Germans bought slightly more meat in 2024 – how about pork?

On the whole, the year 2024 was not a bad year at all for Germany’s meat industry. For the first time in ages, there was even a slight growth visible. German market expert Dr Albert Hortmann-Scholten analyses the data and reflects on the effects for the pig industry.

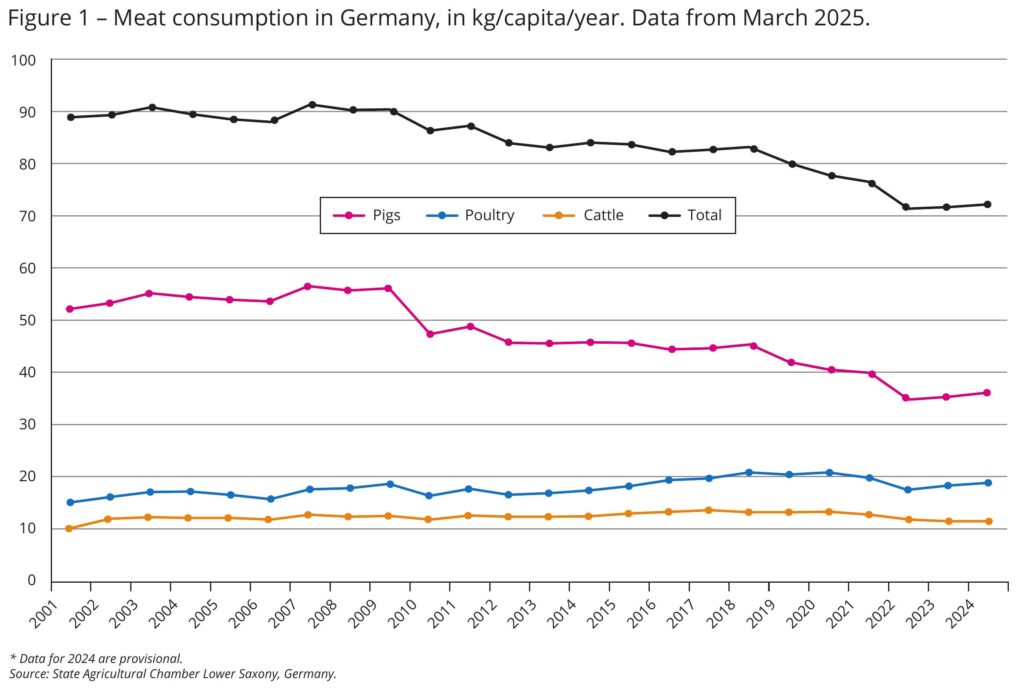

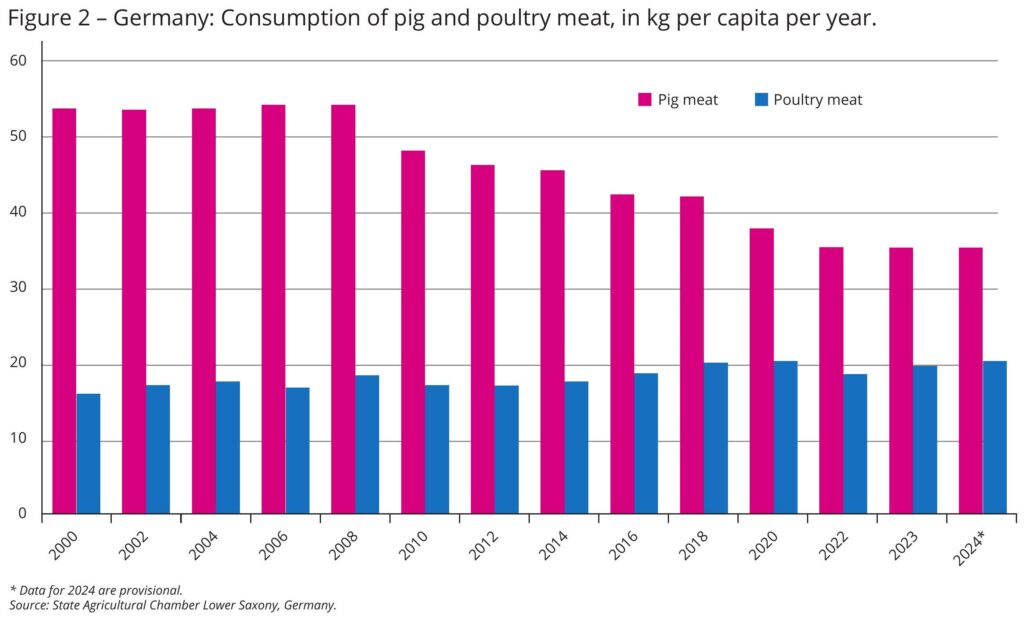

In 2024, meat consumption in Germany rose again for the first time since ages, by about 600 g, although prices both in the retail sector and at producer level were higher than before Covid-19. Average consumption in 2024 was 72.5 kg meat per capita. Pork consumption remained unchanged year-on-year at 35.8 kg. Producer prices for pork did not benefit from the upward trend and decreased by about 7.5%, or €0.23, compared to 2023. Price continues to play a significant role in purchasing decisions.

Halted decline

All in all, 2024 appears to have halted the decline in meat consumption that had been going on for a while. For some types of meat, there even was a slight stabilisation, or, as with poultry, a more significant increase. Pork remains the top meat consumed by German consumers, with a consumption rate of 35.8 kg per year. That is, however, 100 g less than in 2023. Poultry, and especially chicken, experienced a significant increase of about 700 g to 20.6 kg per year, see also Figures 1 and 2. Beef and veal consumption remained comparatively stable, remaining at around 11.6 kg per year.

Stabilisation in the meat market. Why?

The reasons for the stabilisation or increase in consumption are complex. The trend toward slightly declining consumer prices, especially for pork, has favoured consumption. In 2025, pork has become more affordable than beef and poultry, both at producer level as well as in terms of retail prices. In addition, domestic production – especially in the pig industry – has increased slightly since 2023. That led in part to supply-related price pressure and thus to lower consumer prices.

Vegan meat substitutes lost popularity and were sometimes no longer as hyped by food retailers and NGOs when compared to years ago. Fast food chains have even removed vegan alternatives from their portfolios again. They were no longer the growth drivers they had been in the past.

Demographic changes also contributed to an increase in meat consumption.

- The arrival of numerous refugees, especially from Eastern Europe, led to a rise in the number of people who are more positive about meat consumption.

- Consumption behaviour clearly changed. Official statistics do not differentiate between age groups. However, informal surveys show that younger people tend to eat slightly more meat than before, while older groups are cutting back more sharply. Among 14-29 year olds, the proportion of daily meat eaters rose to 26% (previously 17%), while among 45-59 year olds, the figure is just under 20%.

- Evidence of a turnaround in the German meat market and the slight recovery in consumption is the increase in imports of meat products. The total import volume of meat and slaughterhouse by-products increased in 2024 compared to the previous year by around 15,500 tons, or 0.6%, to a total volume of 2.4 million tons. Meat imports continued to recover in 2024 from the sharp decline in 2020, rising slightly by 4,000 tons to 391,800 tons (+1.0%) compared to 2023. However, the import of sausage products included in this volume declined by 2,900 tons to 126,700 tons. The trend is also upward for sausage imports. Consequently, this means that German producers have lost market share while consumption in their domestic market remained largely stable.

Promoting meat and pork

What is the German meat sector doing to get out of the defensive and better differentiate itself from other competitors in the market?

Meat initiative – Eat what you like

Meat initiative – Eat what you like

The German Meat Industry Association (VDF) and the German Farmers’ Association (DBV) founded the Meat Initiative in 2024. Its goal is to reposition meat consumption in Germany. The organisation relies on a modern communications strategy, primarily by improving the image of red meat. The current negative image is to be improved through targeted public relations work. This is hoped to strengthen domestic production and marketing at all stages of pork production – farming, slaughter and processing.

Introduction of meat labelling in retail

Introduction of meat labelling in retail

“Thehaltungsform.de” initiative was launched in 2019 by leading German food retailers to create greater transparency regarding the conditions in which farm animals are kept. Since then, it has achieved some remarkable successes. By applying a uniform 5-level label (levels 1 to 5) to meat products, consumers are able to navigate their shopping choices. The label can now be found in almost all major supermarkets and discounters and has broad market coverage.

Promote German origin

Promote German origin

Large retail chains such as Rewe, Aldi, Lidl and Penny are increasingly focusing on German origin (the 5-times-D rule) and emphasising quality and regionality. “5-times-D” stands for five consecutive production steps, all of which must take place in Germany – namely:

- Farrowing;

- Growing;

- Finishing;

- Slaughtering;

- Meat processing.

The “D” in each case stands for Deutschland, which is German for “Germany.” The goal of the label of origin is to promote transparency, animal welfare and regionally added value. Furthermore, the strengthening of domestic farms is to be achieved through less import pressure and more regional added value.

The Animal Welfare Initiative (ITW) highlights products from the conventional sector. Farmers who maintain a higher level of animal welfare receive premiums and better market opportunities.

Regional marketing and direct marketing

Regional marketing and direct marketing

The multitude of regional programmes in pork marketing are now increasing consumer acceptance and consistent volume sales. Furthermore, regional programmes offer a unique selling proposition compared to cheap imports. Pigs from the region often achieve higher prices, especially for pigs raised in husbandry systems 3 or 4.

Farmers are increasingly relying on direct marketing, organic quality and clear indications of origin to reach quality-conscious buyers and retain them long-term.

Promoting exports to third countries

Promoting exports to third countries

Exports to third countries, i.e., exports outside the EU, have not yet reached their previous levels. German exports of meat and meat products continued to be severely restricted in 2024, among other things due to the outbreak of African Swine Fever (ASF), although the further spread of the animal disease in Germany was prevented.

However, the resumption of deliveries to South Korea led to a noticeable recovery in pork exports. Shipments to Vietnam, Montenegro, New Zealand and Bosnia also increased. Many third countries, including China, a key export market, have maintained import bans on German pork. The export of 3.13 million tons of meat and meat products in 2024 resulted in a moderate increase of 79,000 tons (+2.6%) for the German meat industry.

The outbreak of Foot-and-Mouth Disease (FMD) at the beginning of 2025 led to almost all third-country markets outside the EU banning the import of meat and meat products from Germany. The closure of the UK market, in particular, led to significant revenue losses. Some markets, including the UK, have since temporarily allowed imports of German products again.

The export of pork to third countries, which has continued to be limited since the outbreak of ASF, is disadvantaging the economic competitiveness of German producers.

The share of third countries in total German pork exports fell from just over 35% in 2020 to 19% in 2021 and further to just 14-15% in 2022 and 2023. In 2024, the share rose again to around 17%. If the pork sector continues this trend, that could also have a positive impact on the overall market.

Summing up…

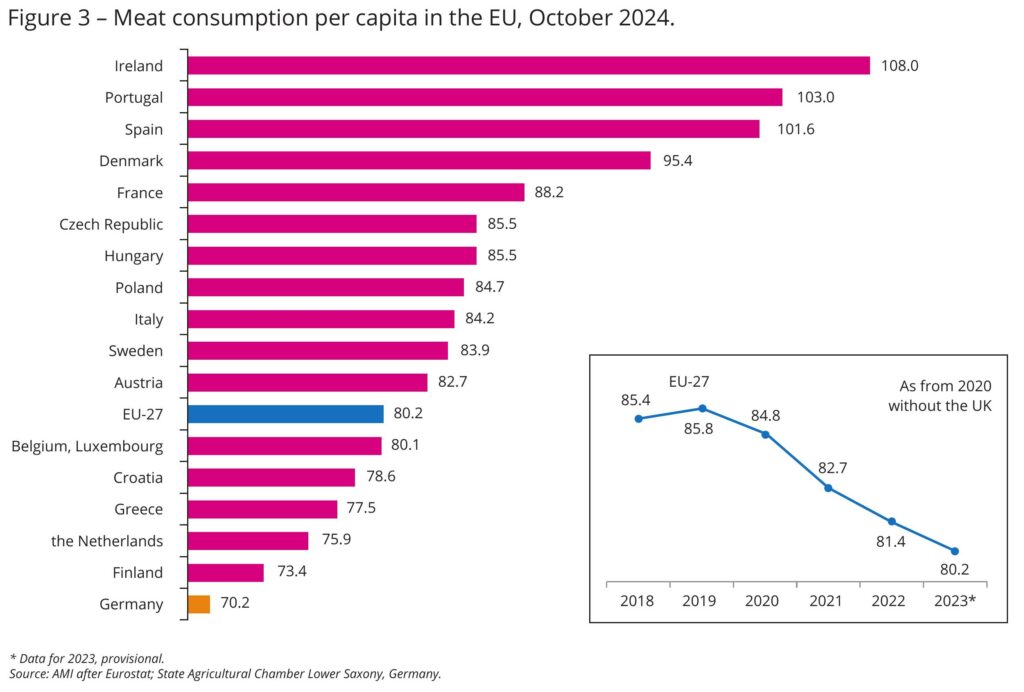

Within the EU, Germany ranks among the lowest in terms of meat consumption. Whether the stabilisation in consumption now represents a reversal of the trend or is temporary remains to be seen. After the massive increases in food prices in 2022 and 2023, the inflation rate fell back to a moderate 1.9% in 2024.

That encourages consumers’ willingness to spend and leads to a stabilisation of demand. For the first time in a long time, Germany is experiencing a minimal increase in per capita meat consumption. It is also encouraging that young people are more positive about eating meat than they were in the past.