Financial benchmarking: Update from Canada

Canada’s pork producers are using benchmarking information to make better decisions – compared with each other and compared with past results. This will help them gain further insight into their international competitiveness.

Benchmarking in agriculture is becoming more common throughout the world and that’s because it provides producers with many tangible benefits. Knowledge is power and the more information a pig farmer has about his/her operation and how it compares with other operations, the better their business decisions will be.

There is research which proves the value of benchmarking to a farm’s bottom line. A study by VIA (the farm management organisation in Quebec), for example, shows that the operating profits of farmers who have participated in provincial business management/benchmarking groups for a number of years are 43% higher than those who did not take part. Participating farmers have also seen a return on assets that is 2.2% higher, as well as a higher overall net worth.

Farm management group in Quebec

The first farm management group formed in Quebec as long ago as 1968, with 50 members and one advisor hired by the farmers. Now, of about 29,000 farmers in the province, around 1,500 have joined one of the roughly 20 groups, paying half the basic membership fee with the other half paid by the provincial government. While the fee comes with information and an individual consultation with the advisor, members can also pay the advisor for further analysis or consulting to help with a farm expansion or another major financial decision.

These groups began to include benchmarking around 1990. René Roy is part of a pork producers’ farm management/benchmarking group in Quebec and has owned a farrow-to-finish pig farm with 125 sows since 2006. He is among many independent Quebec pork producers contracted by the major Canadian pork processor Olymel.

Every year when his group’s average cost of production (COP) figures come out, he and fellow group members always look at whether they fall above or below the average. “I also discuss costs with other producers that have a similar type of management system or are in my region and therefore get similar weather conditions,” Roy says.

“Continuous discussion with colleagues is good. Over time, you can see if you are advancing with the group, and also compare with yourself. It’s good to figure out maybe why you’re not progressing as fast as others. You can look at the options if you are under the average. It could be genetics or something else.” Like other Quebec producers, Roy notes that the cost of feed is higher for them compared to those in other provinces, putting more pressure on their COP. One factor in that is the comparatively higher level of grain trading in Quebec; the number of grain sellers is small and the grain supply smaller too, compared with other provinces.

How is each enterprise doing?

In addition, benchmarking also allows pig farmers with multiple enterprises to assess how each enterprise is doing, notes John Molenhuis, business analysis and COP specialist with the Ontario Ministry of Agriculture, Food and Rural Affairs (OMAFRA).

A typical farm enterprise on hog operations in Ontario is growing field crops. “The farm is growing grain crops for homegrown feed, or to sell as cash crops, or both,” he explains. “Choosing to grow crops for homegrown feeds can be part of the farm’s strategy to control feed costs…[but farmers] will need to do the cost analysis.”

If they don’t grow their own feed, Molenhuis notes that pork farmers can also use the commodity markets and hedging strategies to book their feed needs in advance when there are advantageous pricing opportunities.

Other enterprises on the farm are not always strictly analysed in terms of financial benefit for the main pig operation but in terms of the complementary benefits they provide. For example, Molenhuis reports what he heard during the COP session at the recent ‘London Swine Conference’ in London, Ontario where one panelist explained to the group that the primary value of his trucking enterprise was not profit but to provide biosecurity benefits to protect the health of his herd.

In addition, Molenhuis notes that having other enterprises on a pig farm may also help with labour productivity by using labour more efficiently across more tasks. “But farmers will always need to be making that assessment of whether it is better for them to do it themselves [with their own employees],” he says, “or purchase/hire these inputs or services.”

Country focus: Market access important to Canada’s pork sector

Benchmarking based on past performance

For big long-term decisions, it’s also important to benchmark the farm’s own yearly averages for costs and revenues relative to its past performance. Molenhuis says looking at an average of 3 to 5 years provides a decent indication of farm performance. However, analysis of long-term investment feasibility, he says, should also take into account new technologies that will improve production, reduce energy use, increase labour productivity, and so on.

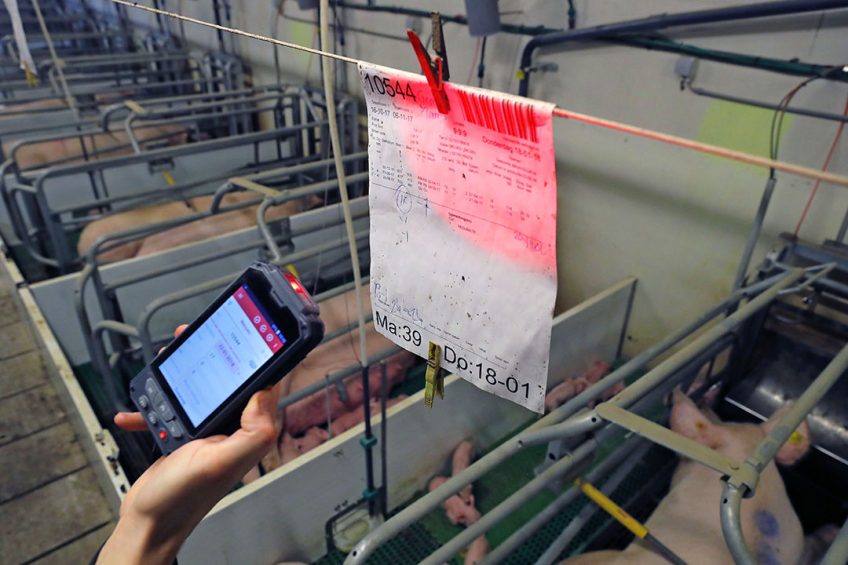

PigChamp Canada business development manager John Wiebe adds that because training and educating farm staff are also important parts of farm management, sharing benchmark data with workers can allow teams to work together to set performance goals. PigChamp Canada invites its customers 4 times a year to take part in the firm’s free benchmarking programme which has been in place for several decades, with the software being adapted over time.

OMAFRA has also partnered with ‘agribenchmark,’ an international farm comparison organisation based in Germany which produces benchmarking data, so that farmers and industry experts can learn more about international competitiveness. Molenhuis says that farming organisations or government agencies in 18 countries are providing financial and production data for swine from typical farms. OMAFRA’s Ontario data is the only data being submitted from Canada at this time.

More Canadian benchmarking in the works

As publicly-available benchmarks are hard to find for most commodities in Ontario, OMAFRA is now working with the ‘Ontario Farm Income Database’ to generate farm financial performance measures using farm tax and insurance data. The reporting and benchmarking structures used are based on those created by AgriFood Management Excellence, explains Molenhuis (see also the white paper on its ‘Standardized Financial Reporting and Benchmarking’ approach on its website). He further indicates that results for swine farrow-to-finish and 9 other Ontario farm types will be posted to the OMAFRA website this autumn.

Alberta Pork, the pork industry association in that province, had conducted a COP study from 2012 to 2014 for Alberta pork producers and will be starting a new 3-year benchmarking project in 2020. Executive director Darcy Fitzgerald says the project will include COP, revenues and market indicators, and that some ‘big-picture’ items will be shared with swine organisations in other provinces.