Quarterly Update: A New Year without much cheer

Pig market analyst Dr John Strak shared his thoughts on the global pork market here in late October last year. He warned of, “a hard winter ahead” and used words like “depressed” and “gloomy times”. A miserable outlook really. Much as he would wish to start this New Year with some more optimistic words, he cannot.

My pessimism last autumn about the state of the global market for pork has been borne out by events and, regretfully, my views about the trends in the next 3-6 months are much the same. Prices and margins for farmers will be relatively low and pig numbers are likely to decline. Basically, less business for everyone in the supply chain.

No turning point in the pig price cycle before the mid-year

Unless there is a major market-disrupting event (animal disease, new Covid 19 variant, financial crash, etc) I am not expecting a turning point in the pig price cycle before the mid-year. Producer prices (adjusted for seasonality) will certainly not improve before the end of Q1 in 2024 and probably not before the end of Q2 2024. Margins, however, could start to show improvement towards the end of Q2 as cost pressures reduce – albeit external events (weather, war and conflict) could throw that of track as well.

Prices in EU slip back, US prices collapse

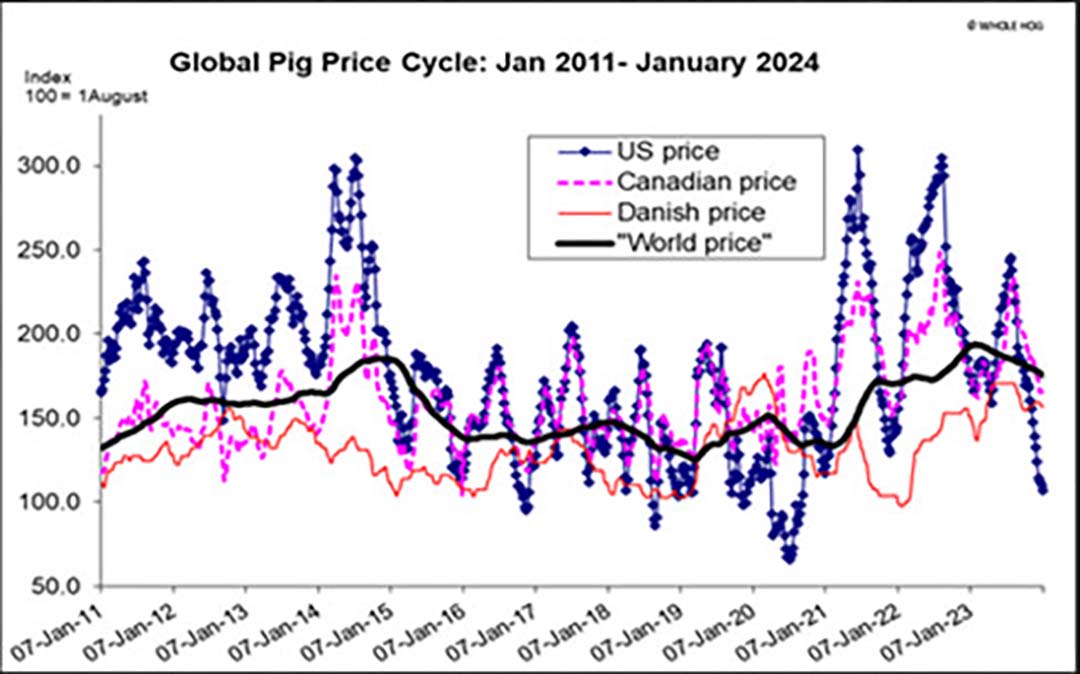

One glance at the chart lines in Figure 1 explains why I am still pessimistic. Prices in the EU had been holding up but are now slipping back and, at the same time, US hog prices have pretty much collapsed. Canada’s hog prices have held up relative to the US producer price but they are still on the way down.

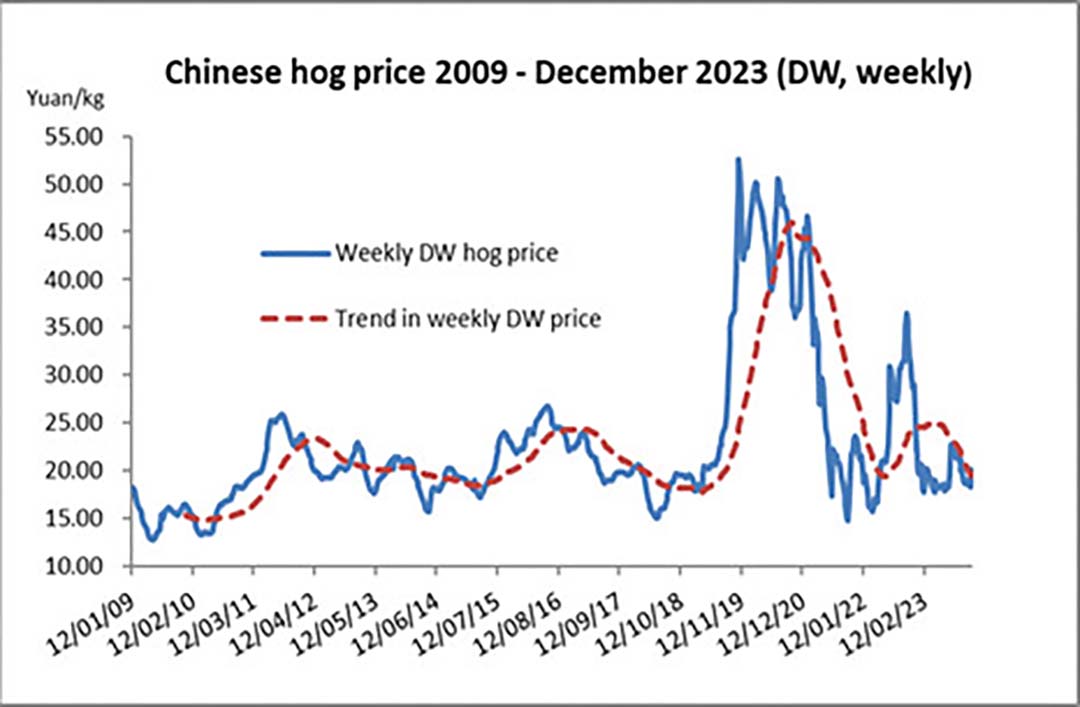

Pig prices in China

China’s pig prices are not shown in Figure 1 but you will see in Figure 5 that pig prices in the world’s biggest producer and consumer of pork have also been declining. The downward phase of the global pig price cycle is well established and very clear in Figure 1. The underlying story here, and in all major pig producing regions -including China – is that producers have been hit hard by declining margins, and consumers and producers have been squeezed by uncertainty (wars/conflict, post-Covid credit/supply chain hangovers) and generally negative views about economic prospects.

Admittedly, consumer confidence surveys are subject to wide swings month to month and between countries – the IPSOS global consumer confidence index illustrates this for its constituent countries – so generalisations about trends are dangerous and need to be based on several data points.

Nevertheless, consumers’ willingness and ability to spend, have added a serious extra twist to the “normal” pig industry contraction after a period of expansion. I will call this the post-Covid “hangover”. Figure 1 offers an illustration of what “normal” looks like – a series of ups and downs in the global market which astute producers and investors watch. There is little to feel cheerful about in that chart.

Expansion of breeding herd

In the USA the latest pig census results (December 2023 collection date) indicate that producers there are bot expanding their key production asset – the breeding herd. The female breeding cohort is down 3% in this census- a much larger drop than analysts were expecting. Table 1 presents some of the key data published in the hogs and pigs report produced by the USDA.

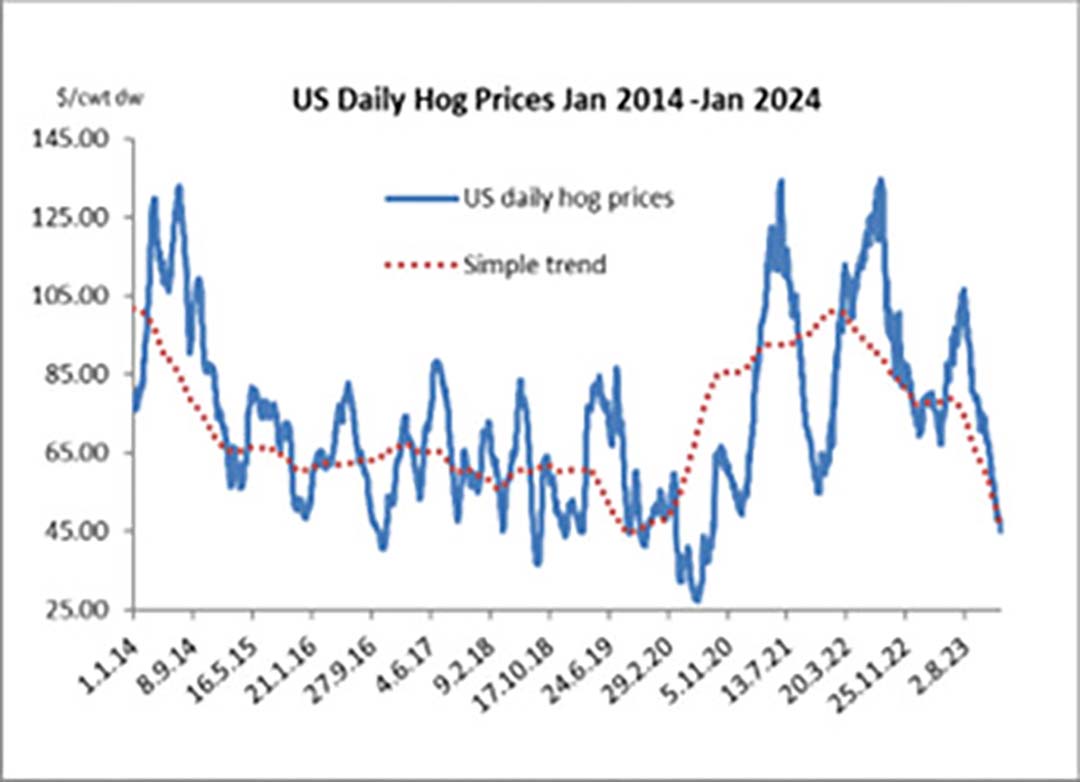

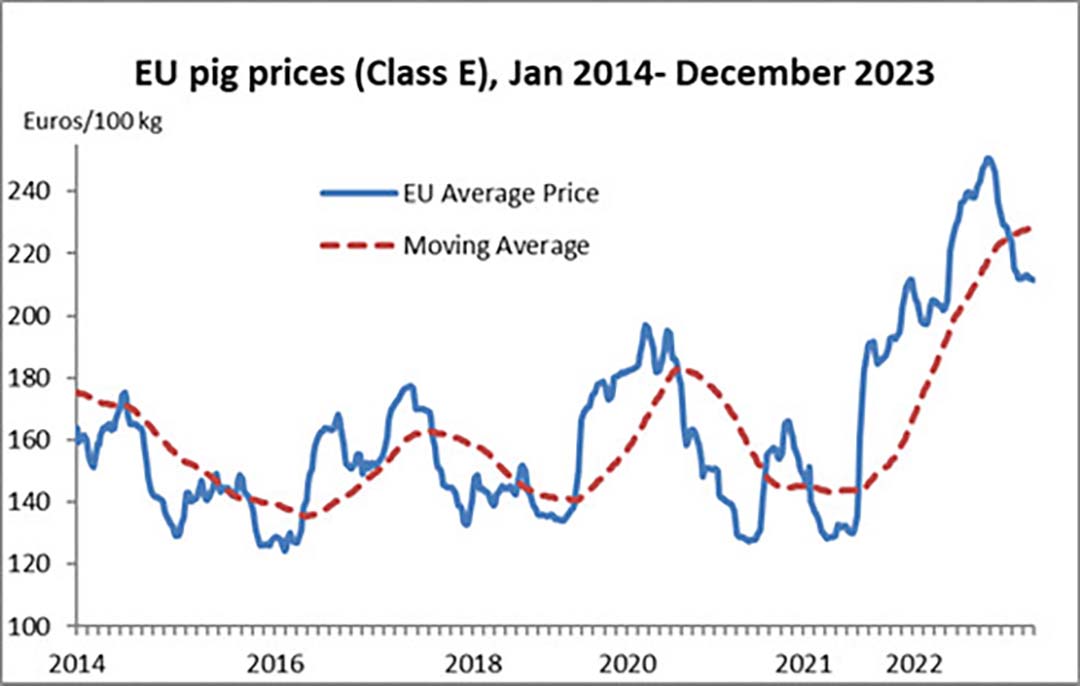

Figure 2 provides a view of how the US breeding herd and total inventory are related over time but, unless productivity improves sharply, we may be at a point of “peak hogs” in the USA. Figure 3 describes the behaviour of US hog prices in more detail. The downward trend has been apparent for almost 12 months now. In the EU, the most recent predictions by the analysts there suggest that pig numbers and meat production will continue to decline. EU pigmeat production is projected to fall by 0.9 % per year between now and 2035 (or almost 2 million tonnes compared with 2021-2023). Although positive margins for pig production returned in 2023 the price trend looks set to turn negative in early 2023. Pig prices in the EU are now only about 5% higher than in 2023.

China’s New Year

The most recent national prices for China’s hog producers are shown in Figure 5. I have checked these against January’s prices published for the Xinfadi wholesale market in Beijing. Market prices seem to be bouncing along the bottom with no signs of a sustained recovery. The big Chinese New Year holiday is approaching at the end of January/early February. That will be a test of the market’s mood.

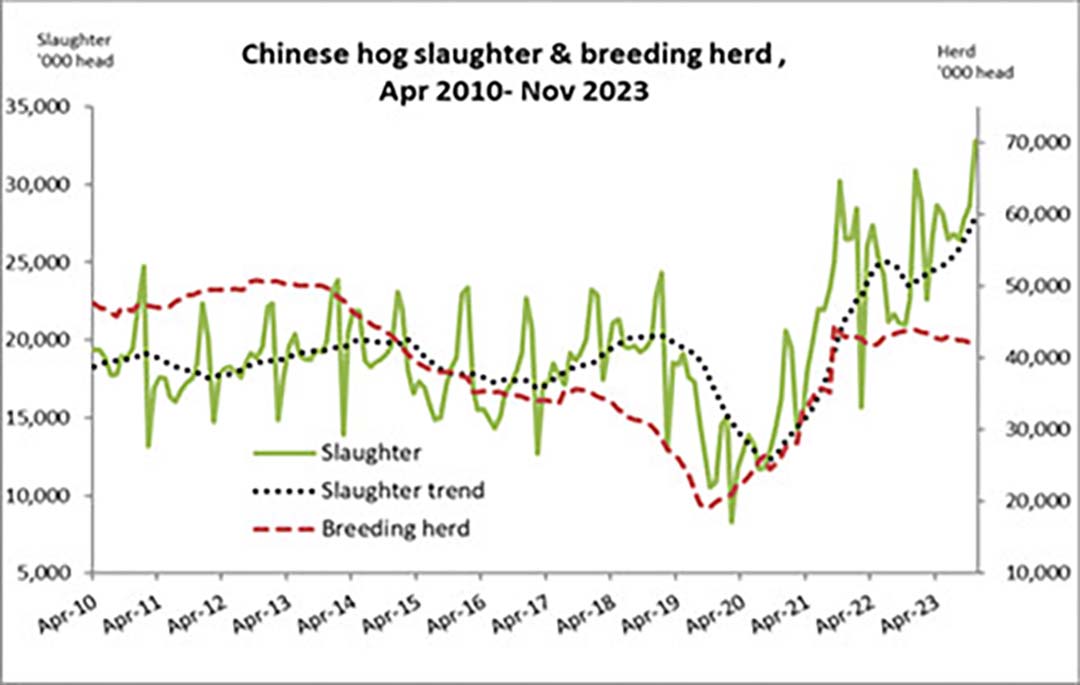

Demand may shift because of that celebration but, as Figure 6 shows, there has been a significant increase in slaughter recently. This is being driven by producers’ negative margins and, it is rumoured, the incidence of ASF and other animal diseases. Figure 6 also indicates that the breeding herd is contracting in China. These data are not the most reliable statistic in China but if this picture is accurate then China is, along with the USA and the EU, reducing the potential for domestic production of pigs and pork. Productivity increases will mitigate this reduction but that admission begs questions about how and when that productivity will be achieved in China.

Silver lining

Overall, it’s another pessimistic view of the major pig producing and export regions of the world from me. Wishing you a Happy New Year after reading this hardly seems enough. There is, perhaps, 1 silver lining for any producer/investor in a commodity sector – continuing supply cutbacks will lead, eventually (and usually), to higher prices paid for the product.

For the global pigmeat value chain the timing of any investment and/or production is crucial. If pressed I would say that Q2 in 2024 is when rational investors and producers could start to think about making decisions about pig production in order to take advantage of pigmeat shortages in Q4 2024/Q1 2025. But in this (very) uncertain world all of these thoughts about the future need to be acted on with a great deal of caution.