Cereal forecasts: some food for thought

Food for thought. That’s what agricultural consultant Rob Fisher, managing director of the International Agribusiness Group, gave his audience at the 17th JSR Technical Conference. According to Fisher, from Farmington Hills, Michigan, over the next decade cereal business could be somewhat disruptive.

By Stuart Lumb

The standard of living is rising throughout the world, which has to be a good thing , but resources are finite. By 2020 China will have 500 million households, of which about 45% will have incomes sufficient to to buy most food products exported by the US, up from just 14% in 2000. There is also a growing middle class in India and Eastern Europe, with more money to spend on food, which is often, but not always, pork. Hong Kong residents eat 54 kg of pork per capita per year and the Chinese would eat half this amount if they had the cash. Naturally increased pork production requires adequate pig feed – maize, soya, wheat etc. and generally a balance has been maintained.

However, recent trends in the USA in the production of bio-fuels, to reduce dependence on imported oil have ‘thrown a spanner in the works’, mainly because of politics, not economics, as biofuels receive a substantial government subsidy. The amount of fuel ethanol used is predicted to practically double, from 2005/2006 to 2008/2009.

·Effectively 25% of the US maize crop is going into biofuel production and this demand is causing great concern to the pig industry, as inevitably it raises feed prices.

Looking at crop production overall, in the USA the harvested land area increased from 82.8 million hectares in 1993 to 85.5 million ha in 2006, although in percentage terms the wheat area harvested dropped from 31% to 22%. The actual area of soybeans increased by 0.67 million ha. China had a harvested land area of 109.2 million ha in 1992, but this decreased to 106.1 million ha in 2005. Like in the USA, the wheat area harvested dropped, in China’s case from 26% to 18%, with maize increasing (18% to 21%). Turning to another key player, Brazil’s harvested land increased from 30.4 million ha. (1992) to 44.1 million ha in 2006. Corn land decreased from 39% to 29%, although land down to soybeans has increased from 34% to 50%.

·Turning to individual crops, Fisher focused on soybeans and wheat. South America overtook the USA in terms of soybean production in 2002 and the production gap is widening. Soybean production in China remains static and in fact South American production matches China’s domestic usage, with imports of soybeans to China rocketing since 1994. On a world basis, soybean supply is matching demand.

·In terms of world wheat production, the EU 25 takes poll position, followed by China, India, USA, Russia and Canada. Harvested wheat land in the USA has practically halved since 1991 with land put down to wheat in China also declining. Currently supplies of wheat are tight, due to weather problems. Good weather can remedy this, although ethanol plants using wheat are being built in the EU and this will affect demand.

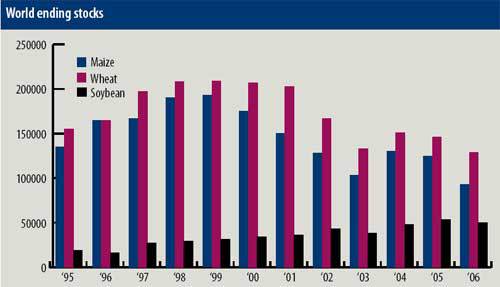

Finally, Fisher commented on world year end stocks. Maize year end stocks have shown a shallow decline over the last ten years, but the situation is ‘not critical’. Wheat year end stocks also show a similar decline, but will improve subject to better weather, whereas soy is doing just the opposite with annual world ending stocks showing a steady linear increase since 1995.

Join 18,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the pigsector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht