Agfeed: Growing fast in a changing market

China’s pig market is changing face rapidly. One of the companies leading the innovation is Agfeed, headquartered in Nanchang, in the country’s south. The company started out in the animal nutrition business, but now it is evolving rapidly into becoming a true swine integrator. Pig Progress travels to China to observe Agfeed’s explosive growth.

By Vincent ter Beek

The city of Nanchang, Jiangxi province, is considered to be only a small city from a Chinese point of view. The city in subtropical southern China, counting ‘only’ four million souls, is surrounded by fields full of orange, cotton and rice cultivation. About 70 km north of the city, the mighty Yangtze river flows eastbound.

Like many cities in China, Nanchang is in transition. Large building projects are set up here, including a completely new city centre complex consisting of several dozens of skyscrapers and an airport terminal of unparalleled size. In one of the skyscrapers in the existing city centre, the headquarters of Agfeed can be found – originally a feed company, but now rapidly transforming itself to become a full-scale pig business integrator.

On the Chinese market, producing high quality pigs in large complexes requires a lot of pioneering skills. About 70% of Chinese pig production is still done in backyard production. Pigs, that are fed leftovers, are usually kept in groups varying from 1 to 20 animals. People and pigs often live close to each other, so biosecurity does not exist at all. As soon as pigs reach slaughterweight, they are sold to middlemen. Against this background, professionalising large-scale farming is the answer to meet the challenges of a rapidly changing Chinese society with increasing amounts of Chinese people living in cities and having more money to spend. In addition, more than ever, the Chinese government has started promoting safe food production through its ‘Food Safety Law’ introduced in 2009. All these factors play an important role in Agfeed’s rapid rise.

Only take a look at the company’s figures to understand the process of change the company is in: before 2008, Agfeed only generated revenue from feed production. After 2008, 60% of revenue suddenly came from swine production – and the company grew from a few hundred employees to almost 2,000 – this is Change with a capital C. And the end is not yet near.

History

Crucial in the stormy development of Agfeed was the year 2007, in which it became the first Asian animal husbandry enterprise to enter the US’ Nasdaq stock market. Only one year later, Agfeed managed to raise US$100 million, to buy 31 traditional Chinese pig production sites, located roughly in the region between Guangxi province in the south and the Shanghai region in the middle of China, see Figure 1. This area is considered the richest area in terms of consumer purchasing power.

Agfeed was founded only 13 years before that, in 1995, by five enthusiastic young animal nutritionists from Nanchang, Jiangxi province. The founders are still connected to Agfeed – one of them being the company’s current chairman, Dr Songyan Li. “Over the years we have acquired five feed mills, located in Guangxi province, Hainan, Nanchang, Shanghai and Shandong,” Dr Li explains. Agfeed has predominantly focused on providing feeds for the swine business. “Approximately 50% by volume of what we produce are complete feeds, using corn and soybean meal as a basis. The rest consists of premix feeds, using vitamins, minerals and amino acids.” (also see Box Nanchang Best Animal Husbandry Company).

The connection with the USA is closely linked to the desire of introducing western-style pig production in China, Dr Li explains. “We really needed American expertise to run western-style hog farms. That’s why I came up with the idea to hire American people for the board of directors.” At the moment, the Agfeed board of directors includes two American experts – and what’s more, its factual headquarters is now located in Hendersonville, Tennessee, USA. “In fact, Agfeed is now an American company that does its business in China. Nanchang is the city this business is centered from.”

The 31 farms purchased in China together have a market capacity of 600,000 hogs per year and house about 30,000 sows altogether. “Most of these hog farms have a traditional Chinese setup, i.e. farrow-to-finish in one site,” Dr Li explains. “Their typical capacity is 10,000 to 20,000 market hogs per year. It is, however, very hard to run these traditional hog farms because some of them have had bad facility conditions – and we needed to do some updates there, which is what we are doing right now.” In addition to standardising these production sites, Agfeed is in the process of constructing two modern, western sow farms, set up in a multisite system. Finishing will be contracted to local farms. The Dahua farm, in the south of China, was under construction in 2010 and will give a space to 10,000 sows; and at the same time, a western-style farm was constructed near Xinyu, Jiangxi province, which will house an additional 15,000 sows. In total, seven large-size, technologically advanced commercial hog farms are planned, with capacity for 35,000 sows and production capacity of 850,000 market hogs annually.

Getting these elements of the new pig integration working requires a lot of training and technology transfer, Dr Li says. This is why Agfeed approached American pork production company M2P2 to form a joint venture in 2009 to build hog production systems on modern western standards and to learn how to reach American hog production efficiency – as average growth figures lag behind in China. Barely one year later, Agfeed even acquired the firm. “We need the expertise and the technology to manage our own hog farms,” he says. “We will send our Chinese people to the USA to be trained at their farms. In the other direction, American people will come to China to manage the Chinese farm sites too.” The takeover of M2P2 had one other important side-effect: Agfeed’s revenue base nearly doubled in connection with this acquisition.

| Nanchang Best Animal Husbandry Company One of Agfeed’s five feed production plants can be found near the company’s headquarters in Nanchang, Jiangxi province. ‘Nanchang Best Animal Husbandry Company’, as it is called, was established in 1995, and acquired by Agfeed a good four years later. Employees are living with their families in a large apartment block which is located on-site. More than 90% of its production is destined for pigs. The majority of its production consists of premixes, for which it uses ingredients from various international companies, e.g. Novus, Lucta and Pancosma. In total, five types of grower swine premixes are produced. There is baby feed for pigs of several days; a mixture for weaned pigs to which 60% corn should be added; as for pigs of 70 days of age, the feed mill produces three premixes, for small (15-30 kg), middle (30-60 kg; see picture) and larger pigs (60 kg and up) – all to be used for on-farm mixing, at 4% rations to a diet of corn, soybean and fish meal. Apart from grower pig feed premixes, Agfeed also produces premixes for dry and milking sows, also to be mixed on-farm with a diet of soybeans, corn and fishmeal. Agfeed does not exclusively produce for its own farms – premixes are also sold to the market. |

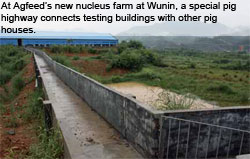

| Jiangxi Hypor Agfeed Breeding Company Three hours drive to the east of Nanchang, near Wunin, Agfeed has constructed a brand new nucleus farm in a joint-venture with Hypor: the Jiangxi Hypor Agfeed Breeding Company. In the autumn of 2010, the farm was populated with 833 crossbred Landrace x Yorkshire gilts from France. Another shipment of an additional 600 gilts from Hypor Canada followed later in 2010 – after which the farm was ‘closed’. Biosecurity is strict – anybody working inside the complex needs to stay in quarantine for two to four days and pass a disinfecting shower prior to entering. The Wunin farm has a capacity for approximately 1,400 GGP sows. The facility has four different ‘colour’ areas for biosecurity reasons. In red roofed buildings, employees are located as well as the medicine zone. The barns with blue roof tops are testing buildings – here gilts are being tested for health condition, to assure absolute top quality. Barns for grower gilts can be recognised by the yellow roofs. Next door is the breeding department, separated from the rest having light green coloured roofs. A lot of feeding, housing and ventilation equipment in the nucleus farm is provided by German livestock equipment manufacturer Big Dutchman, like the farrowing crates on the picture. The compartments have piglet boxes of disinfectable plastic for the newborn piglets. This allows the farm to use natural temperatures in summer and in winter, only these boxes need warming – not the whole room. In addition, the farrowing crates can be opened. Dry sows are kept in gestation crates. Only when they return from the AI section without being in-pig, they are mixed for heat stimulation purposes. All manure is collected at a central place on the farm, and is used for biogas production. The system provides energy for e.g. a heating system in the grower facility. |

Hypor

The geographical area Agfeed now covers, comprises over half a billion people whose demand for pork will rapidly rise. Having laid the basis for future expansion in the south of China, Agfeed’s swine business now needs further consolidating and expanding. The addition of own swine slaughterhouses may well be expected within the next two to three years, Dr Li adds. “Once the threshold of 1 million market pigs is reached, investing in one or more slaughterhouses will be an option.”

This threshold, however, can only be met when a proper breeding programme has also been put in place, which is the responsibility of Dr Jinfeng Yuan. Since genetics companies do not exist in China, the company looked abroad for support and decided to do business with Hypor, owned by Hendrix Genetics. In April 2009, a multiplier farm in Lushan, north of Nanchang, was populated with Hypor gilts (also see Box Jiangxi Lushan Agfeed Breeder Pig Farm). In December 2009, Agfeed and Hypor even closed a deal to build a GGP nucleus farm in Wunin, north west of Nanchang (also see box Jiangxi Hypor Agfeed Breeding Company). The farm in Wunin, said to be ‘among the most advanced breeding farms in China’ will eventually be populated with approximately 1,400 GGP sows, providing grandparent stock for a number of multiplier farms. GGP gilts flown in from Canada and France will be crossbreeds between Landrace and Yorkshire sows; these will be crossed with Duroc sire lines.

| Jiangxi Lushan Agfeed Breeder Pig Farm In order to supply its newly acquired pig farms, Agfeed is in a transition phase constructing its own breeding pyramid. Its multiplier farm can be found in the Lushan area, two hours drive north from Nanchang, Jiangxi province. Relatively few people live in this region, which makes it ideal for pig production. The multiplier farm, one of three in total, was constructed in 2006 by a local breeder and just like the other 30 farms, it was acquired, in 2008. In total, 46 employees are living on-site. In the background, weaner and grower facilities are located. At approximately 70 days, the pigs will be moved to the testing barns (blue roofs) and be separated for sex. Breeding facilities are located nearby. Hypor genetics were introduced to Lushan in April 2009. Landrace x Yorkshire gilts are crossed with Duroc sire lines to produce breeding animals. Gilts are not only bred for use in Agfeed’s own production chain but are also sold to third parties. For purchase purposes, sales exhibition rooms are installed, where interested parties can look at the pigs without actually having physical contact with them. On average, gilts weigh between 50-70 kg when they leave. In total, the multiplier farm produces up to 6,000 breeding gilts per year. The rest and also the barrows are sold to commercial farms. Pigs born on-farm are vaccinated for Classical Swine Fever, swine influenza and PCV2. Castration happens between three to five days; weaning happens at 21-24 days. Antibiotics are only sparsely given to the animals and in low levels in the nursery rooms. |

Future

In 2009, total Agfeed revenue was US$173.2 million with $109.5 million from hog production and $63.6 million from animal nutrition. Total revenue is expected to rise to $250 million in the current year and revenues are projected to proceed towards $400 million in 2011. Expanding its own swine integration is what Agfeed will focus on over the next couple of years – which is in accordance with its own vision, communicated in brochures: “We are striving to realise our dream of becoming a premix market leader and a safe and quality pork producer in China!”

Dr Li adds, “In China, more and more people realise the importance of food safety, it is a major concern. They no longer go to the wet market, and turn away from cheap and affordable meat. Still I do not think that backyard production is cheaper than our production, because producing in backyards leads to a lot of mortality, sometimes up to 30 to 40%.” In terms of distribution, Agfeed has exclusive arrangements with about 1,300 independently owned distribution stores and the company serves over 790 commercial farms. But Dr Li knows there is still a world to win. “Ten years ago, backyard production in swine was 90% but up to now it’s come down to 70%. This trend will continue and the percentage will fall to 30-40% in the next five to ten years.” He concludes, “We are going to set an example for this industry. We will create an integration from feed production to hog farms and to slaughterhouses. Our western hog farms are still under construction. Right now we are only half way.”

For more pictures and stories on Agfeed: www.pigprogress.net/photo-gallery