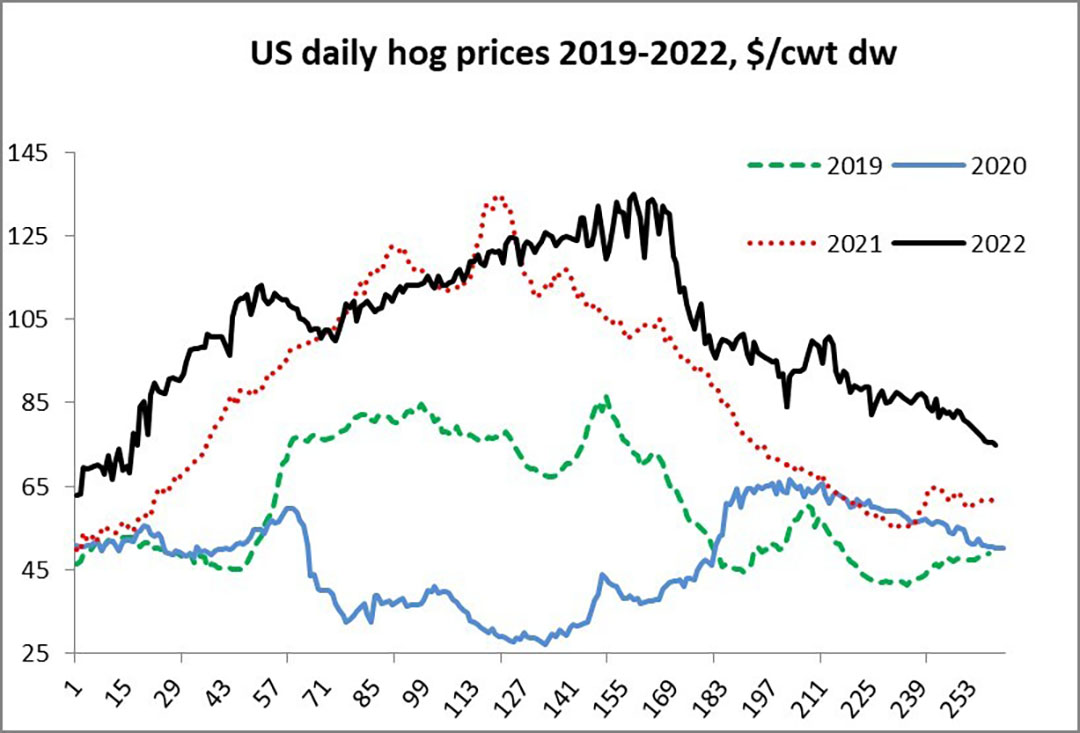

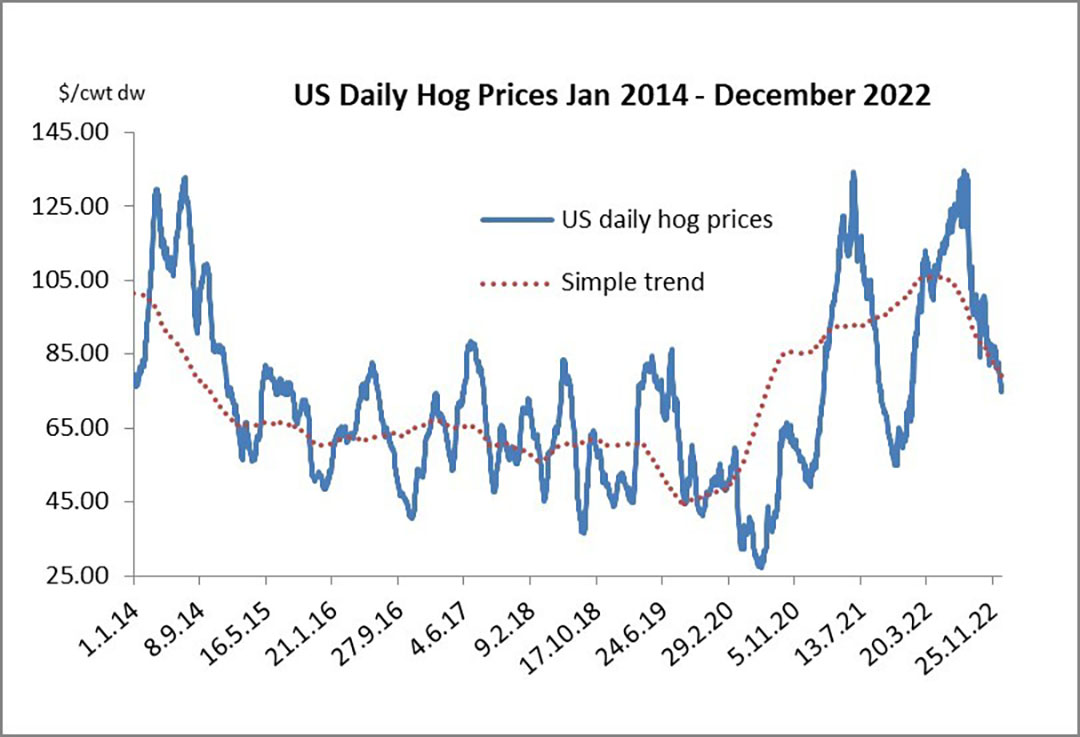

Table 1 and figures 2 and 3 present some key data for the US hog sector. The price behaviour shown in these charts describes a period of strongly rising hog prices in the USA and a seasonal pattern that is “back to normal”.

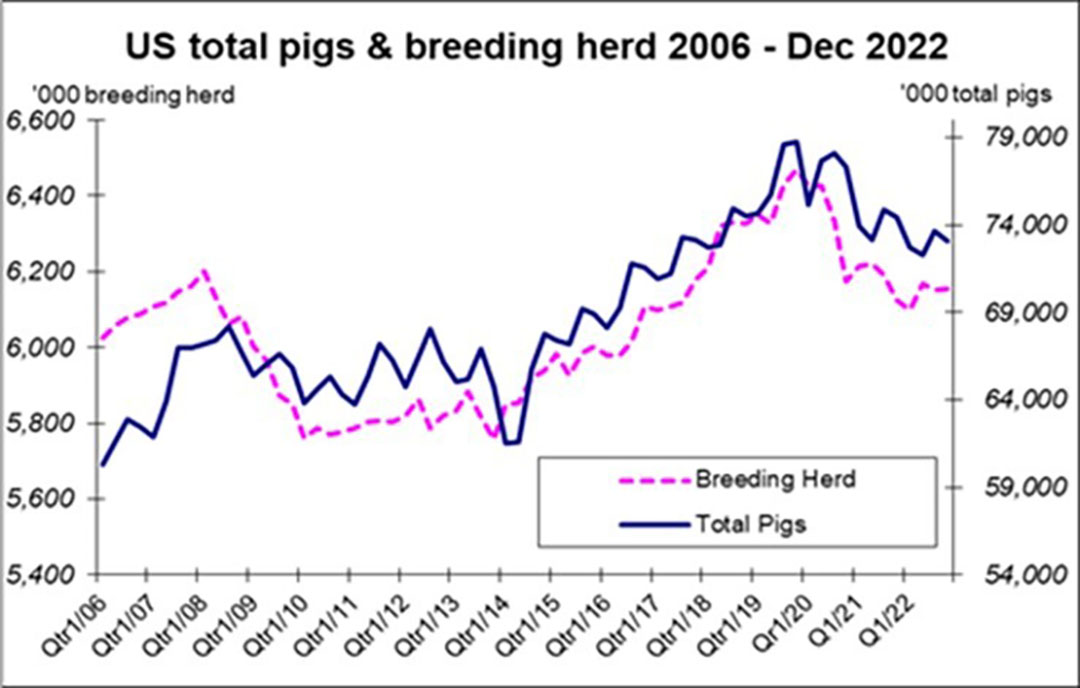

Table 1 presents the US census data as reported for December 2022 and Figure 4 presents the census data for the total number of hogs and the size of the breeding herd in a chart for the period 2006-2022. The estimate from the census for the total inventory of hogs indicates that a decline of 1.8% has occurred. The census estimate for the number of market pigs is a fall of 2%.

Significantly, however, the breeding herd data in the census point to a rise of +0.5% in the herd in December 2022. Is this just a census anomaly which will be revised in due course, or the turning point in producers’ views about the future?

One caveat to the interpretation of the latest US hog census is that the reports of high sow mortality in the USA may offer another explanation for increases in the sow herd. Farmers may simply be expanding breeding herd numbers to compensate for perceived or actual losses in herd productivity. This one census result is not enough for us to be sure of anything.

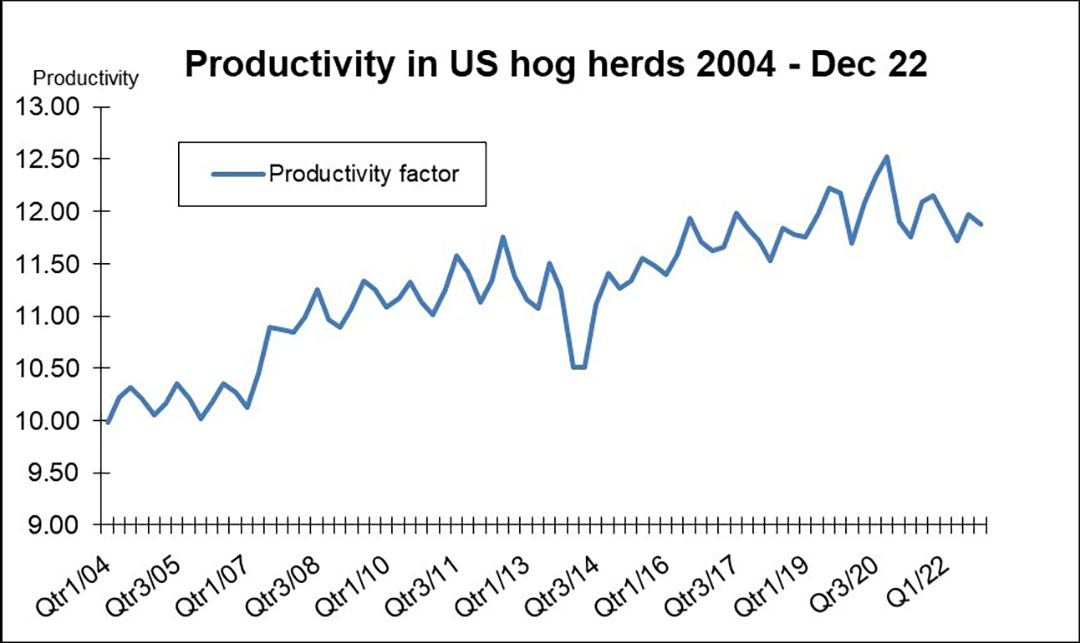

Figure 5 provides a simple illustration of how US productivity has behaved in recent years: it is not especially impressive. The wider US economy seems to be in good shape and there is no suggestion that inflation has hurt the demand for pork but the strong dollar will have affected the demand for US pork in foreign markets.

US exports in 2022 are likely to be down by 8-10% over the full year (they are down by almost 12% in the YTD October 2022). But again, if China’s herd is contracting, and demand post-Covid lockdowns is returning in China, there could be s resurgence in demand for pork imports by the Chinese. The US is well placed to respond to this if it occurs.

High prices but low expectations in the EU

I provided the census data for key pig producers in the EU In my last article for Pig Progress (October 2022). Almost all those data showed declines in the herds in key member states – with some (Germany, Poland) exhibiting double digit reductions in pig and breeding herd numbers. Only Spain has showed any resistance to major cutbacks in pig sector activity in recent years.

Pig meat exports from the EU have fallen in 2022 and that contraction was originally encouraged by supply chain disruptions linked to Covid-19 policies plus a recovery in Chinese pork production. There are indications though that EU exports have picked up at the end of Q3 in 2022.

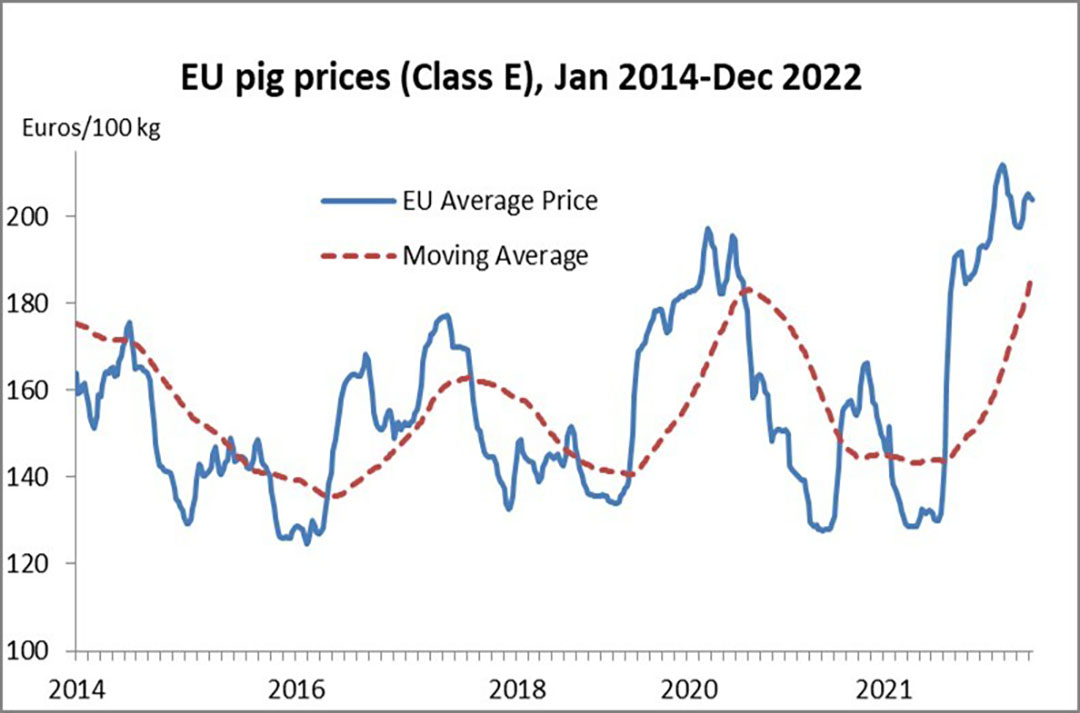

The war in Ukraine made the situation for EU producers worse as major input costs rose to eye watering levels in 2022. Higher prices for pigs resulted as pig numbers and pork production fell sharply. Figure 6 illustrates how EU pig prices have behaved in the period 2014-2022. Do not let anyone tell you that a pig price cycle does not exist! In the period of January-October 2022, pig slaughter numbers were down nearly 5%. There are few signs that producers’ confidence has risen in 2022 or that there is any intention to expand in 2023.

Such investment drivers and forward looking behaviours (confidence and breeding intention) are not regularly surveyed by EuroStat or DG AGRI. The profitability and margin data that are available, suggest that some EU producers may have gone into the black in Q4 2022 – but it would appear that this partial recovery is not enough to encourage any expectation of investment or producer expansion in Europe.

China – a twist in the plot

China’s leadership and policies on Covid-19 gave everyone a surprise before Christmas. The rapid exit from previously draconian lockdown policies has raised questions about how Chinese consumers and supply chains will react. I have no special expertise in answering these questions but for what it is worth I see it this way. Even if they are hit by high levels of infection and illness/death, Chinese consumers will now be inclined to go out, spend, and travel.

We have seen this movie before – in Europe. Consumers in the Old World were instantly ready to eat, drink and be merry as soon as they were given a chance after Covid-19 policies were relaxed (and sometimes before they were relaxed). The upcoming Chinese New Year is the perfect excuse for Chinese consumers to party and celebrate the Year of the Rabbit with their family and friends. My view is not incorporated in the model of the global pig price cycle – it cannot be as hard data is not available yet that would confirm this theory.

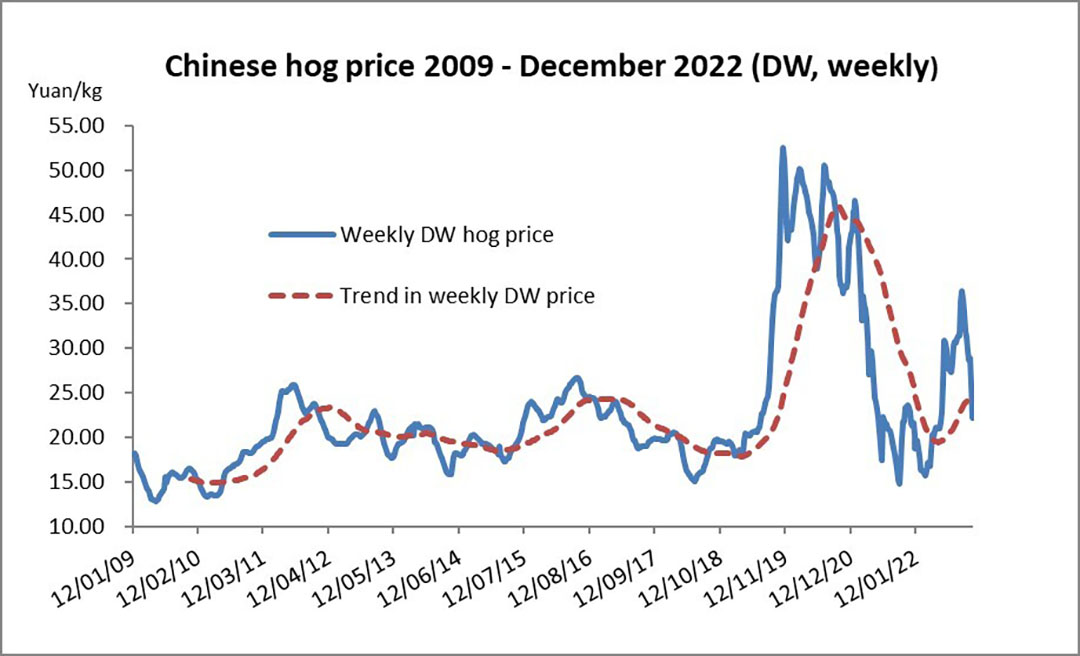

But if I am right, we could see a rebound in Chinese economic activity and demand for pork imports in Q1 2023. Figure 7 presents a description of how Chinese pig prices are behaving. They have been falling now for several weeks, but so have slaughter numbers. Is a recovery in consumer demand and pig prices possible? We can only wait and see as China’s experiment with human disease control plays out.

Be cautious, and be cheerful

My descriptions of how global pig prices have been behaving in the past and forecasts for how they might behave in the near future are always given with a caveat. The published data (the building blocks of the analyst) aren’t always reported accurately and events (disease, war, weather) are all “known unknowns” that confound the crystal ball gazer. At this moment, in January 2023, I take the view that the New Year should be given a cautious welcome. There is a real possibility that profit margins will improve for producers – even if pig prices are falling. We should be cautious about commercial decisions but recognise that there are reasons to be cheerful in the year ahead.