Russia’s largest pork producers see profits slump

In the first half of 2022, several Russian agricultural holdings saw their net profit plummet, despite a revenue rise.

The Russian agricultural company Rusagro experienced a 99% drop in net profit from 16.7 billion roubles ($ 276 million) in the first half of 2021 to 166 million roubles ($ 2.75 million) in the first half of 2022, the company said in its quarterly report.

Increased revenue

Rusagro’s revenue increased by 21% compared to the same period last year, to 65.72 billion roubles ($ 1.08 billion). The company sold 133,000 tonnes of pork, 10% up compared to the first half of 2021.

“Net revenue grew by 21% due to the rise in sales volumes in the sugar and meat business,” Timur Lipatov, general director of Rusagro, said. He explained the drop in net profit with “losses incurred by exchange rate differences.”

Cherkizovo’s net profit decreased

Cherkizovo Group’s net profit in the first half of 2022 amounted to 6.9 billion roubles ($ 114 million), a decrease of 48.9% year-on-year, the company said in its quarterly report. On the other hand, the company said its revenue increased by 20.1% to 88.9 billion roubles ($ 1.47 billion). Cherkizovo is the largest Russian meat producer.

Negative net operating cash flow

Due to lower profitability and investment in working capital, net operating cash flow in the first half of 2022 was negative. It amountedto 1.2 billion roubles ($ 19,9 million), compared with a positive value of 8.5 billion roubles ($ 140.9 million) a year ago.

Negative forecasts come true

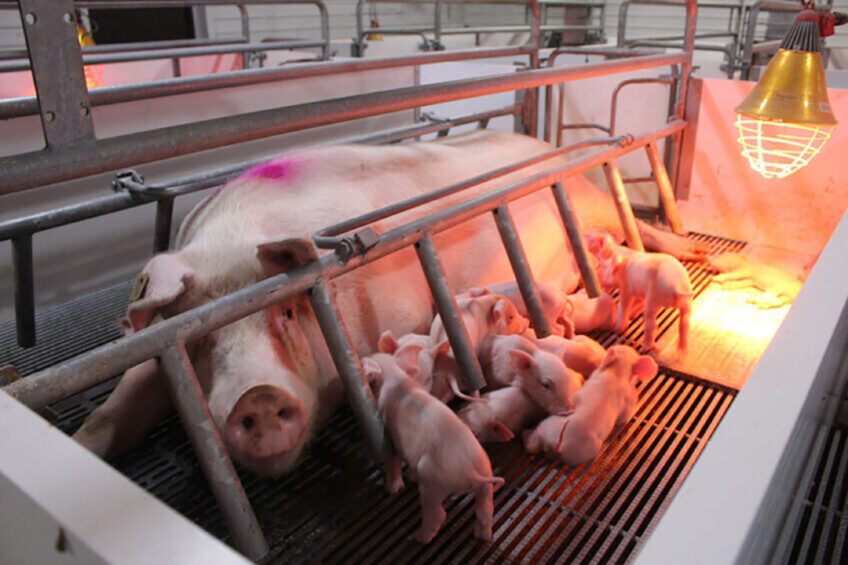

The Russian largest pork producers have repeatedly warned about falling profitability of pig breeding stemming from soaring production costs and falling prices.

In May of 2022, a spokesperson for Rusagro told to the Russian newspaper Kommersant that some share of pig farms in Russia sold live pigs at a loss. Cherkizovo agreed that the profitability in the pig farming segment went down proportionally to a drop in prices. The Russian largest pork producer Miratorg told the publication that if the negative trends in the Russian pork market continue, some companies could be forced to reduce output.

Rising production costs

The Russian Union of pork producers estimated that the production costs in the pig segment jumped by 30% over the past 2 years. Farm-gate prices declined by 20% in 2022. The Russian National Meat Association voiced concerns that the falling profitability hit recently launched pig farms. The reason for this is that their owners now experience difficulties serving the bank loans. Most market players anticipate a further price decline in the second half of 2022.