China Yurun Food Group Limited year end result – Dec 2010

China Yurun Food Group Limited, a leading vertically-integrated meat-product processor and supplier in China, announced its annual results for the year ended 31 December 2010.

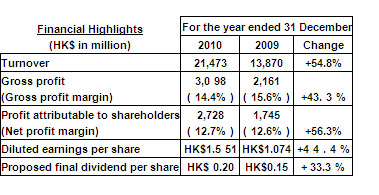

- Turnover Increased Significantly by 54.8% to HK$ 21,473,000,000

- Net Profit Soared 56.3% to HK$2,728,000,000

- Diluted Earnings Per Share Reached HK$1.551

During the year, the Group recorded a turnover of HK$21,473 million (2009: HK$13,870 million), representing a 54.8% growth over the same period last year. In spite of volatility in hog prices during the Year, the Group was able to significantly increase the sales volume of its products by leveraging on the competitive edge of its “Yurun” brand, its optimized nation-wide production network as well as abundant hog supply, therefore driving the strong growth of its business.

During the year, the Group’s gross profit and net profit were HK$3,098 million (2009: HK$2,161 million) and HK$2,728 million (2009: HK$1,745 million) respectively, representing a considerable growth of 43.3% and 56.3% respectively as compared to that of 2009. The Group’s gross profit margin slightly decreased by 1.2 percentage points to 14.4%, as compared to 15.6% in the same period last year. The slight decrease was attributable to the segment mix change with extraordinarily strong growth of the upstream business, which has a relatively lower gross margin. However, our profitability remained strong with four major profitability ratios at their historical best levels, namely the gross profit margin of our upstream segment at 10.5%, the gross margin of low temperature meat products (“LTMP”) at 29.9%, the selling, general and administrative expenses as a percentage of turnover at 5.1%, as well as the net profit margin at 12.7%.

The Board of Directors of the Company recommended a final dividend of HK$0.20 per share for the Year (2009: HK$0.15). This final dividend together with the interim dividend of HK$0.20 per share (2009: HK$0.15), will make a total dividend of HK$0.40 (2009: HK$0.30) per share for the year ended 31 December 2010.

Mr. Zhu Yicai, Chairman of Yurun Food said, “Amid the challenges posed by increasing hog prices and production costs in 2010, by leveraging on its experienced management and strong brand name recognition, as well as the thorough implementation of the market based pricing strategy of upstream chilled meat segment, and the continuous optimization of product mix and distribution channel of downstream LTMP, the Group not only effectively mitigated the pressures from various rising costs, but also propelled its profitability to new heights.”

“The Central Government aims to eliminate outdated hog slaughtering capacity which does not conform to the hygienic and technological management standards across the nation before 2015, further facilitating industry consolidation. With its leading production capacity network and brand name recognition, Yurun Food will be able to drive the sustainable development of its overall business. In addition, with the enlarging scale of industry consolidation and a continuously improving product mix, Yurun Food proposes to achieve strategic upstream and downstream expansion through greenfield projects, mergers and acquisitions, as well as the enhancement and upgrading of equipment, with an aim to further strengthen its leading position in the industry and capture the tremendous business opportunities brought by industry consolidation.”

Food safety

Mr. Zhu continued, “Ensuring the highest quality of our products has always been Yurun Food’s philosophy. With our unrelenting effort and determination in our quality control, we have established a positive image of product quality and food safety among consumers. Benefited from robust market demand and our brand, Yurun Food maintained its growth in 1Q2011. Looking forward, the Group will continue to implement the most stringent quality control procedures to ensure that rigorous tests are in place throughout processes ranging from raw material procurement to production and in line with national and international food safety standards. We will remain committed to the highest level of quality and safety, and by upholding the philosophy of “You trust because we care”, we strive to bring meat products of the highest quality to consumers as well as satisfactory returns to shareholders.”

Mr. Zhu continued, “Ensuring the highest quality of our products has always been Yurun Food’s philosophy. With our unrelenting effort and determination in our quality control, we have established a positive image of product quality and food safety among consumers. Benefited from robust market demand and our brand, Yurun Food maintained its growth in 1Q2011. Looking forward, the Group will continue to implement the most stringent quality control procedures to ensure that rigorous tests are in place throughout processes ranging from raw material procurement to production and in line with national and international food safety standards. We will remain committed to the highest level of quality and safety, and by upholding the philosophy of “You trust because we care”, we strive to bring meat products of the highest quality to consumers as well as satisfactory returns to shareholders.”

Business Review

The Group’s business is divided into downstream processed meat products and upstream chilled and frozen meat segments.

The Group’s business is divided into downstream processed meat products and upstream chilled and frozen meat segments.

Production Capacity

As at 31 December 2011, slaughtering capacity of the Group was 35.60 million heads per year, representing an increase of 10.05 million heads as compared to 25.55 million heads at the end of 2009, while the Group’s annual capacity of downstream meat processing was 304,000 tons. The Group will continue to expand its capacity, accelerate the enhancement of its nation-wide production capacity in the coming years and aim to reach a slaughtering capacity of 70 million heads per year, as well as a downstream capacity of 600,000 tons per year by 2015, so as to further strengthen its leading position in the industry and capture the tremendous business opportunities in both upstream and downstream markets.

As at 31 December 2011, slaughtering capacity of the Group was 35.60 million heads per year, representing an increase of 10.05 million heads as compared to 25.55 million heads at the end of 2009, while the Group’s annual capacity of downstream meat processing was 304,000 tons. The Group will continue to expand its capacity, accelerate the enhancement of its nation-wide production capacity in the coming years and aim to reach a slaughtering capacity of 70 million heads per year, as well as a downstream capacity of 600,000 tons per year by 2015, so as to further strengthen its leading position in the industry and capture the tremendous business opportunities in both upstream and downstream markets.

Prospects

Following the continuous prosperity of the Chinese economy and continued improvement in the business environment, as well as a series of favorable policies by the Chinese Government to stabilize hog prices and support the development of the hog slaughtering industry, the hog slaughtering and meat products market is set to maintain its ongoing development.

Following the continuous prosperity of the Chinese economy and continued improvement in the business environment, as well as a series of favorable policies by the Chinese Government to stabilize hog prices and support the development of the hog slaughtering industry, the hog slaughtering and meat products market is set to maintain its ongoing development.

The Chinese Government promulgated the “Guideline for National Hog Slaughtering Industry Development (2010-2015)” in late 2009. The plan aims to accelerate industry consolidation, significantly eliminate outdated hog slaughtering plants nationwide and systematically increase the sales percentage of chilled meat and small packaged pork products in China. As a leading enterprise in the hog slaughtering and meat products industry, the Group will further strengthen its advantages in its production network, brand, distribution and food safety standards, which will become a strong driving force for future development of its core businesses of chilled meat and LTMP, allowing the Group to further expand its market share, and strengthen its leading status in the industry to ensure long-term business development.

Fork more info: www.yurun.com.hk