Changing places in the pig productivity league table

Every year, InterPIG releases benchmark data about a range of leading swine countries across the globe. This year’s outcome? Spanish producers have fallen down the league table, farmers in Brazil and in France seem to be advancing steadily; and the Dutch and the Danish are contending who’s the most efficient producer in Europe.

The latest InterPIG data on global pig production metrics have recently been published by Wageningen Economic Research. The latest data available (for 18 countries and regions) are for 2023. Those technical KPIs are a useful way of understanding how one country’s national pig sector is performing across space, through time and, crucially, compared with other countries.

In this analysis, the focus is on who is going up and who is going down the global league table of productivity, according to the InterPIG data. The key conclusions are that: pig producers in Great Britain** are continuing to fall behind their competitors in northern Europe, Spanish producers have fallen down the league table, farmers in Brazil and in France seem to be advancing steadily, and it’s a debate about whether Denmark or the Netherlands can claim to be the most efficient producer of pigmeat in Europe. At the moment it seems that the Dutch pig has its nose (snout) in front.

Pig data for 11 countries

The figures presented here use data for 11 countries, using the Mato Grosso region for Brazil and the indoor system for Great Britain (which tends to overstate the average performance of pigs weaned by around 7% due to the prevalence of the lower productivity outdoor system). Canadian data are absent in this most recent set of InterPIG results due to missing data sources.

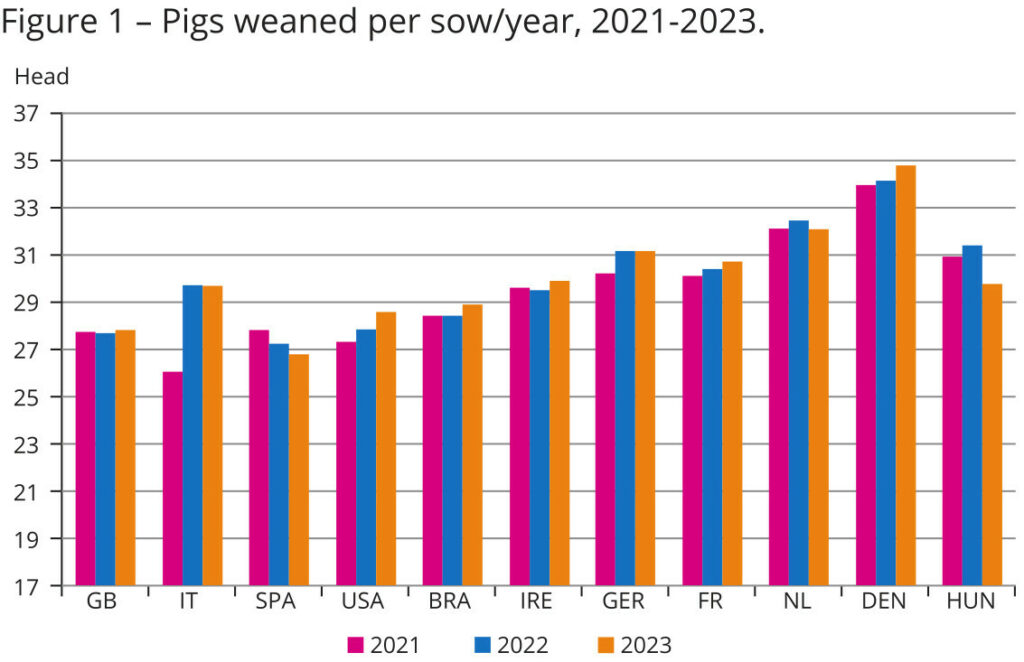

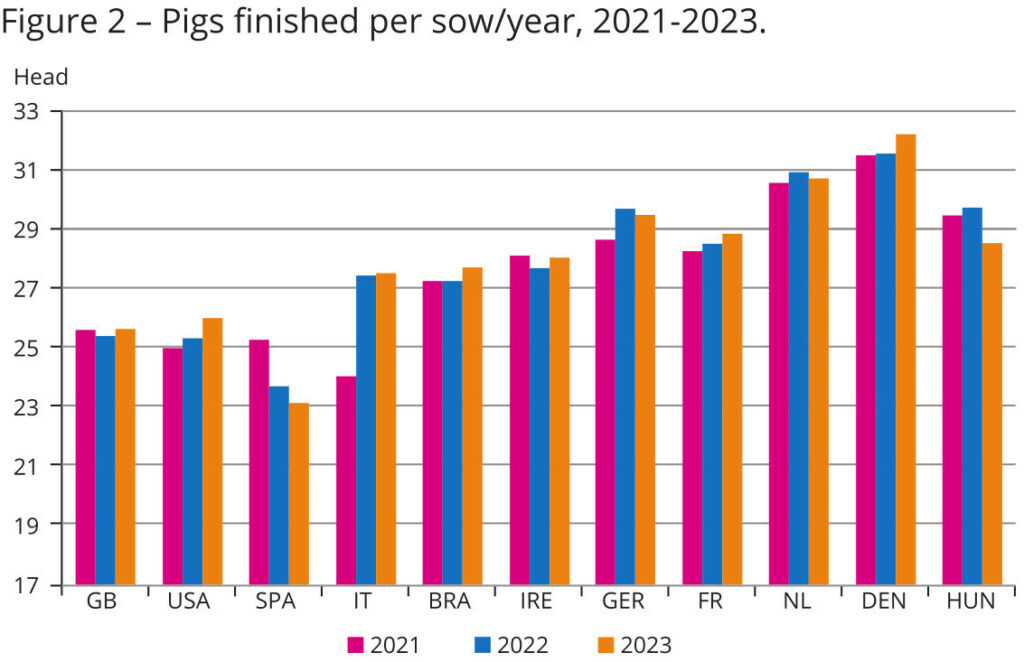

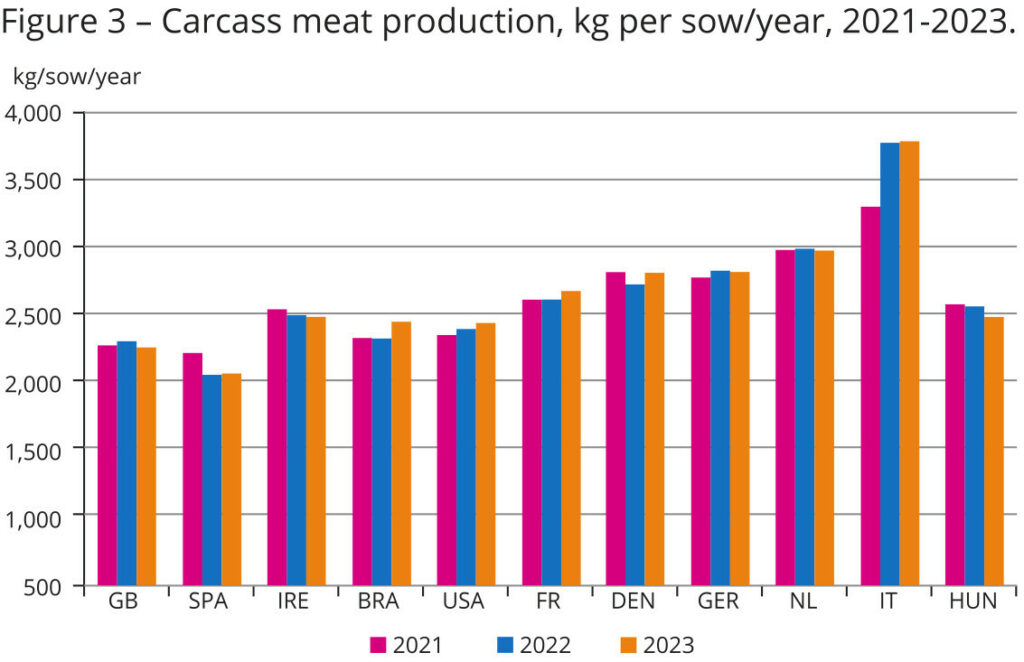

3 key performance indicators are considered here and are represented in Figures 1, 2 and 3: pigs weaned/sow/year; pigs finished/sow/year; and carcass meat production/sow/year. These KPIs can be used to construct a global ranking of pig production efficiency, thus enabling the construction of a “global league table” of technical productivity. This gives an insight into the relative performance of producers using the farm’s key investment asset, the breeding sow, in the production unit in different countries.

Costs of production like feed and energy are also important in comparisons – but exchange rates are a key variable in international value/cost comparisons and rates can swing wildly from period to period. Overall, these InterPIG data provide a good indication of which producers are more or less competitive.

PRRS has pushed Spanish pig producers down the table

For the British pig industry, the evidence of the InterPIG data is that the Brits seem to be stuck in the lower half of the table. Spanish producers have slipped down the table and this period of InterPIG data coincides with the detection of the virus PRRS Rosalía in the northeast of Catalonia at the beginning of 2020. Subsequently, the virus spread and mutated in most regions of Spain and the resulting severe illness in breeding pigs along with foetal death and abortions have dramatically affected sow productivity right across Spain. Figures 1, 2 and 3 illustrate the gap between different pig farmers and their global competitors. These data are shown for the most recent three-year period, 2021-23.

The sow’s only purpose on the unit is to produce the maximum amount of saleable meat and on this measure British and Spanish producers score poorly in relation to most other countries with an output per sow, that is around 20% less than the average for sows in Germany, the Netherlands and Denmark.

Indeed, British and Spanish producers in the period 2021-23 are producing roughly the same amount of meat per sow/year as those in Brazil and the USA, but British producers will certainly have significantly higher feed and energy costs than those competitors. These differences in performance between neighbouring and transcontinental competitors are chronic. Carcass meat production is the key driver for revenue generated per sow and if the British or Spanish need to improve this metric, if they wish to compete in the EU and global market for pork and pigmeat. For Spain, the need to improve biosecurity and reduce the impact of PRRS is obvious. For Britain’s producers, the route to a more competitive position is not so clear.

Multi-annual growth rates

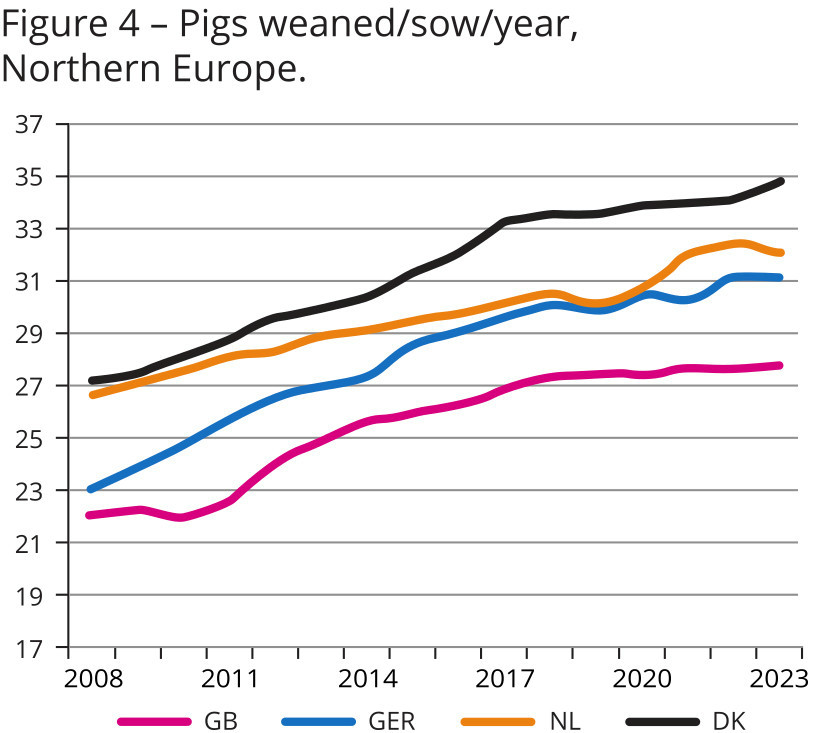

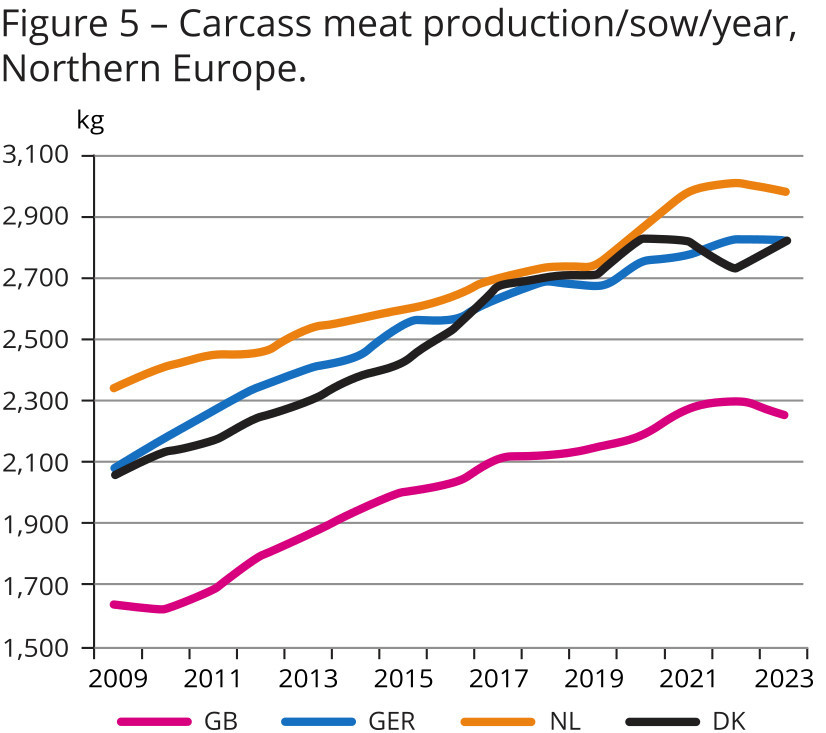

Another way of presenting these data is to look at multi-annual growth rates and compare how they move over time. Figures 4 and 5 do that for northern European producers by comparing the annual average growth rates of two technical KPIs; pigs weaned /sow/year and carcass meat production/sow/year.

In these charts it is clear that there has been a steady growth in productivity of the key producer asset (the breeding sow) over time. Productivity has improved right across the pig sectors of northern Europe. However, a decline and a rebound in carcass meat production can be seen in the Danish pig sector at the time of the Covid-19 outbreak. The Dutch industry data, however, show a jump in this particular metric just before the pandemic and a relatively stable position during the pandemic. German and French producers have also achieved higher productivity on the farm and in the abattoir. In terms of meat produced, and pigs weaned and finished, the British pig sector seems to have a consistently poor performance through time.

Denmark is being challenged

It seems that the relative position of all of these producers in Northern Europe has hardly changed – except that, according to the InterPIG data, the Danes are now being challenged strongly by Dutch producers in their finishing units and in the abattoirs. When carcass meat production/sow/year is considered, the Dutch now top the league table in northern Europe (the Italians are a special case since their very heavy pig production system is not a valid comparison with typical commercial production systems elsewhere).

British producers are improving their productivity but are not moving quickly enough to catch up with the leading players in northern Europe. The Spanish sector, according to InterPIG data for 2021-23, needs to deal with the challenge of PRRS Rosalía in order to improve its key metrics.