High feed prices remain worrisome for US producers

High, higher, highest. The development of US feedprices seemed to be a one-way traffic in the first months of 2011. Although the situation has stabilised over the summer, it’s likely new levels are here to stay – so US pig producers should be prepared for a higher cost of production. That was, once more, the key message from this year’s World Pork Expo, held in Des Moines, Iowa, US, from 8-10 June 2011.

High feed prices? Hardly anybody present at the annual pork show in Des Moines really seemed to care – as carcass prices had never been so high. So a fairly optimistic atmosphere could be noted at the annual show in Iowa, the heart of America’s Corn Belt. Producers were happy, salesmen were happy and the barbecues were pleasantly lit – despite heavy thunders and hailstorms on day two.

The mid-term future does however give some reason to frown for America’s pork production sector, when looking at data provided by Dr Steve Meyer, Paragon Economics. In his annual outlook for the pig industry, he mentioned that pork producers in the United States would lose approximately $5 per pig sent to market over the whole of 2011. For a year (so until the 2012 World Pork Expo), he even expected an $11 loss per pig.The reason behind these losses is fairly complex and multifactorial and as usual the outcome of an intricate play of supply and demand.

It is common, however, that the major costs of swine production are made up of feed prices – and in this case it is no different. Ever since the George W. Bush administration, the development and growth of ethanol plants has been stimulated, using increasing amounts of corn for fuel. Recent figures by the United States Department of Agriculture (USDA) indicate that more corn goes into ethanol than into animal feed these days. From this year’s anticipated US corn crops of 342 million metric tonnes, over 130 million tonnes will be used for ethanol production – about 40%. It is estimated that in 2011-2012, ‘only’ 128.3 million are used for animal feed. This development alone caused various US livestock boards, along with the American Meat Institute, to protest, calling for policy changes.

So far, however, the result is that the demand for corn will continue to grow. The US export business requires increasing amounts of corn, as livestock and food production in developing economies are on the increase. Demand from major swine producer China is often quoted as a rapidly changing figure, with the USDA forecasting the Asian tiger to import 2 million metric tonnes of US corn in the crop year starting 1 September 2011. For the one ending August 2011, USDA expected exports to be about 1.5 million metric tonnes.

Add to this the notion that human food production also takes a part of the annual corn share, and one could conclude that the food-fuel-feed debate just needs record crops.

Supplies

The year 2011 however hasn’t been the most convenient for the supply side of pig feed – mainly due to adverse weather conditions. It was well illustrated by the Des Moines weather conditions during the World Pork Expo.

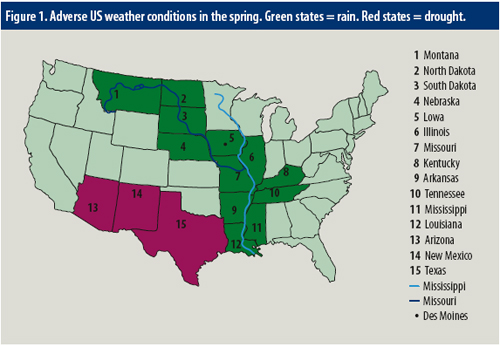

The second day’s rain and hail storms were metaphorical for the situation in the first six months of 2011 around America’s big major rivers – the Missouri and the Mississippi. Anywhere along both river basins, consequences could be dearly felt of a very wet spring – a combination of heavy rainfall and snow melt, which led to excessive flooding. Hence crop production in Montana, the Dakotas, Nebraska, Iowa, Missouri, Arkansas, Mississippi, Louisiana all suffered as the flooding delayed planting and reduced usable acreages.At the World Pork Expo, Michael Formica, chief environmental counsel at the US National Pork Producers Council (NPPC) added: “In major corn areas, it was simply too cold and too wet to plant. As for the Eastern Corn Belt, east of the Mississippi river, the further they are to the Atlantic, the further behind they were.”

So high prices for corn – but other stocks suffered as well, like e.g. winter wheat production, grown in the north of the Great Plains, like the Dakotas, and planted between September and December, suffered severe blows due to the abundant rainfall and flooding.

Drought

Besides excessive water problems, other parts of the US also suffered from historic droughts. Again the World Pork Expo’s circumstances served well as an example, as the first day experienced a sizzling 100 degrees Fahrenheit (38 degrees Celsius), something which was topped later in July. Crop production due to drought suffered most in the states Texas, Oklahoma, Kansas and Nebraska. “The drought that some of these areas have been experiencing is the worst since 1971,” Formica summed up. He recalled the ‘Dust Bowl’ – a period of extreme drought in the Great Plains, in the 1930s, turning the landscape into a dust-covered area, and severely affecting crop production.

The result of all this? Prices of corn shot up to record levels. April 2011 showed highest levels, as prices of $319 per metric tonne were reported, or $8.10 per bushel. Just to compare – four months earlier, prices of corn were $251 per tonne, or $6.38 per bushel – a 27% price increase in four months’ time.

Stocks

By mid-July, corn prices were ‘back’ at $303 per metric tonne ($7.70 per bushel), which is considerably higher than the last months of 2010. These price drops were mainly due to the USDA reporting that more corn would be available than expected. This optimism is mainly related to short-term outlooks. Formica said, “There are people who want to be optimistic, and yes, there are areas where the corn supplies are good. For this year I don’t think we will have a shortage, as there are still some places where there is a surplus.” Formica added that the best label that can be given to the long-term US feed availability projections is ‘uncertainty’, indicating that corn stocks by the end of next crop year may prove to be the bottleneck. “I think in the autumn of 2012 is where we are going to see some contraction in the livestock industry, as the ethanol industry has now bypassed the livestock industry in its use. What is certain is that next year we are going to need an all-time high record of crops.”

Harvests

It’s not all doom and gloom, Formica concluded, as the last years’ harvest results, e.g. due to the development of more resistant types of corn, show there is reason for some optimism. “The US corn yield grows higher and higher. The year 2009 was an exceptional year with the highest harvest ever; 2008 is the second highest ever; and 2010 is the third largest ever.”

In addition, the consequences of the ethanol policies are now more widely understood, even in the White House. Once that knowledge makes it to legislation, ethanol prices will reach a plateau, Formica hopes. And with eventual ever-increasing yields of corn, prices in the end may begin to even out.

Check our website www.pigprogress.net for several video reports from the World Pork Expo, as well as a photo report and news coverage, including interviews, innovations and a day-to-day impression.

Once more a Korean mantra at WPX For annual visitors, the sounds have become familiar. Each year again, the National Pork Producers Council (NPPC) beats the drum about the US-Korean Free Trade Agreement. This so-called ‘Korus’-agreement was agreed upon in 2008, and would over a series of years abandon two-way tariffs, but so far approval has been delayed in US Congress since e.g. the US automotive industry has a strong lobby protecting its domestic market. The NPPC does not stop asking, demanding, pleading for the quick approval of Korus – and grudgingly has to accept that the European Union’s FTA went into effect on 1 July 2011, that the Canadians have closed a trade deal with Korea and so have the Australians. The best quoted man from the World Pork Expo therefore was no doubt Professor Dermot Hayes, Iowa State University, whose calculations (10,000 extra jobs for pig production due to Korus – or out of Korean pork business in ten years) rolled like a mantra over the Pork Expo. This year, Korea’s ambassador to the United States, previous Korean prime minister Han Duck-soo made it to the expo to add some pressure. In addition, stickers were given to anyone interested, asking Congress for a swift pass of the Korus FTA (and those with Panama and Columbia). But will it help? The NPPC said it had high hopes the FTA would be ratified by the summer of 2011. Time will tell if the mantra will continue to roll to June 2012. |

World Pork Expo: Visitor numbers Nearly 20,000 people participated in this year’s edition of World Pork Expo, in Des Moines, Iowa, USA – about the same as last year’s edition. Attendees also viewed business seminars, Pork Academy, the record-setting Junior National swine show and musical entertainment. Organised by the National Pork Producers Council (NPPC), the show attracted producers and exhibitors from a total of 39 countries. “We heard optimism about marketing prospects along with healthy concern regarding the availability of affordable feed from the producers at World Pork Expo this year,” said Doug Wolf, NPPC president. Attendees viewed displays from more than 400 exhibitors from 11 different countries. Free business seminars sponsored by five companies featured discussions about risk management, pig nutrition and health, and anaerobic manure digestion. The Pork Academy sessions covered topics ranging from the latest about PRRS, to managing feed costs and efficiencies while putting US pork on the world’s table. Next year’s edition will be held 6-8 June 2012. |