What was driving Spain’s pig performance in 2024?

Recently, new insights were presented related to financial and performance results of 200 of Spain’s largest farms, covering a total of 1.6 million sows. In the latest figures, including 2024, total production costs have been decreasing; however health issues have caused weaner mortality to grow since 2022.

The insights and analysis were shared by Catalan consultancy company SIP* – a reference in Spain with regard to pig market insights. Over the period 2020-2024, the company noted strong margin fluctuations for pig farms, mainly due to 3 factors:

- Pig prices;

- Feed costs; and

- Health situation.

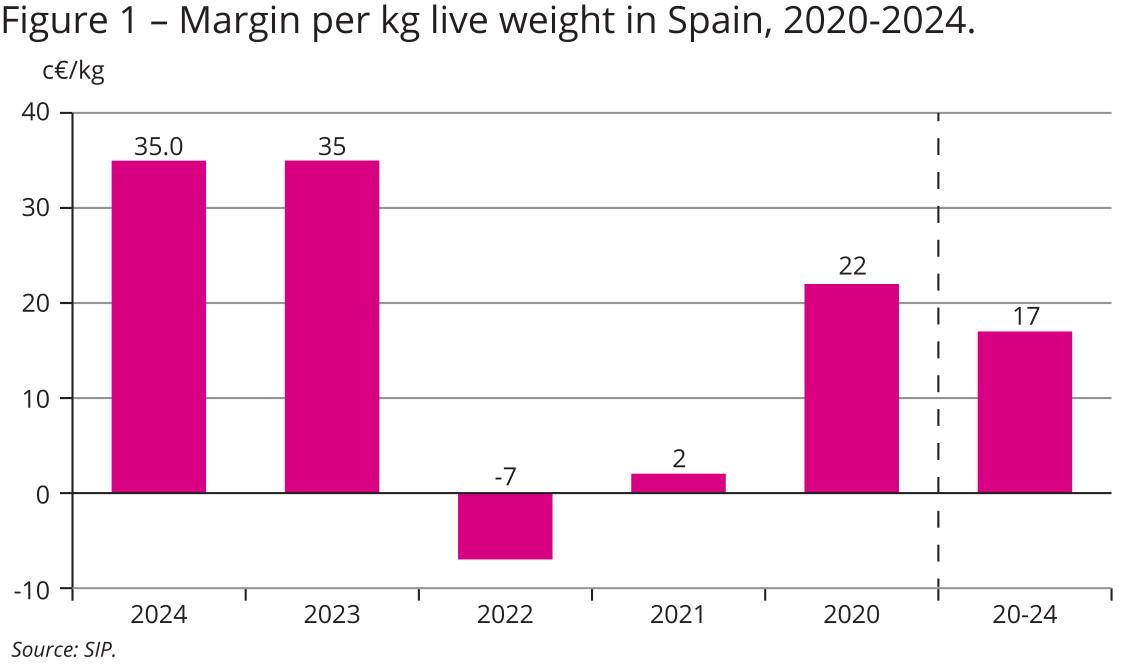

Over 2024, the financial results of farms connected to SIP were very positive, with a positive margin averaging at €0.35/kg. As can be seen in Figure 1, that outcome was similar to 2023 and much higher than the rest of the years analysed. The average margin for the last five years was €0.17/kg.

Pig prices

Pig prices

Over the last 2 years (2023-2024) the pig price, established by reference market in the city Lérida (Mercolleida), has been clearly higher than in previous years. In 2023 it increased, reaching a very high level for the whole year (€1.87/kg), never seen before. In 2024 the prices dropped (€1.72/kg), however, they were still high. The net price obtained by producers in 2024 was €1.70/kg.

The difference between the Mercolleida price and the net price this past year has been €2.40/kg. That is slightly lower than in previous years. The difference between the Mercolleida sales price and the net price corresponds to the costs, bonuses and discounts of the sale, in addition to the seasonal effect of selling more or less kg throughout the year.

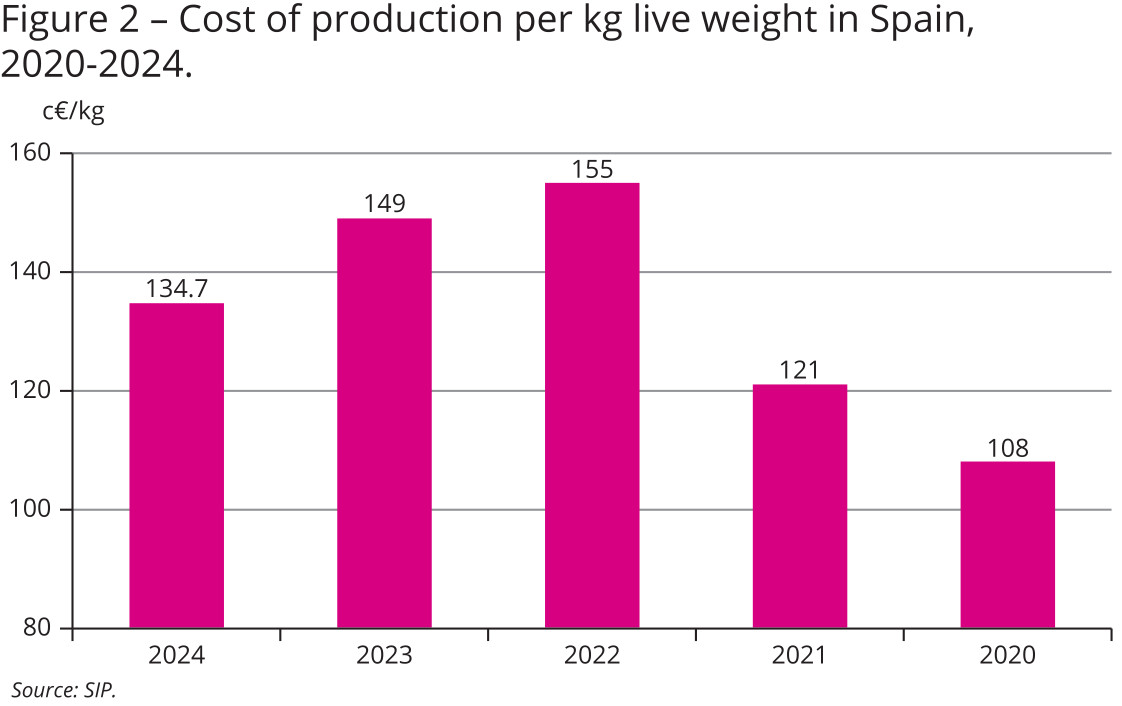

In 2024, Spanish production costs came down to €1.35/kg, as can be seen in Figure 2. It fell compared to 2023 thanks to more favourable feed prices, but production costs were higher than in 2020-2021 and the years prior. In 2022, there was a sharp increase in costs, of around €0.35/kg compared to the previous year. All that was caused by the conflict in Ukraine, which increased the price of raw materials and feed by more than €100/ton. In addition, health problems since 2021 have worsened the productive results of sows and mortality on farms, increasing the cost of production.

Optimising production costs was also an increase in final slaughter weight in recent years. Between 2022 and 2024 the finishing weight increased by over 5 kg: from 113.4 to 118.6 kg, optimising the cost of production.

Feed costs

Feed costs

There have been strong changes in feed prices over the last 5 years. Until 2020, feed prices were relatively stable. At the end of 2020, prices began to rise due to strong global demand for raw materials and this trend continued throughout 2021 (an increase of €43/ton). In 2022, with the start of the conflict in Ukraine, the price of raw materials increased further, reaching feed prices never seen before (to €429/ton, increase of €111/ton). In 2023 and 2024, the market calmed down, and feed prices settled at €337/ton.

Overall feed conversion increased by about 50 g in recent years, reaching 2.68. That increase is explained by the loss of productivity per sow and higher mortality in growing and finishing phases. However, feed efficiency has improved slightly, as it has remained at 2.68 for the last two years, despite the increase in sales weight.

The health situation

The health situation

Since 2021, the SIP database there has been a strong deterioration in sow productivity (piglets weaned per sow per year), as well as in the mortality of sows, piglets and pigs. Since 2021, health related problems have persisted.

Main causes that have led to this situation are:

- The reduction in the use of antimicrobials (January 2019);

- Emergence of the Porcine Reproductive and Respiratory Syndrome (PRRS) strain Rosalía (January 2020);

- Suppression of zinc oxide in piglet diets (June 2022).

In summary, the health problems affecting the sector are caused, on one hand, by the difficulty in controlling bacterial diseases (reduction in the use of antibiotics and suppression of zinc oxide), and, on the other, by the emergence of Rosalía strain, which is characterised by its rapid spread and high pathogenicity. In recent years, health problems have generated a significant loss in pig production, significantly reducing the number of pigs sold per sow per year from 25.7 (2020) to 23.3 (2024).