China’s livestock and meat trade, 2017–2023

African Swine Fever (ASF) and COVID-19 have had far-reaching impacts on China’s meat production and trade. In 2 papers, Pig Progress examines the impact of ASF and COVID-19 on meat production, consumption and trade, and the prospects for the next decade. This second article analyses the dynamics in foreign trade between 2017 and 2023 and provides a forecast for the current decade.

During the period under review, China’s supply deficit for the 2 most important meat types changed considerably (see Table 1). The supply deficit for pork more than tripled between 2017 and 2021. It decreased again when the ASF outbreaks subsided. However, it was still 20% higher in 2023 than before the outbreak. Conversely, the deficit for beef increased continuously over the period under review. It reached 3.5 million tons in 2023. Despite the rising demand, the deficit for chicken meat remained very stable at 200,000 to 300,000 tons. This isbecause domestic production grew by 3.1 million tons or 28%.

Differences in trade in pigs and cattle

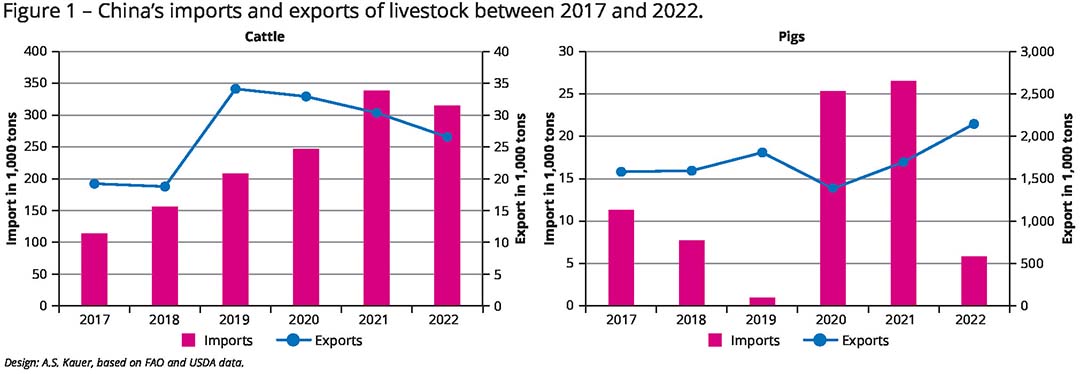

The high animal losses in pig inventories caused by ASF and the collapse in cattle herds as a result of the COVID-19 epidemic necessitated extensive imports of livestock. Figure 1 shows that imports of cattle and pigs differed significantly. Imports of cattle, especially beef cattle, rose continuously until 2022. The main supplying country was Myanmar,. This country was able to contain the outbreaks of Foot-and-Mouth Disease (FMD) and thus could export to China again. Breeding cattle was imported from Australia, Uruguay and Chile. Exports of beef cattle remained at a low level, with Hong Kong as the main buyer.

Imports of pigs

The imports of pigs were mainly hybrid sows because ASF had also affected valuable breeding stock or these were culled as a preventive measure to stop a further spread. The breeding farms had to be restocked in 2020 and 2021. The most important supplying countries for the sows were the USA, Denmark and France. Despite the tense situation in the supply of pork, slaughter pigs continued to be exported, mainly to Hong Kong and Japan.

Strong fluctuations in meat imports

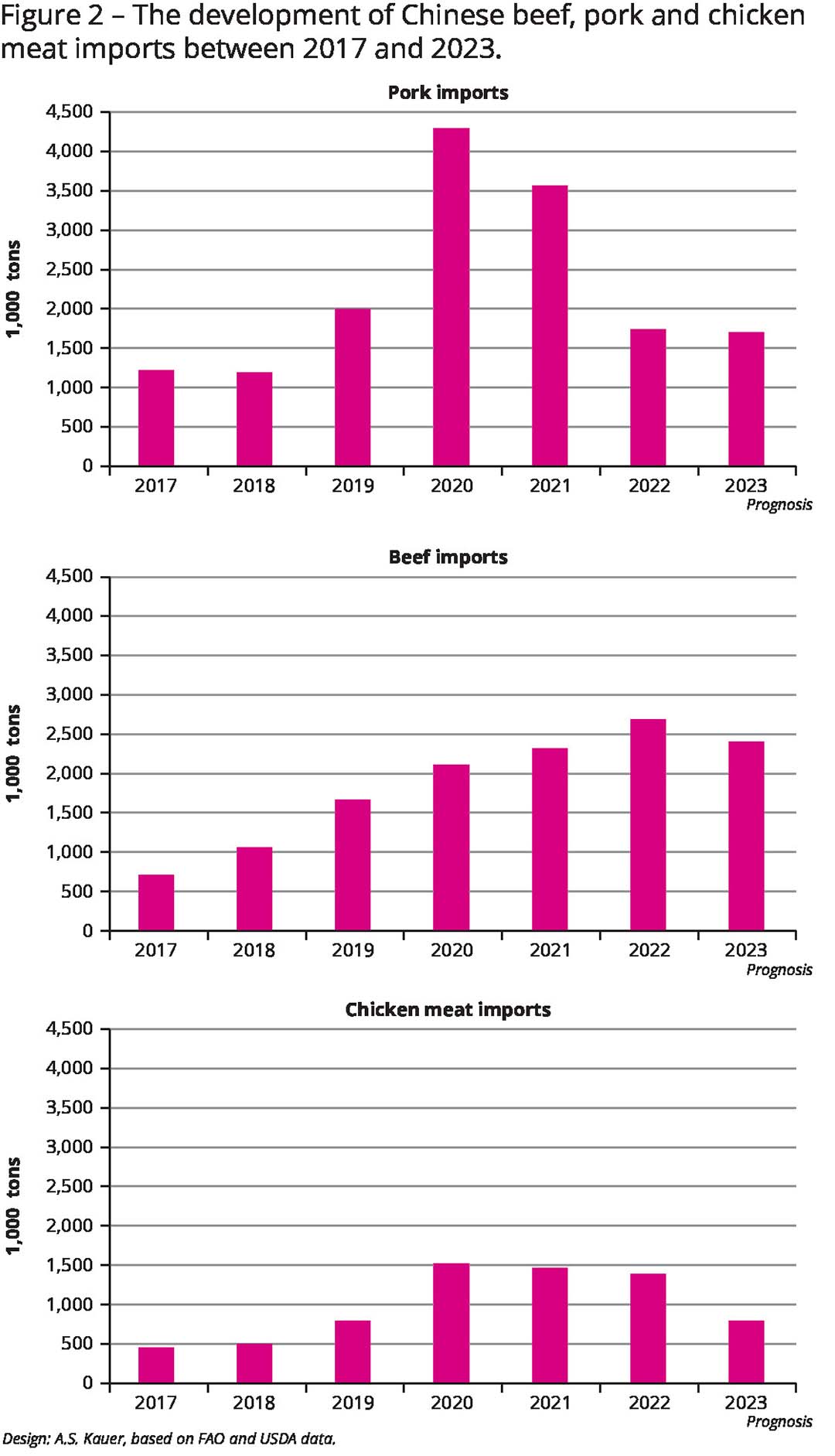

Meat imports showed remarkable dynamics between 2017 and 2022. Pork imports almost quadrupled between 2018 (see Figure 2), when the ASF outbreaks began, and 2020. When the epidemic subsided, imports fell again significantly. They were however still 500,000 tons higher in 2023 than in 2017.

Imports of beef rose steadily until 2022, reaching a peak of 2.7 million tons in 2022. A decline in imports is assumed for 2023, as demand is expected to fall due to high prices and consumers turning to the considerably cheaper pork and poultry meat. Nevertheless, imports will remain high because beef production, which is dominated by small and medium-sized farms, is less efficient than on the few large farms, resulting in higher production costs.

Large fluctuations in chicken meat

The large fluctuations in chicken meat imports are remarkable. This is mainly “white” broiler meat, which is increasingly favoured by consumers over the “yellow” meat of domestic breeds. In parallel to the sharp decline in pork production, imports doubled between 2019 and 2020 and remained at a high level until 2022. A significant decline is expected for 2023. The lifting of import restrictions on grandparent stock will allow more broiler chicks to be produced. However, the new wave of avian influenza (AI) outbreaks in the USA, which began towards the end of 2023, could lead to import bans again. This would then result in a growth in meat imports. The domestic hybrid lines for white meat, released in 2022, have so far been less efficient and cannot compensate for any supply shortages that may occur.

Remarkable dynamics in trade flows

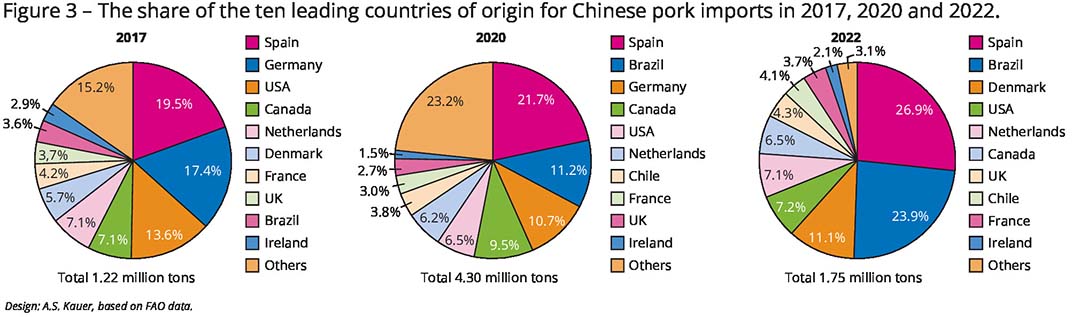

It is interesting to analyse the pattern changes of meat trade between 2017 and 2022. Figure 3 shows the change in pork imports. Spain, Germany and the USA were the 3 leading supplying countries in 2017. Together, they accounted for 50.5% of the imports. Brazil was still ninth.

When 4.3 million tons were imported in 2020, due to the high supply deficit, Spain remained in first place with a share of 21.7%. Brazil had replaced Germany becoming second. Regional concentration had decreased, however, as the 3 leading countries now only accounted for 43.6% of total imports. Whilst the USA’s share halved, Canada was able to significantly increase its exports. Chile was another South American country to join the top group.

Pattern changed in 2022

The pattern changed again in 2022. Germany dropped out as a supplying country due to the ASF outbreak amongst wild boar. Spain and Brazil were able to consolidate their leading positions. Together, they contributed 50.8% to the overall imports, which had fallen, however, to 1.75 million tons.

The regional pattern of beef imports remained very stable despite the fourfold increase in volume between 2017 and 2022. Countries with extensive natural grasslands occupied the top positions. Uruguay, Brazil and Argentina had a combined share of 69.3% in 2017. In 2022, they even accounted for 72.4% of imports. Australia fell back to sixth place, whilst the USA was able to expand its exports to China. It can be assumed that this regional pattern will remain stable in the following years.

Imports of chicken meat were still insignificant in 2017 at less than 500,000 tons. Brazil alone accounted for 84.8% of total imports, followed by Argentina and Chile. By 2022, the import volume had almost tripled. Although Brazil still ranked first amongst the supplying countries, its share had halved because the USA, Russia and Thailand were able to significantly increase their export volumes. Preliminary data for 2023 shows that Brazil was not only able to maintain its market position, but even to increase its exports.

Exports despite high supply deficits

At first glance, it is surprising that China exported chicken meat and pork during the period under review despite obvious supply shortages. Considering the production volume of more than 50 million tons, exports of pork were almost insignificant in most years at less than 50,000 tons. The main customers were Hong Kong and Macao. Exports of chicken meat, excluding processed products, ranged from 161,000 tons in 2020 to 227,000 tons in 2022, in which Hong Kong shared 57.7% and Macao 5.7%. Including processed products, exports reached a volume of 532,000 tons in 2022. Here, too, Hong Kong was the most important customer. It is obvious that the Hong Kong and Macao special administrative regions were the main destinations for the meat exports.

Summary and prospects

China’s foreign trade reflected the dynamics of meat production in the years 2017 to 2023. Declining inventories of pigs and cattle led to supply deficits which could only be met by increasing imports. When the ASF outbreaks subsided and the restrictions imposed during the peak of the COVID-19 epidemic were lifted, the import volume of pork normalised again. It was however still around 500,000 tons higher in 2023 than in 2017.

Poultry meat imports doubled between 2019 and 2020 because consumers were reluctant to buy pork due to the sharp rise in pork prices and uncertainty regarding the possibility of ASF being transmitted to humans. Imports fell only slightly in the following 2 years because meat production could not be increased in line with demand. Beef imports grew continuously between 2017 and 2022. They reached a plateau in 2023 and are likely to fall marginally in the following years due to high retail prices.

Meat imports

Regarding the development of meat imports until the end of the current decade, the OECD-FAO forecasts differ considerably from those of the USDA. Whilst the OECD-FAO predict declining imports of pork on the assumption that it will be possible to control the ASF outbreaks, the USDA apparently assumes that problems in containing the disease will continue and imports will therefore remain at a high level.

The OECD-FAO does not expect any major changes in beef imports, whilst the USDA assumes an increase of 24%. The OECD-FAO is forecasting a 25% decline in poultry meat imports because it is assumed that production will grow faster than demand. In contrast, the USDA expects imports to grow by 30% because the rising demand for white broiler meat cannot be met by domestic production.