Quarterly update: Resilience and uncertainty in the pig market

If one word would sum up the theme for the next months to come in the pig and pork market, it would be resilience. Those markets that manage to withstand the uncertain times, will probably thrive, writes Dr John Strak, international pig market expert.

At the previous quarterly update in April my final observation was, “My conclusions for this quarterly forecast have one certainty – nothing is certain.” This might have seemed a cop out but I am not one to pretend that I know how president Trump thinks (in my defense many more observers who are well above my pay grade also seem unable to predict his mindset). And it is Trump’s unpredictable words and actions that have dominated the last 3 months of the news cycle.

Shortly after I wrote my April piece, Trump announced a 90-day pause in the application of his punitive “Liberation Day” tariffs. Which, in round terms, now puts us back at the point where we were in early April. The arguments with China have been put on the back burner (they are not resolved) and trade tensions continue between Canada and Mexico, the EU and the USA. All these countries, and more, are facing a July 9 deadline from Trump – after which who knows what other tariffs and threats will affect global trade. Nobody is betting on a swift return to normality in 2025.

But what about the global pork market I hear you ask?

US pig and pork market

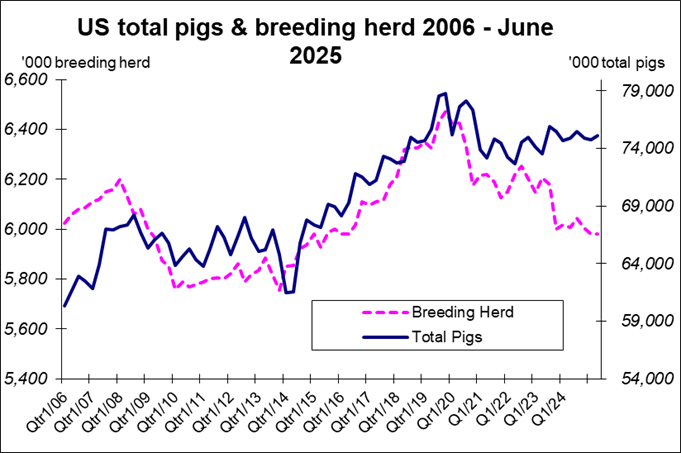

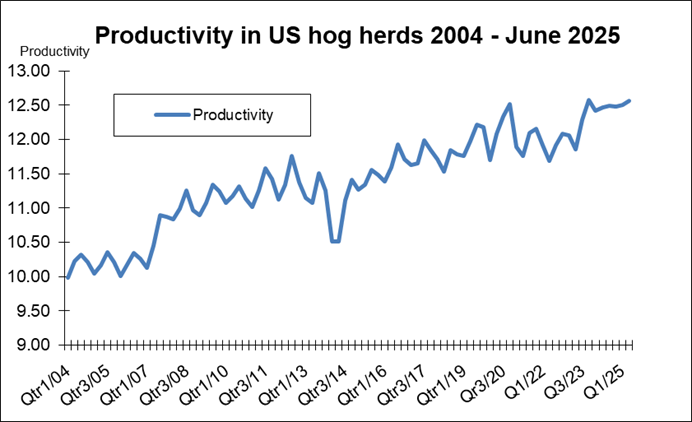

In Figure 1 and in Table 1 I present some of the latest data published in the June hog census for the United States. These data show a relatively stable position for the US herd across the key measures. There may be a slightly larger year on year cohort of pigs for slaughter in July/August 2025, implying more supply, and interestingly, another good set of productivity figures for the quarter which maintain the positive trend in the pigs finished /breeding sow metric.

The figure above illustrates this and this trend counters the downward trend in the breeding herd.

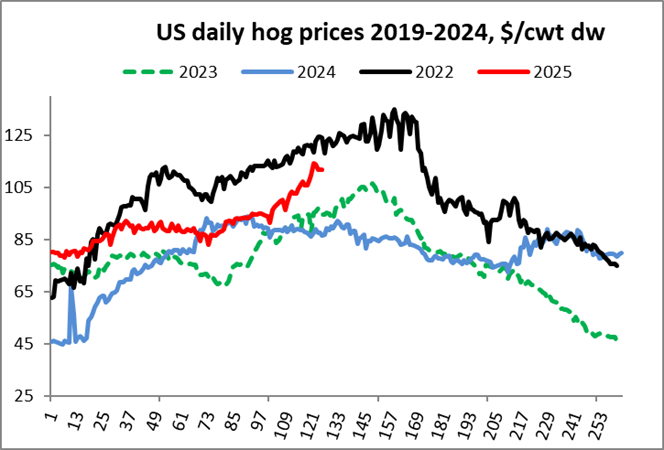

As for prices, in April I thought that Trump’s interference in trade would affect US hog prices negatively, but since late May a marked recovery has occurred (coinciding with the dollar’s decline and eased trade tensions with China?). The deseasonalised price data in Figure 3 clearly show the marked upturn in US hog prices since the latter part of May. This strong rise in prices seems to be driven by demand – also influenced by very high prices in the retail beef market. I have been bearish on US consumer demand – inflation and the job market data do not encourage optimism – and I am yet to be convinced that president Trump’s economy will see significant growth this year.

EU pig and pork market

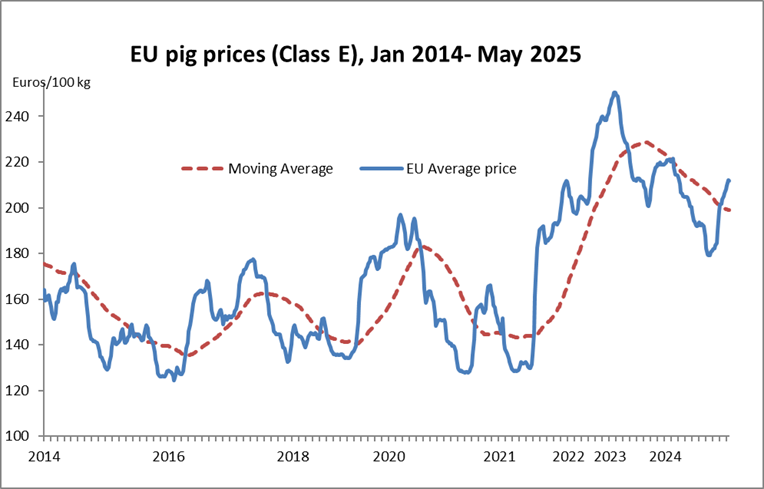

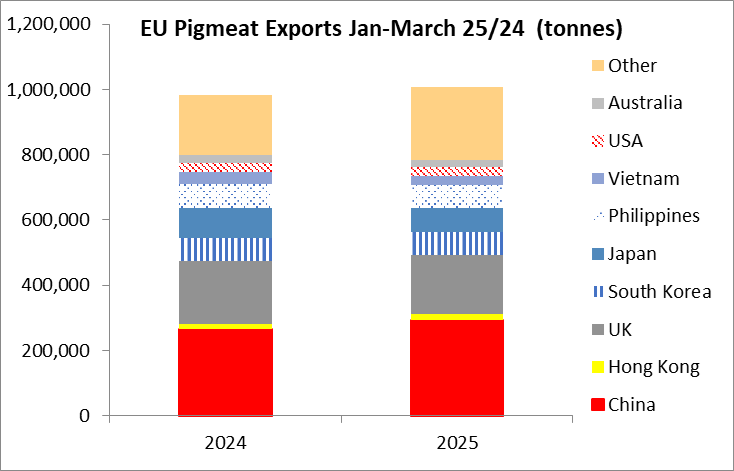

In the EU, even with ongoing ASF outbreaks and the Ukrainian war not far from the front pages, pork exports and pig prices have been relatively strong. Figure 4 illustrates how pig prices have improved. In Q1 2025 total pigmeat exports from the EU grew by around 2.5%. And in the 4 months to April the growth rate was almost 3%.

The distribution of exports to key markets in 2024 and 2025 for Q1 is shown in Figure 5. The EU’s export demand was growing before Trump’s announcements in April – but that demand has likely received a serious shove from the president’s tariff shocks. As the monthly trade data become available that story will be told in detail. Whatever the short-term impacts of Trump’s tariffs, the competitive landscape between pork exporters in the USA and exporters in the EU (and in Canada) has probably been permanently affected.

The buzz words from global management consultancies now are; resilience and supply chain rebalancing. It’s not just about price and quality – reliable supply partners are now a bigger part of the equation for international business and the old assumptions about “just in time” suppliers are being heavily revised.

China’s pig and pork market

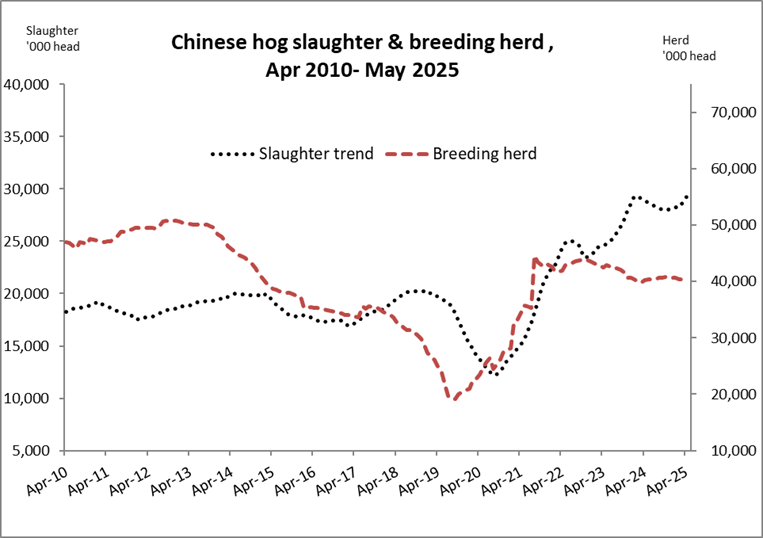

China’s pig and pork market is still struggling with how to control the boom-and-bust cycle. Officials are anxious to avoid another “bust” as producers, large and small, are tempted to use technological advances to reduce costs and increase supply. The national target for the size of the herd has been reduced and, no doubt, large producers in China are being quietly encouraged to hold back expansion plans. But those large producers are still a relatively small part of the total pig supply in China.

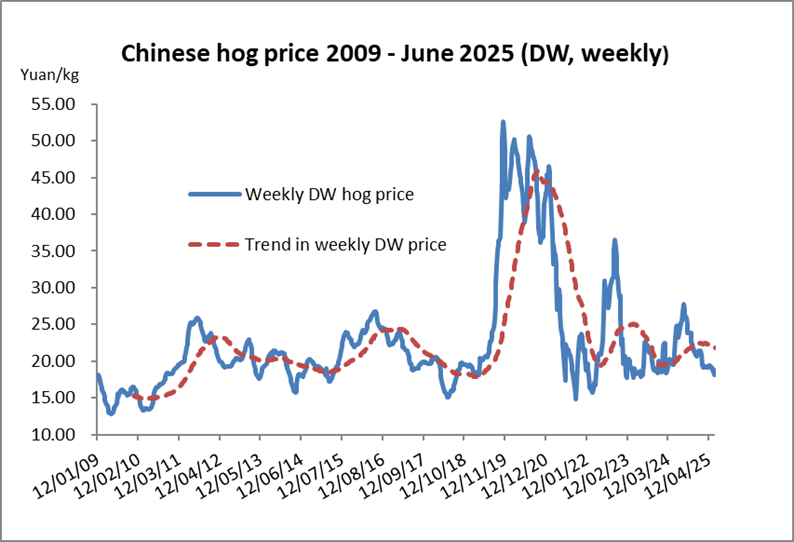

Pig prices bounce along a floor

The trend line for China’s breeding herd shown in Figure 6 needs to fall faster if the latent productivity in China’s national herd is to be harnessed without crashing pig prices. Pig prices meanwhile are bouncing along a “floor” of just under 20 yuan/kg dead weight: see Figure 7. I have observed before that there seem to be little chance of a big recovery in Chinese pig and pork prices, or in the Chinese pig inventory in the first half on 2025. That prediction can be extended to all of 2025 now.

Global position

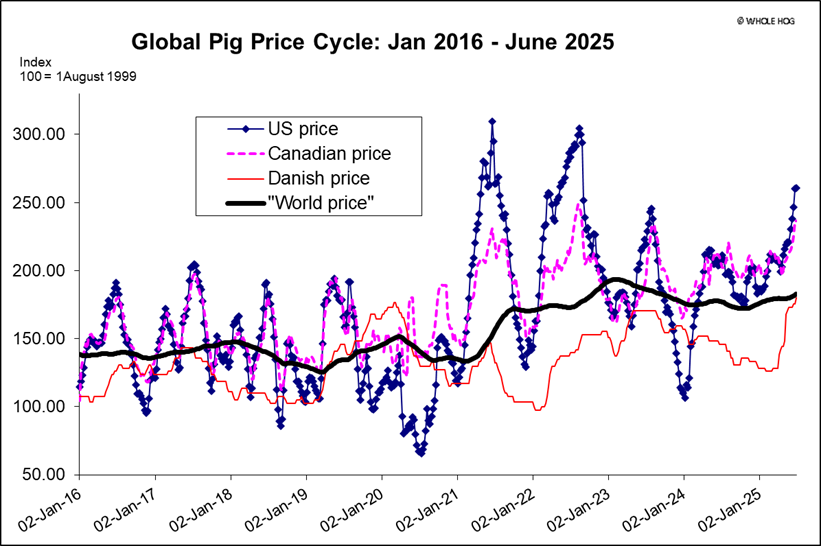

Figure 8 presents the updated data for the global pig price index and the key global pork exporters. We are most definitely in an upturn for the global pig price cycle. In past years I would have been confident to say that the upturn would last for at least 6 months – and likely 12 months. Today, I will go as far as to predict that pig producers in the North America and Europe will have a better 2025 than 2024.

But, as we have seen in the last few months, these are different times and the rule books for international trade and commerce are being torn up at a moment’s notice, and armed conflicts between major powers also seem more likely than not. Uncertainty and risk have increased in almost all areas of business activity. So, those management consultancies have a point, I predict that resilience will be the guide for producers and investors in 2025 – especially in supply chain relationships that were once taken for granted.