Zhongpin: 2012 Q1 – Higher revenues and lower net income

Zhongpin Inc., a meat and food processing company in China reported higher sales revenues and lower net income for the three months ended March 31, 2012 compared with the first quarter 2011.

First Quarter 2012 highlights:

- Sales revenues increased 31% to $374.1 million in the first quarter 2012 from $285.8 million in the first quarter 2011.

- Net income decreased 27.8% to $12.2 million in the first quarter 2012 from $16.9 million in the first quarter 2011.

- Basic earnings per share decreased 29.8% to $0.33 in the first quarter 2012 from $0.47 in the first quarter 2011 on average basic shares outstanding that were 4.6% higher than in the first quarter 2011.

- Diluted earnings per share decreased 29.8% to $0.33 in the first quarter 2012 from $0.47 in the first quarter 2011 on average diluted shares outstanding that were 3.5% higher than in the first quarter 2011.

- Guidance for 2012 is maintained: Zhongpin expects that sales revenues should be within a range of US$1.55 billion to $1.72 billion for 2012. Gross profit margin is expected to be within the range of 8.6% to 10.2%. Net profit margin is expected to be within the range of 3.3% to 4.2%. The resulting diluted earnings per share for the year 2012 is expected to be within the range of $1.36 to $1.92 per share, assuming average diluted common shares outstanding of about 37.5 million shares in 2012.

- As of March 31, 2012, Zhongpin had a total annual capacity of 904,760 metric tons for pork, pork products, and vegetables and fruits.

Mr. Xianfu Zhu, shairman and chief Executive officer for Zhongpin, said, “The intense competitive pressure in the pork market to gain market share continued in the first quarter as the pork industry goes through consolidation. As a result, pork prices did not increase, as a percent, as much as hog prices increased, which narrowed the gross profit spread between the cost of hogs and the price of pork. Further, substantial promotion costs were required to be competitive in both keeping and gaining market share. As expected, we incurred higher expenses in promotion, marketing, and operations to build market share and prepare the Company for increasing success in the future.

“Although, pork prices and volumes were generally higher in the first quarter than in the first quarter of 2011, we expect the prices of both hogs and pork to decline approximately 15% to 20% in 2012, so it will continue to be difficult to report higher results in 2012 than in 2011.

“As you know, in 2012 we are slowing the rate of our capacity expansions and focusing on greater use of existing facilities, which we believe should help offset some of the pressure on our financial results.

“Given the challenging competition that is very likely to continue in the marketplace in 2012, we still expect to report somewhat higher revenues in 2012 than 2011, a somewhat lower gross profit margin, and a somewhat lower net profit margin than in 2011, and diluted earnings per share within the range of $1.36 to $1.92 per share in 2012.

Capacity and market expansions in 2012

Zhongpin is investing approximately $58.5 million to build a new production, research and development, and training complex in Changge, Henan province, excluding the cost of land use rights that we have already obtained. When completed, we anticipate that this new facility will have a production capacity of about 100,000 metric tons for prepared pork products. Adjacent to this new production facility, we also plan to develop a center for research and development, training, and quality assurance and control. Construction for the first phase with a production capacity of approximately 50,000 metric tons for prepared pork products started in the second quarter of 2011 and is scheduled to be completed by the second quarter of 2012.

Zhongpin is investing approximately $58.5 million to build a new production, research and development, and training complex in Changge, Henan province, excluding the cost of land use rights that we have already obtained. When completed, we anticipate that this new facility will have a production capacity of about 100,000 metric tons for prepared pork products. Adjacent to this new production facility, we also plan to develop a center for research and development, training, and quality assurance and control. Construction for the first phase with a production capacity of approximately 50,000 metric tons for prepared pork products started in the second quarter of 2011 and is scheduled to be completed by the second quarter of 2012.

Zhongpin is investing approximately $18.0 million in a cold-chain logistics distribution center in Anyang, Henan. This distribution center will have processing capacity, a temperature adjustable warehouse with a floor area of approximately 27,000 square meters, a distribution center, and a quality control center. The distribution center will be used for third-party cold-chain logistics service. Zhongpin expects to put this distribution center into operation in the third quarter of 2012.

The company plans to invest approximately $87.5 million in a chilled and frozen food processing and distribution center in Kunshan, Jiangsu, which is near Shanghai. The center will be built in three phases. The first phase will include a processing center, cold-chain logistics center, and business complex. Zhongpin expects to invest about $35.0 million on the first phase that should be put into operation in the fourth quarter of 2012.

It will be investing approximately $49.0 million to build a slaughtering and processing plant, low temperature prepared pork plant, and logistics center in Tangshan, Hebei province. This facility will have an annual production capacity of about 60,000 metric tons for chilled pork, 20,000 metric tons for frozen pork, and 22,000 metric tons for prepared pork products. The construction is scheduled to start in the second quarter of 2012 and the new facility for chilled and frozen pork is expected to begin operations in the first quarter of 2013.

Zhongpin will be investing approximately $10.5 million in a by-product processing plant in Changge, Henan province. This facility will have a production capacity for 100 million meters of casings and 300 billion units of raw material to make heparin sodium. The construction started in March 2012 and the new facility is expected to begin operations in the fourth quarter of 2012.

It has established a joint venture company, of which the Company owns 65%, with Henan Xinda Animal Husbandry Company Limited in June 2011. The joint venture company is financed by capital contributions and bank loans. All capital contributions to the joint venture company have been made to date. The joint venture company will provide 20,000 sire boars annually. The facility for sire boar breeding is under construction and should start operating in the second quarter 2012.

As of March 31, 2012, the company had an annual capacity of 728,760 metric tons for chilled and frozen pork, 126,000 tons for prepared pork products, 20,000 tons for pork oil, and 30,000 tons for vegetables and fruits, for a combined total of 904,760 metric tons.

Guidance for the year 2012

Mr. Warren Wang, Zhongpin’s chief financial officer, said, “We are maintaining our prior guidance that we issued on March 13, 2012.

Guidance for 2012 is based on several assumptions that include:

- Continuation of China’s policies designed to stimulate domestic consumption and economic growth.

- Average hog prices in China are expected to decrease about 15% to 20% in 2012 from 2011, based on the assumed forecasted trend for the supply of live hogs and the increasing cost to raise hogs.

- A higher percentage of sales from our higher-margin chilled pork and prepared pork products in 2012 compared with 2011, while we plan to continue to increase sales volumes of processed pork products to optimize our product structure.

- Average capacity utilization for the year of about 75% for pork products.

- Increasing distribution efficiencies and reduction in the duration of delivery times through the expansion of our cold-chain logistics system, networks, and services.

- Total government subsidies for Zhongpin are expected to be $5 million in 2012.

“In addition, we have assumed that the more aggressive price competition that we saw in the latter part of 2011 and the first quarter of 2012 will continue in 2012, especially aggressive promotion efforts by our major competitors.

“For the year 2012, we expect that Zhongpin’s sales revenues should be within a range of US$1.55 billion to $1.72 billion.”

“Gross profit margin is expected to be within the range of 8.6% to 10.2%. Net profit margin is expected to be within the range of 3.3% to 4.2%.”

“Diluted earnings per share for the year 2012 are expected to be within the range of $1.36 to $1.92 per share, assuming average diluted common shares outstanding of about 37.5 million shares in 2012.”

“Zhongpin believes that China’s meat and food industry will continue to consolidate in 2012 at a more rapid pace than in 2011, which may result in higher market shares for the leading producers. We believe that Zhongpin is equipped to meet the challenge of increasing competition and that our guidance for 2012 can be achieved.”

Sales revenues

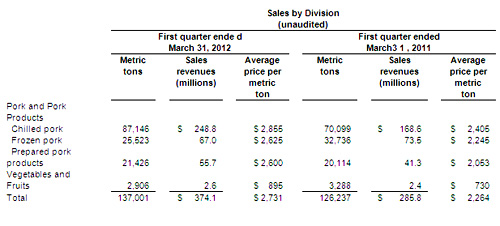

Total sales revenues increased $88.3 million or 31% to $374.1 million for the three months ended March 31, 2012 from $285.8 million in the first quarter 2011 primarily due to higher average selling prices and higher sales volume for pork products. The higher volume resulted mainly from continuing increases in the number of retail outlets, geographic expansion of our distribution network and processing facilities, and higher sales to chain restaurants, food service providers, and wholesalers and distributors in China. The following table shows the changes in our tonnage, sales revenues, and average price per metric ton by product division.

Chilled pork revenues increased on higher tonnage at higher average prices per ton. Chilled pork revenues increased 48% in the first quarter 2012 from the first quarter 2011. Chilled pork tonnage increased 24% and the average price per metric ton increased 19% in the first quarter 2012 from the first quarter 2011. The higher average selling price for chilled pork was mainly due to fluctuations in the market price of pork or pork-related products and changes of our product mix within this product division. The increase in chilled pork revenues was also due to successful capacity expansion, increased sales to existing customers, and increased volume of sales of our products as we entered new geographic markets, expanded our points of sales, and gained new customers.

Frozen pork revenues decreased on lower tonnage at higher average prices. Frozen pork revenues decreased 9% in the first quarter 2012 from the first quarter 2011. Frozen pork tonnage decreased 22% and the average price per metric ton increased 17% in the first quarter 2012 from the first quarter 2011. The decrease in tonnage was due to the strategic adjustment of our product mix towards selling less frozen pork products, which have a lower profit margin. The higher average selling price of frozen pork products was the result of fluctuations in the market price of pork or pork-related products.

Prepared pork revenues increased on higher tonnage at higher average prices. Revenues from prepared pork products increased 35% in the first quarter 2012 from the first quarter 2011. Prepared pork tonnage increased 7% and the average price per metric ton increased 27% in the first quarter 2012 from the first quarter 2011. Prepared pork products are becoming more important to our business since customers are increasingly demanding them for their convenience and flavor. We plan to gradually increase sales from prepared pork products by building our brand recognition and expanding our capacity for these products.

Pork products totaled 99.3% of total sales revenues in the first quarter 2012 and 99.2% in the first quarter 2011.

For more information: Zhongpin

Join 18,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the pigsector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht