Quarterly Update: Global pig cycle signals an upturn

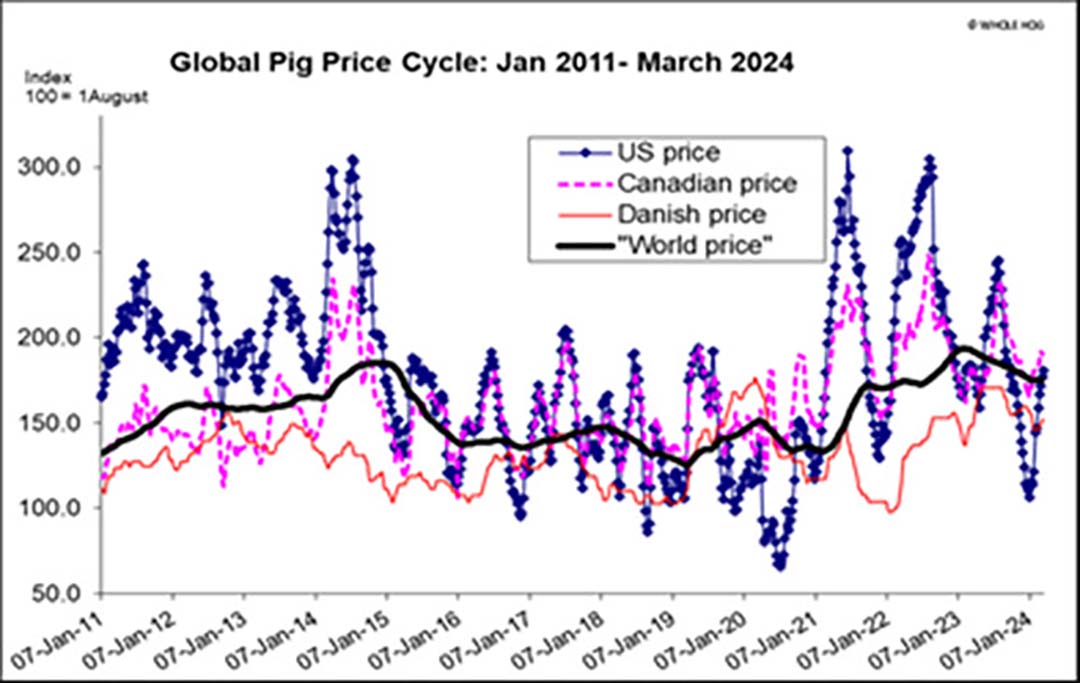

Pig market analyst Dr John Strak wrote his last column in January. In it, he presented a somewhat gloomy picture. He wrote (optimistically) that, “….one silver lining (is that) continuing supply cutbacks will lead, eventually (and usually), to higher prices paid for the product.” However, his short-term forecast was very pessimistic, “I am not expecting a turning point in the pig price cycle before the mid-year (2024).” This latter prediction has turned out to be inaccurate.

The price data that drives the global price cycle for the pig and pork industry have made a sharp about turn – apparently initiated by shortages of pigs in Europe – and exhibited positive rates of week-to-week change in March. The cycle now shows an upward turning point in its chart at the end of Q1. It is not impossible that this could be a false dawn but the latest news from China indicates that this missing piece of the global pork market jigsaw puzzle may be falling into line with other major markets.

The latest US hog census also confirms a further tightening in America’s pigmeat supply chain. In January, I noted that, “I would say that Q2 in 2024 is when rational investors and producers could start to think about making decisions about pig production in order to take advantage of pigmeat shortages in Q4 2024/Q1 2025”. It seems that this timing was exactly right.

China

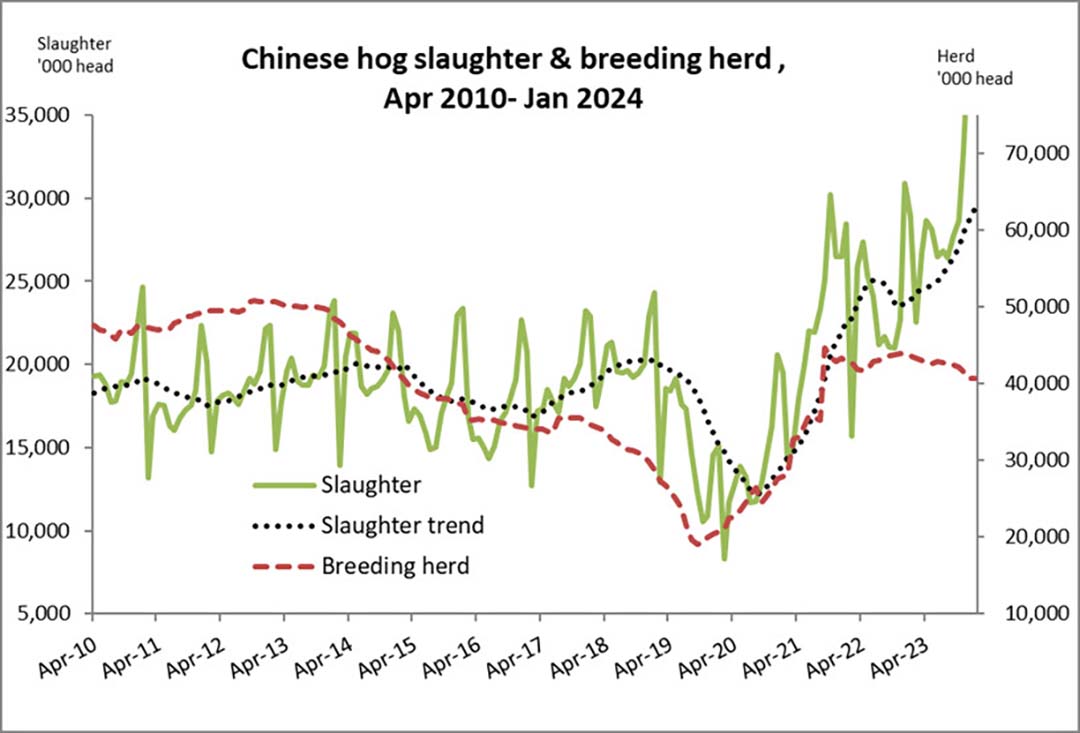

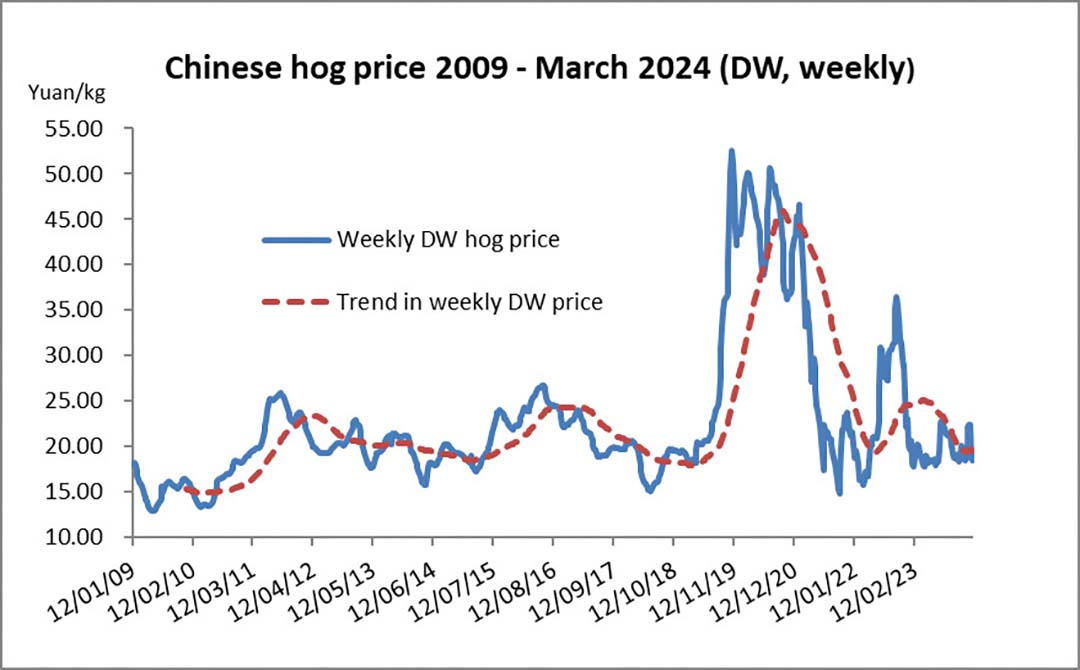

The levels of slaughter and numbers in the breeding herd, and pig prices in China are presented in Figure 1 and Figure 2. The slaughter data capture the run up to the Chinese New Year and are also likely to include culling driven by disease, low prices, and margins. Most of the local Chinese commentary and the wholesale price data from the CNY period indicate that consumer demand was, and is, poor in China.

Further, despite low returns, corporate producers maintained throughout 2023 that their growth plans were unchanged. And there was silence throughout last year from the Chinese government about what was clearly an expansionary phase in the domestic pig sector.

This bullish outlook was encouraged by corporates keen to grab market share and, perhaps, financial incentives by competitive provinces (my subsidy is bigger than yours). National and regional policy, and private sector investment decisions carried on as if no decision-maker in China had attended the Economics 101 class which describe the supply-demand conditions that underlie the hog cycle. Maybe they did not(!).

According to the official notice, regulatory measures will be triggered when the number of breeding sows rise or fall excessively to ensure a stable supply of pigs

But economic reality catches up with us all. In a significant move, China’s Ministry of Agriculture issued new regulations in March to control and reduce the nation’s pig production capacity. This is a direct result of the oversupply of pigs and losses made in the industry in the last 12-18 months. The official target for the number of breeding sows has been lowered to 39 million from 41 million. According to the official notice, regulatory measures will be triggered when the number of breeding sows rise or fall excessively to ensure a stable supply of pigs. This revision of China’s ambitions for its domestic pig sector has implications for the global pork market.

USA

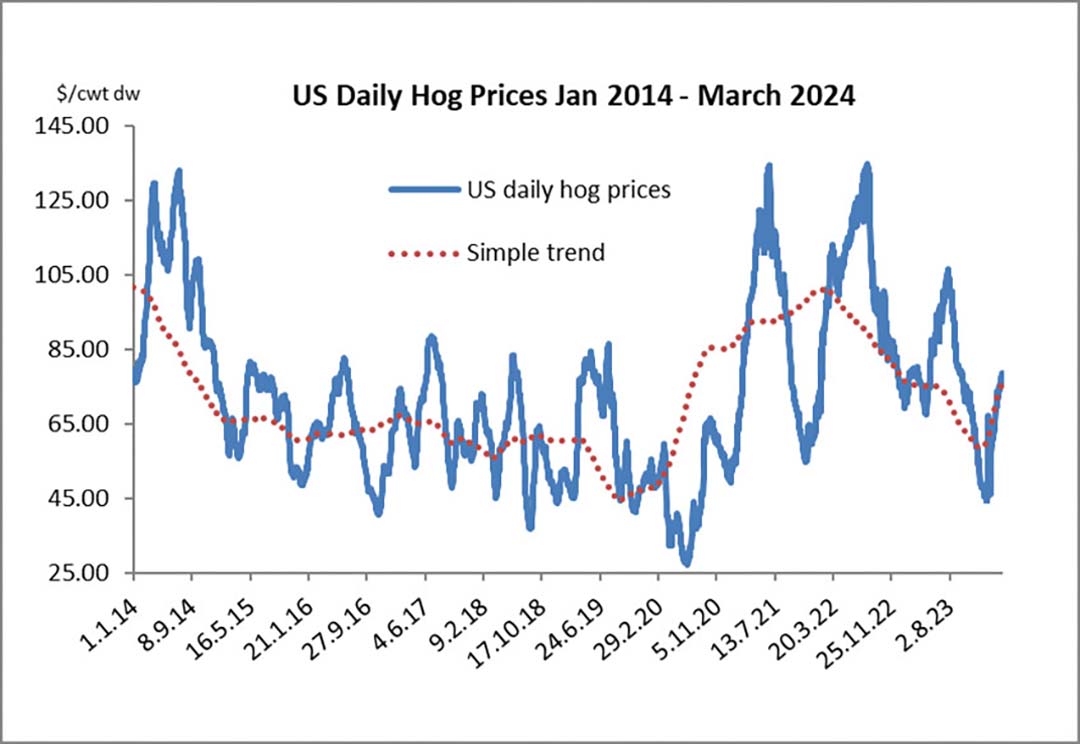

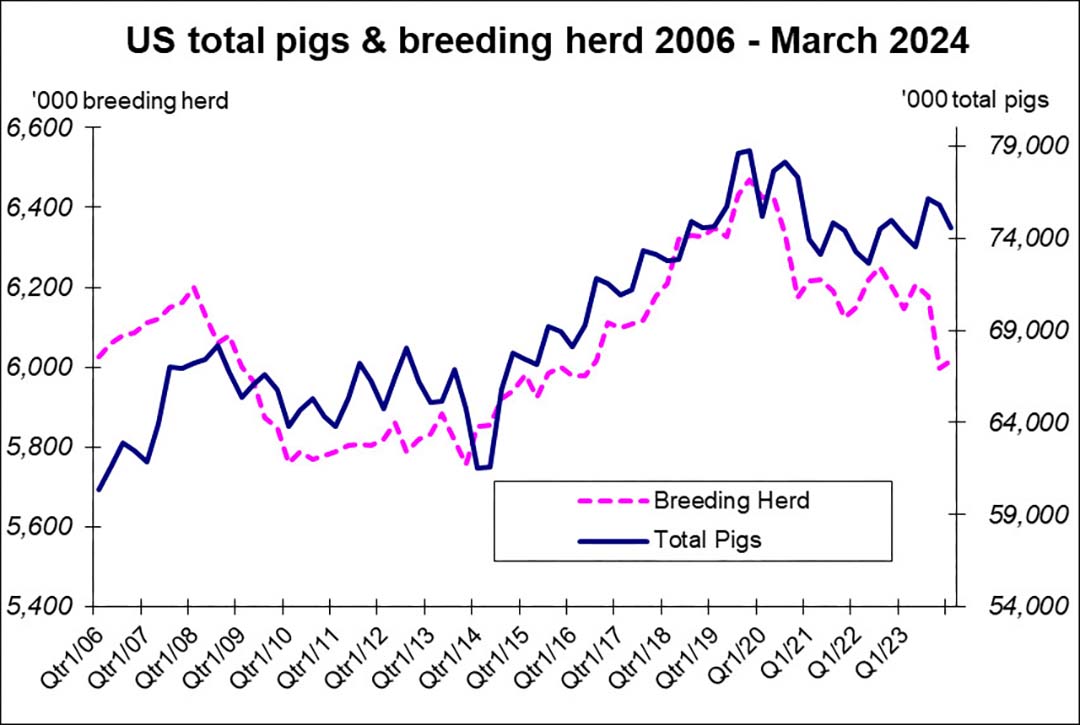

American pig producers have seen their prices yoyo-ing throughout most of 2023 but the underlying trend was negative. In Q1 2024 hog prices were rising, as expected with the season, and there are signs that these upward movements may be strong enough to reverse the trend (Figure 3). The USDA’s March 1 hogs and pigs report determined that the total number of pigs in the USA had risen by 0.6%. However, the census results indicate that producers there are still reluctant to expand their breeding sows. The female breeding cohort is down 2.1% according to this survey. Furthermore, US producers expect to have fewer sows farrowing in the next six months – down 1% or 2% year on year. Overall, even with rising productivity, it seems unlikely that US pork supplies will grow significantly in the remaining part of 2024.

EU

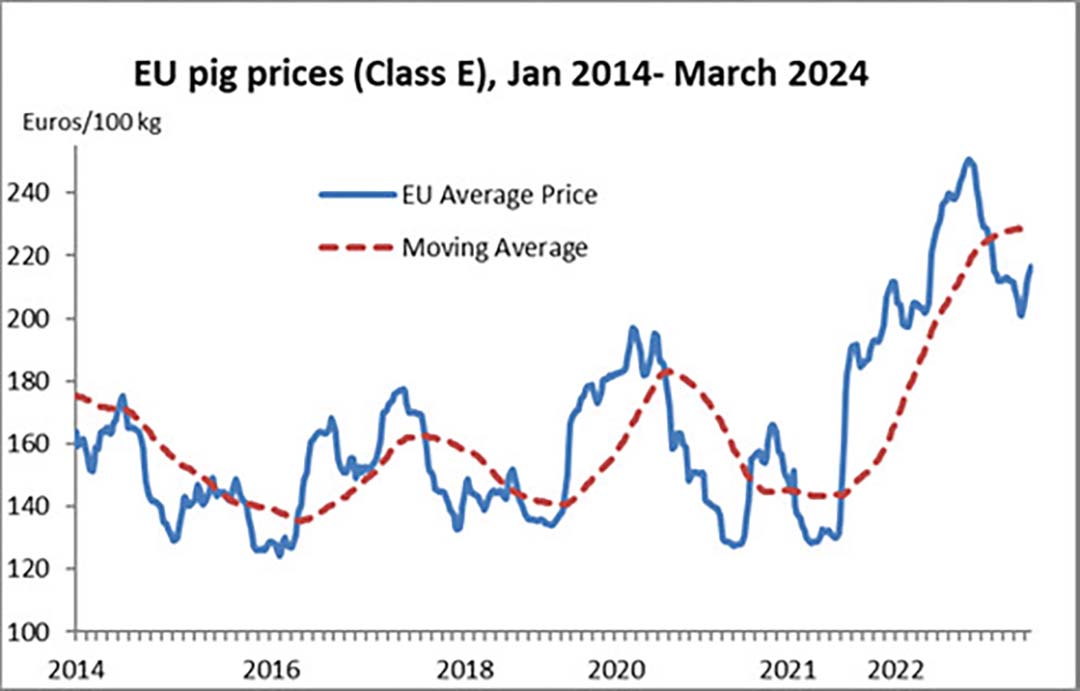

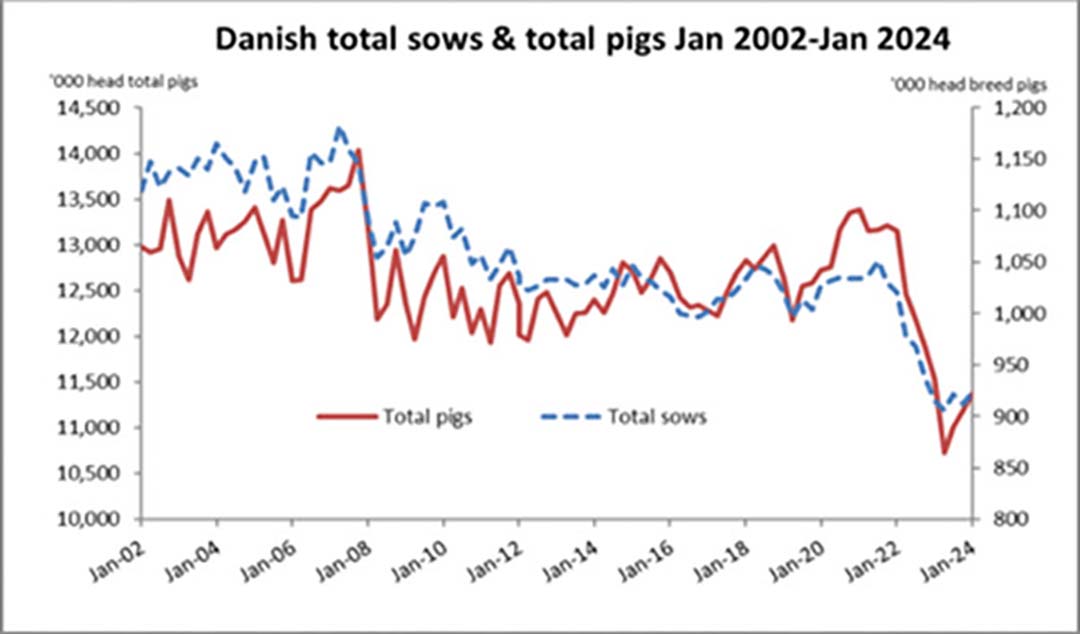

In Europe prices were falling back at the end of last year and the cutbacks in the EU’s pig sector throughout 2023 were sweeping. EU slaughter data indicate that production decreased by 6.7% in volume and by 7.3% in numbers of pigs in 2023 compared to 2022. Pig slaughter volumes were down in all Member States, ranging from a minor drop of 1.3% in Romania to a drop of -20% in Denmark. EU production in 2023 amounted to 20.6M tonnes (220 million head). It has substantially decreased over the last 2 years and is now at its lowest level in 10 years.

In 2023, total pig meat exports amounted to 4.2 million tonnes, with a value of €12.2 billion. EU pigmeat exports decreased by 20.2% compared to 2022, its value decreased by 11.5%. This huge contraction of economic activity in the EU’s pig sector was documented here last year – and the positive impact this contraction had was also observed. As Figure 5 shows, Europe’s prices made a strong recovery as supplies tightened in the first half of 2023 and only tailed off in the second half of 2023. Prices are now bouncing back as tight supply in the pipeline has become apparent in some countries in Q1 e.g. Germany and Poland. Piglet prices in the EU are, nevertheless, buoyant. Indeed, the Q1 census data from Denmark (see Figure 6) suggest that producers have ended their contraction and are now rebuilding breeding herd numbers (+1%) – albeit that the Danes are a long way from their previous peak herd numbers as illustrated in Figure 6.

Turning point in March 2024

The global picture is summarised in Figure 7. Our model of the global pig price cycle shows a turning point in March 2024. If this is sustained it will mark the end of a run of negative rates of change in weekly global pig prices since January 2023. We will be able to be more conclusive about the strength of this upturn at the end of Q2 but meanwhile its seems that we can celebrate a change in the direction of the price trend. Fundamentally, this isn’t a surprising observation since so many reductions in breeding numbers of major exporters had occurred – although the turning point seemed a long time coming. That contraction happened at the same time as a general downturn in demand/consumer spending power in some countries.

Looking ahead, it will be important to track how any turnaround in prices affects supply and demand – just as the downturn in the last fifteen months was unusual it may be that the upturn does not follow previous patterns. Watch this space!