European pig markets migrate

Political and economic reasons have made European pig farmers reconsider their future. Many quit production and some relocate and either move or expand their production to countries where there is a better economic future.

By Wiebe van der Sluis

The EU pig market is rapidly changing due to considerable differences in government policy and economic returns. Over the past five years the total EU pig population dropped slightly. Nevertheless, sizeable shifts in meat production have taken place between member states in recent years (Table 1).

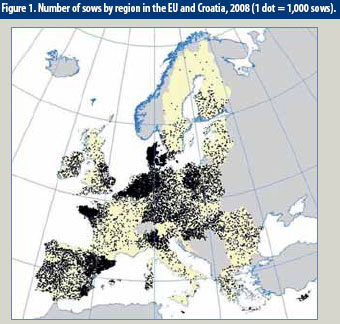

Historically pig meat is produced throughout the EU on several types of farms with large variations in size from one member state to another. However, three quarters of the fattening pigs are reared by just 1.5% of the largest producers, which can be found in major production regions in just a few countries, including Denmark, Germany, Spain, France, the Netherlands and Poland (Figure 1). In these countries one may also find more than two thirds of all breeding pigs in the EU. Consequently the remaining pigs are to be found in the rest of the EU. These pigs are, especially in the new member states, produced by small operations (Figure 2).

Positive economic trend

In the past decade, economics in EU pig farming have not been favourable. The average income of specialised pig farms has been relatively low, although financial results may vary enormously. However, during the course of last year, EU pig producers have been relieved from a two-year crisis on the EU pig meat market. The upturn continued in the first few months of this year, during which time the average EU pig prices have risen by 19%, which is 34% higher than April last year. This positive trend is the result of tighter supplies, steady consumer demand and the fact that EU pig meat has become far more competitive on the world market due to the strong US dollar.

The tight supply is the result of high feed prices and low returns in the past which caused many producers to stop or cut down on production.

Analysis, made following the pig meat crisis, revealed that production costs and margins vary significantly between member states. High margins, however, are not necessarily an equivalent for a high income, because lower margins are often compensated by larger farm size.

The variation is comparatively large in Spain, Italy, Latvia and Slovenia. The latter can be seen as an indicator of the coexistence of different production systems. In Spain and Italy, for example, pigs are fattened in very extensive producing systems aiming at high quality and high revenue per pig, as well as by standard production techniques. This causes a wider variation of production costs and margins.

Effect of governmental policies

Huge variations in government policies regarding environment and welfare in livestock production have a major impact on production costs. The Danes for example were forced to decrease their ammonia deposition by 30% last year, the Dutch pig producers have to meet the nationally set level this year while the rest of Europe still has time till 2013 to comply with the Ammonia Emission Decree.

Similar differences are present where it concerns animal welfare regulations. The ban on farrowing crates and the expansion of the living area for weaned piglets and fattening pigs as well as the introduction of slats measuring a maximum of 18 mm on slatted floors for fattening pigs have a dramatic impact on the economics of pig farming. These issues have a more prominent position on the political agenda in the North Western European countries than in the Southern European countries as well as the EU new member states.

A study conducted in the Netherlands showed that a limited group of producers is able to make all investments needed to comply with all Dutch government measures on pig farming. Calculations made by the economic department of the Wageningen University and Research Centre showed that around 34% of the pig farms have the potential to invest in all the measures which will apply from 2013. This calculation takes into account that some of the farms will reduce the number of pigs on the farm or will terminate production entirely.

Migration to continue

The Wageningen study also concludes that as a result of the current regulations, from 2013 welfare in pig farming will improve and the environmental impact of pig farming will significantly decline due to lower ammonia emissions and lower burden of the manure market. However, this will be at the expense of the number of pig farms, partly due to acceleration of the autonomous restructuring process. Particularly where modifications are required, the investments required to expand the living area and replace slatted floors are relatively high. For many farms, the investments are difficult to finance due to the average low yield prices and income in recent years. This situation is not expected to improve much in the coming years. Furthermore, the study concluded, pig farmers who can invest and continue their farming will have to accept a much lower income.

Forecasts like these stimulate producers either to stop production or to move their production to regions or countries with a milder governmental interference. A recent ban on a further concentration of intensive livestock production in specific regions, to protect the environment and secure animal and public health, announced by the Dutch minister of agriculture, nature and food quality, creates an extra burden for modern producers who struggle with keeping their business going efficiently.These differences in national government policies will at the end further stimulate the migration of pig production within the EU to those countries where they have to comply with fewer rules and can produce more efficiently.

| Increasing demand for bio-products EU consumers show an increasing interest in organically produced products, including meat. Although the demand for organically produced pig meat is still relatively small (1-2% of all pig meat) there is a clear sign for growth. A study conducted by the Economic Department of the Wageningen University, the Netherlands, showed this trend and took a closer look at the cost of production at organic-farms in four EU countries. The chosen countries (Netherlands, Denmark, Germany and the UK) are seen to be either competitors or demand markets for Dutch organicpig meat. The comparison is based on 2005/2006 figures and shows that the cost price in the UK is much higher than that of the other countries (see Table 2). The difference is mainly due to the high feed price in the UK. Germany has the lowest cost price, but that results from low housing costs due to the fact that most German organic pig producers make use of old houses. In a case where new housing systems would be used, the cost price would dramatically increase. In the short term the German producers have a cost price advantage over the Dutch and Danish producers, which allows them to stay in business even when the sales revenues sour. |